Global PEFs, IBs, and Pension Funds Send 'Love Calls' to Rental Housing

'Jeonse Fraud' Shakes the Housing Market... Betting on Rising Monthly Rent

“Global big players” are paying attention to South Korea’s rental housing market. Following global investment banks (IB) and private equity funds (PEF), even world-class pension funds have joined this market. Analysts suggest that this move is a bet on the continued upward trend of monthly rent prices.

According to the financial investment industry on the 30th, the Canada Pension Plan Investment Board (CPPI) recently partnered with domestic real estate impact developer MGRV to establish a joint venture (JV) for rental housing project development. The scale is about 500 billion KRW. MGRV holds 5% of the JV shares, while CPPI holds 95%. For CPPI, this represents an investment of approximately 450 billion KRW. This is the largest investment by a foreign institutional investor in rental housing in terms of amount. CPPI is the world’s 6th largest pension fund, managing assets under management (AUM) of 675.1 billion Canadian dollars (about 685 trillion KRW). This is CPPI’s first direct investment in the Korean residential market.

Global PEF, IB, and Pension Funds Send 'Love Calls' to Rental Housing

CPPI has mainly focused on office spaces in the domestic commercial real estate market, and recently expanded into data centers (IDC) by establishing a 1 trillion KRW JV with Pacific Asset Management. Now, it has extended its reach to the rental housing market, which foreign institutions have been rushing to enter. MGRV, which is cooperating with CPPI, operates a business centered on “shared housing.” Shared housing is a type of corporate rental housing that guarantees private spaces such as bedrooms and bathrooms while sharing living rooms and kitchens. The JV established by the two companies plans to invest up to 133 billion KRW as a seed project to develop rental housing near major business districts and universities in Seoul.

Global capital views South Korea’s rental housing market as a new investment destination. Previously, global PEF operators such as Kohlberg Kravis Roberts (KKR) and ICG, investment bank Morgan Stanley, and real estate developer Hines have entered the market. KKR secured prime sites in Yeongdeungpo and Dongdaemun, while ICG acquired valuable land in Gangnam and Jung-gu. Morgan Stanley is supplying small-scale luxury rental housing in Geumcheon, Seongbuk, and Gangdong. ICG has executed the largest investment so far, worth about 300 billion KRW.

'Jeonse Fraud' Shakes the Housing Market... Betting on Rising Monthly Rent

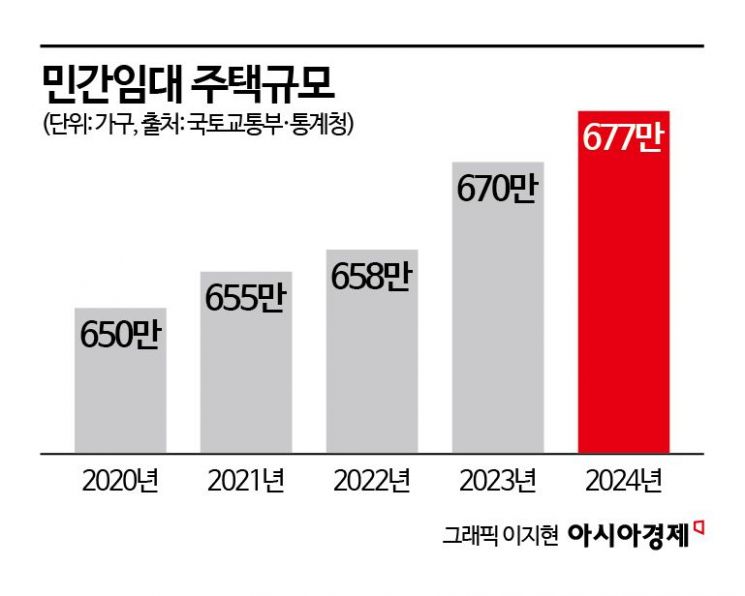

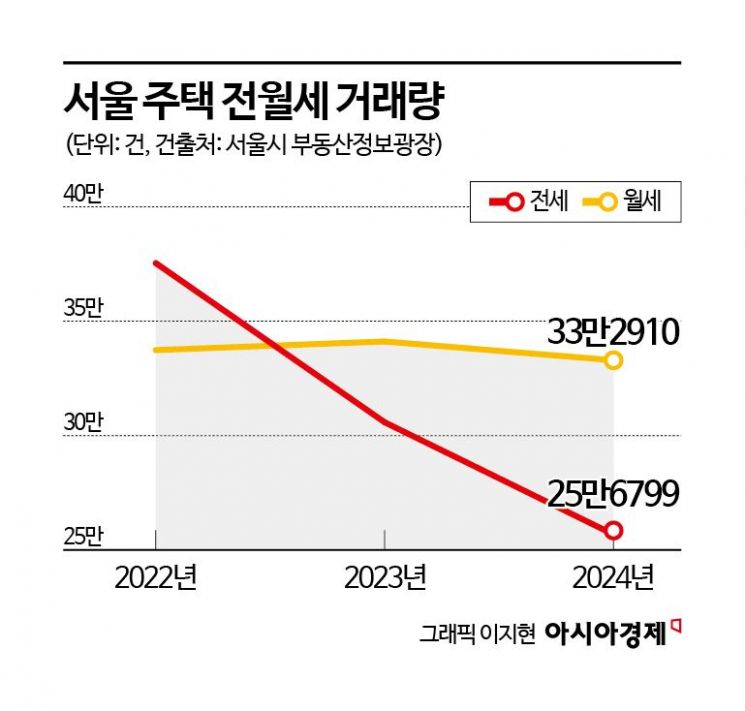

Foreign institutions’ investments in Korean real estate have so far been limited to large office buildings. However, a major transformation is underway as the perception that “Korean rental housing is profitable” spreads. Analysts link this to a series of “jeonse frauds” in recent years, the increase in single-person households, and the prolonged high interest rate environment, all of which are shifting Korea’s housing market toward monthly rent. According to Seoul’s housing lease transaction data, monthly rent transactions reached 332,910 last year, surpassing jeonse transactions at 256,799. Just two years ago, in 2022, jeonse transactions were 375,351, higher than monthly rent transactions at 337,361. Since monthly rent transactions first overtook jeonse in 2023, the gap has widened further. According to the Ministry of Land, Infrastructure and Transport, the size of the private rental housing sector increased from 6.5 million households in 2020 to 6.77 million households in 2024, showing an upward trend.

In particular, the greater potential for monthly rent increases in Korea compared to other countries is cited as an attraction of the domestic rental housing market. This is seen as a breakthrough in the “ceiling” on monthly rent that was blocked by the unique jeonse system, which is hard to find overseas. According to OECD data comparing quality of life across countries as of 2022, Korea recorded the lowest “housing cost to income ratio” among 42 surveyed countries at 14.7%. Now, as the market shifts to a monthly rent focus, the burden of monthly rent is rising sharply. According to the Korea Real Estate Board, the nationwide comprehensive monthly rent price index for housing (June 2021=100, excluding semi-monthly and semi-jeonse) was 105.28 in December last year, the highest level since related statistics began in 2015.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)