Hyundai Livart Leads Sales in Q1?Q3

B2B Growth Slows Due to Construction Downturn... Q4 Remains Uncertain

B2C Expected to Be the Key Factor for Both Companies' Performance

Competition between Hanssem and Hyundai Livart for the top spot in the domestic furniture industry is fierce. Last year, Hyundai Livart surpassed Hanssem in quarterly sales for the first time, but it is uncertain whether it will secure the annual sales crown this year as initially expected. The slowdown in growth in the business-to-business (B2B) sector and the real estate market downturn are holding it back.

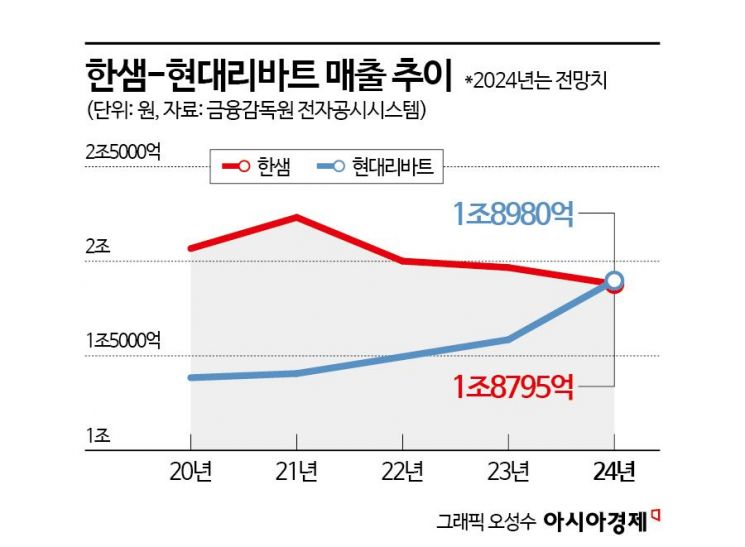

According to financial information firm FnGuide on the 31st, the sales consensus for Hanssem and Hyundai Livart last year is estimated at 1.8795 trillion KRW and 1.898 trillion KRW respectively, with Hyundai Livart expected to lead by about 12 billion KRW. If Hyundai Livart surpasses Hanssem in annual sales including the fourth quarter, it will achieve the first-ever top position in the domestic furniture industry since its establishment.

Hyundai Livart took the top spot in quarterly sales in the first quarter last year with 504.8 billion KRW, surpassing Hanssem’s 485.9 billion KRW, and continued to lead in the second and third quarters as well. Cumulative sales through the third quarter were 1.4559 trillion KRW for Hyundai Livart and 1.418 trillion KRW for Hanssem.

Hyundai Livart’s advancement was driven by growth in the B2B sector. With the recovery of housing sales, built-in furniture sales increased by 86.1% year-on-year, boosting performance. About 75.6% of Hyundai Livart’s sales come from the B2B sector, including built-in furniture and special sales to construction companies. In contrast, Hanssem’s B2B sales account for only 45%, making it more dependent on business-to-consumer (B2C) sales.

However, since the third quarter, the decrease in apartment completions and the housing construction market downturn have slowed Hyundai Livart’s B2B sales growth. The Korea Institute of Construction Policy forecasts that the number of houses to be completed this year will fall 19% year-on-year to 360,000 units.

Ultimately, fourth-quarter results are expected to be a crucial variable determining the annual sales ranking of the two companies. The fourth quarter is when the decline in B2B sales due to reduced completions will be fully reflected, and growth in the B2C sector is expected to be key for both companies to defend their performance. In the third quarter, Hyundai Livart narrowly led Hanssem by 20 million KRW, but forecasts suggest Hanssem will lead in fourth-quarter sales with 461.5 billion KRW compared to Hyundai Livart’s 442.1 billion KRW.

Industry insiders see the B2C sector as the key factor that will determine the performance direction of both companies. Kim Ki-ryong, a researcher at Mirae Asset Securities, analyzed, “The B2B sector that drove Hyundai Livart’s performance is expected to see a full-scale decline in sales following the contraction of new housing supply. It is a time when tangible effects in the B2C channels, such as expanding offline customer inflow through online malls and qualitative growth of dealership channels, are required.”

Along with expanding sales, improving profitability is also a challenge both companies must address. According to FnGuide, last year Hanssem and Hyundai Livart posted operating profits of 27.4 billion KRW and 24.7 billion KRW respectively, with operating profit margins still low relative to their nearly 2 trillion KRW sales scale. An industry official said, “As the real estate market recovers, the overall atmosphere in the furniture industry will also revive. Currently, improving profitability centered on premium lines is the biggest challenge.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)