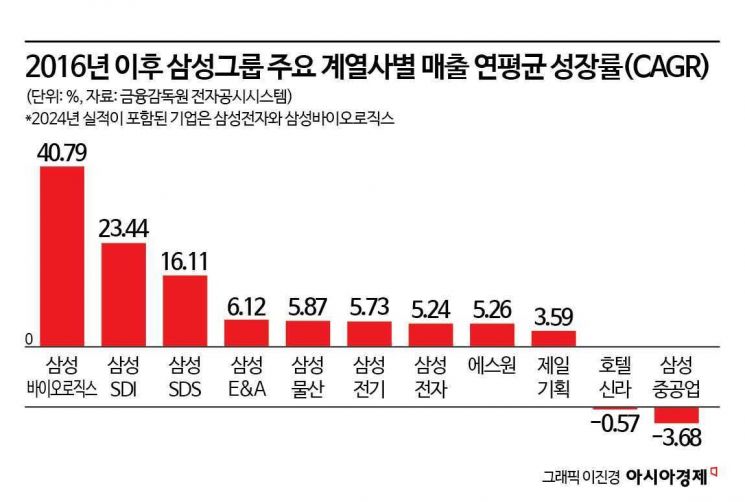

Annual Growth Rate Comparison Among 11 Affiliates Since 2016

Samsung Biologics Leads with 40% CAGR

Samsung SDI Ranks Second with 23%, Samsung SDS Third with 16%

Aggressive Plant Expansion and Customer Acquisition Strategies Prove Effective

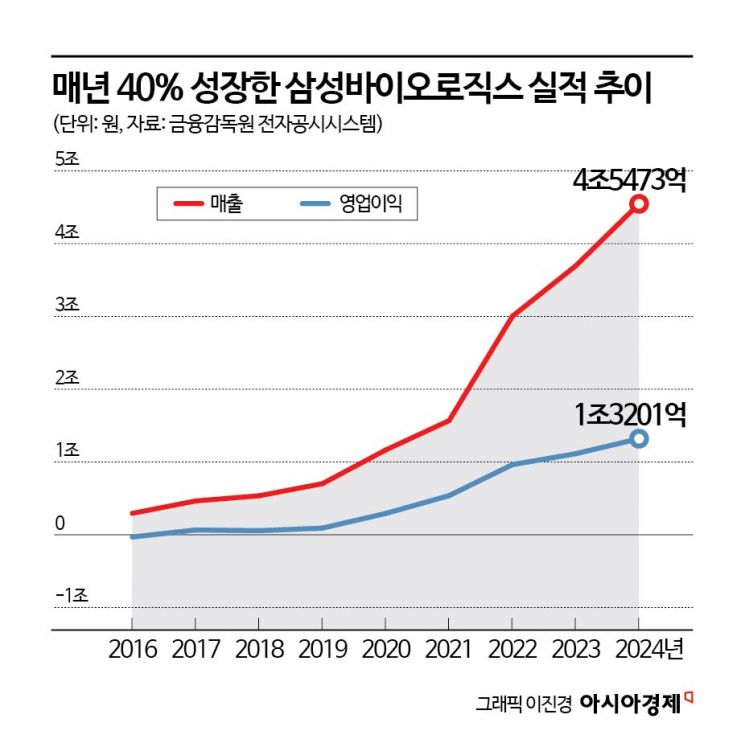

Samsung Biologics has been increasing its sales by approximately 40% annually, recording the highest growth rate within the Samsung Group. This success is attributed to its aggressive expansion of production capacity and a strategy to quickly absorb global market demand. With a major additional expansion of production facilities scheduled from the first half of this year, it is expected to solidify its position as a key affiliate driving overall growth across the group in the future.

On the 22nd, Asia Economy compared the performance of 11 major non-financial affiliates of the Samsung Group from 2016 to last year, revealing that Samsung Biologics recorded a compound annual growth rate (CAGR, based on sales) of 40.79% over the past eight years, the highest growth rate within the group. Samsung Biologics surpassed 1 trillion KRW in sales in 2020 after recording 294.6 billion KRW in 2016, and exceeded 3 trillion KRW in 2022.

