Record Lows After Spin-Off...

Lack of Communication on Corporate Value Enhancement

Poor Performance Also Drives Stock Weakness

GS Retail and GS P&L, which were listed after a spin-off, are experiencing continued stock price sluggishness, with both recording their lowest prices since the split. Over the month following the split, GS Retail's stock price fell by 21%, and GS P&L's by 34%. Analysts attribute the stock price decline to weak performance momentum and a lack of communication with the market regarding corporate value enhancement after the split.

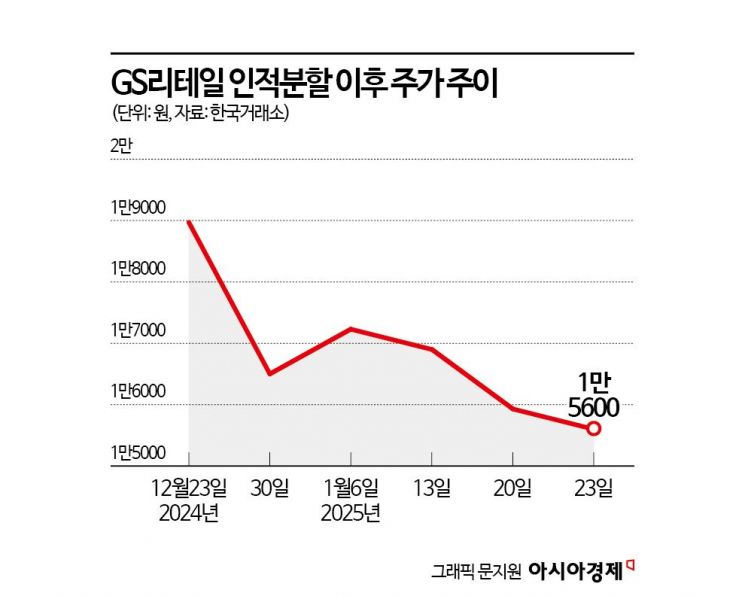

According to the Korea Exchange on the 24th, GS Retail's stock price dropped 21.21% since the spin-off on the 23rd of last month. GS Retail's stock, which started at around 18,000 KRW, fell to the 15,000 KRW range. It hit a 52-week low during the previous day's trading session, dropping to as low as 15,600 KRW. GS P&L's stock also fell to an intraday low of 19,690 KRW, marking its lowest point since the split listing. GS P&L's stock, which started at 30,100 KRW, dropped below 20,000 KRW.

GS Retail decided on a spin-off in June last year, separating into GS Retail (distribution business division) and GS P&L (hotel business). GS Retail stated that the purpose of the split was to efficiently allocate management resources and receive a fair corporate valuation from the market, ultimately enhancing corporate and shareholder value. However, due to the post-split stock price slump, corporate value has instead declined. As of the closing price on the 23rd, the combined market capitalization of the two companies is 1.6977 trillion KRW. Before the trading suspension due to the GS Retail split, the market capitalization was 2.4242 trillion KRW.

Jong-ryeol Park, a researcher at Heungkuk Securities, said, "Along with weak performance momentum, the lack of communication with the market regarding corporate value enhancement after the split appears to have contributed to the stock price decline." He added, "It is necessary to communicate with the stock market through a value-up disclosure as soon as possible, providing more concrete information on the company's future growth potential and various efforts to enhance shareholder value, including shareholder returns."

According to financial information provider FnGuide, the consensus for GS Retail's Q4 performance last year (average securities firm forecast) is sales of 2.9245 trillion KRW and operating profit of 62.8 billion KRW. These figures represent decreases of 8.01% and 53.45%, respectively, compared to the same period last year. Securities firms expect GS Retail's Q4 results to fall short of consensus. Jena Heo, a researcher at DB Financial Investment, said, "GS Retail's Q4 sales are expected to be 2.8943 trillion KRW and operating profit 48.9 billion KRW, underperforming market expectations," adding, "Due to limited sales growth in the convenience store division and increased selling and administrative expenses, a decline in profit is anticipated."

A short-term stock price rebound seems unlikely. Researcher Heo said, "Due to worsening business conditions, uncertainty in the development division's performance is increasing, and the convenience store division is also entering a profitability decline phase due to prolonged domestic demand weakness and increased promotional expenses. Given the poor performance, the incentive for a short-term stock price rebound is low, so a conservative approach is recommended."

However, the convenience store division's performance is expected to recover starting from the second quarter of this year. Jin-hyup Lee, a researcher at Hanwha Investment & Securities, said, "The convenience store division's poor performance was due to increased fixed cost burdens caused by inefficiencies in new stores opened at the end of 2023." He added, "For the convenience store business to return to a normal trajectory, underperforming new stores need to complete a one-year cycle and be incorporated as existing stores, eliminating the inefficiency impact of new stores. The business is expected to enter a normal trajectory from the second quarter."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)