Need for Parallel Restructuring and Rehabilitation Strategies

Although the scale of real estate project financing (PF) has decreased, the risk of insolvency is increasing, highlighting the urgent need to support viable projects.

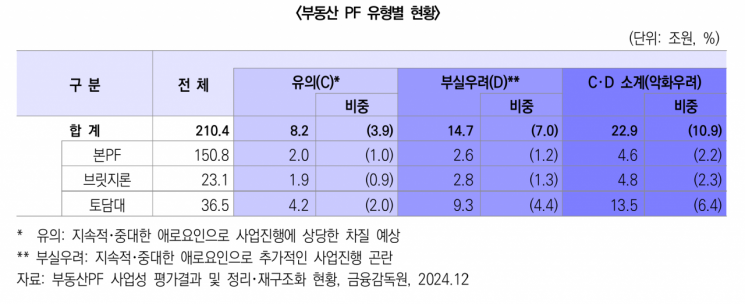

According to the 'January Construction Brief' recently released by the Korea Construction Policy Research Institute on the 27th, the scale of real estate PF decreased from approximately 231 trillion won at the end of 2023 to about 210 trillion won at the end of the third quarter of last year. On the other hand, during the same period, the PF scale rated as cautionary (C grade) and at risk of insolvency (D grade) surged from about 9 trillion won to approximately 23 trillion won.

Looking at the composition of real estate PF, the main PF accounts for 71.7%, bridge loans 11.0%, and land-secured loans 17.3%. Kim Tae-jun, a research fellow at the Korea Construction Policy Research Institute, stated, "While the scale of real estate PF is decreasing, insolvency is actually increasing, necessitating prompt action." He added, "The proportion of deterioration concerns by PF type is 3.1% for main PF, 20.8% for bridge loans, and 37% for land-secured loans, indicating that insolvency is higher in the early-stage PF."

Researcher Kim further noted, "The government's 'Measures to Revitalize the Construction Industry' announced in December last year focuses on supporting PF for viable projects, but support for insolvent projects is insufficient."

As a PF normalization measure, the government plans to increase the size of syndicated loans from the current 1 trillion won to 2 trillion won, with a phased expansion up to 5 trillion won. However, the currently planned 2 trillion won is less than half of the 4.6 trillion won scale of C and D grade main PF.

Researcher Kim said, "The evaluation of PF projects can change rapidly depending on external environmental changes," and added, "Among the approximately 8.2 trillion won scale of PF projects rated C grade, many have medium- to long-term improvement potential."

He continued, "In the short term, adjustments and restructuring should be pursued focusing on projects with high insolvency risk," and "From a medium- to long-term perspective, it is necessary to subdivide the viability of C grade projects and prepare support measures." Currently, the total amounts to 7.5 trillion won, including C grade main PF (2 trillion won), bridge loans (1.9 trillion won), and D grade main PF (2.6 trillion won).

Researcher Kim emphasized, "We must prevent viable projects from collapsing due to lack of funds," and stated, "The size of syndicated loans, currently set at 2 trillion won, should be expanded to at least 3 to 4 trillion won or more."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)