Last year, it opened a new horizon by becoming the first Korean pharmaceutical and bio company to surpass 4 trillion KRW in sales. Samsung Biologics announced in an afternoon disclosure that its consolidated sales for last year reached 4.5473 trillion KRW, with an operating profit of 1.3201 trillion KRW. Compared to 2023, sales increased by 23% (852.7 billion KRW) and operating profit rose by 19% (206.4 billion KRW).

Samsung Bioepis, a subsidiary developing biosimilars (biopharmaceutical generics), recorded sales of 1.5377 trillion KRW and an operating profit of 435.4 billion KRW. With the expansion of global market entry for biosimilar products, sales increased by 51% (517.4 billion KRW) and operating profit surged by 112% (230 billion KRW) compared to the previous year.

Among Samsung Group affiliates, Samsung SDI, which experienced rapid growth due to expanding demand for electric vehicles, ranked second with a CAGR of 23.44%. Samsung SDS, which operates system integration and logistics businesses, recorded 16.11%, showing the third highest growth rate. The flagship affiliate Samsung Electronics showed a CAGR of 5.24%.

The affiliates included in this survey were Samsung Biologics, Samsung Electronics, Samsung C&T, Samsung SDI, Samsung Electro-Mechanics, Samsung SDS, Samsung Heavy Industries, Samsung Engineering & Construction, Hotel Shilla, Cheil Worldwide, and S-1 Corporation. Although Samsung Biologics was established in 2011, its performance was analyzed based on 2016, when its IPO and factory operations began in earnest. For affiliates that have not yet announced their annual results for last year, records from 2016 to 2023 were used as the basis.

The high growth rate exceeding 40% annually is much steeper than the growth trend of the biopharmaceutical CDMO (Contract Development and Manufacturing Organization) market. According to the Korea Bio Association, the global biopharmaceutical CDMO market is expected to grow at an average annual rate of 10.1%, from $11.3 billion (approximately 16.21 trillion KRW) in 2020 to $20.3 billion (approximately 29.12 trillion KRW) in 2026. Samsung Biologics is analyzed to be showing growth far exceeding the market average through aggressive factory expansion and customer acquisition strategies.

Samsung Biologics' growth is remarkable not only domestically but also overseas. The semiconductor design and manufacturing company NVIDIA's recent 10-year CAGR is about 38%, and TSMC, the global number one semiconductor foundry, showed growth of about 13% from 2016 to 2023. The electric vehicle company Tesla's recent 5-year CAGR was about 32%.

Only Samsung Electronics and Samsung Biologics among Samsung Group affiliates consistently recorded double-digit operating profit margins. Samsung Biologics started with 14.21% in 2017, the year it first turned a profit, followed by ▲10.40% in 2018 ▲13.07% in 2019 ▲25.14% in 2020 ▲34.27% in 2021 ▲32.11% in 2022 ▲30.14% in 2023 ▲29.03% in 2024. Especially since 2021, it has maintained an operating profit margin around 30%, establishing itself as the most robust affiliate.

Samsung Biologics' key strategies for this year include expanding production capacity, strengthening investments, enhancing order acquisition activities, and digital transformation. CEO John Rim stated at the JP Morgan Healthcare Conference held on the 14th of this month (local time) at The Westin St. Francis Hotel in San Francisco, USA, "We plan to proactively expand production capacity to respond to surging market demand," adding, "In addition to the current 604,000 liters of production capacity at Bio Campus 1, we plan to secure a total of 720,000 liters of production capacity at Bio Campus 2 by 2032."

Samsung Biologics holds the largest production capacity among global CDMOs. With the completion of the 5th plant scheduled for April this year and the completion of the 2nd campus (plants 5 to 8) by 2032, production capacity will increase to 1,324,000 liters. Since only Samsung Biologics, Fujifilm, and WuXi Biologics have announced production facility expansions, the production capacity gap with competitors is expected to widen further.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)