Recovery Driven by Economic Outlook After Sharp Decline Last Month

Expectations for Resolution of Political Uncertainty and Easing of U.S. Tariff Policies

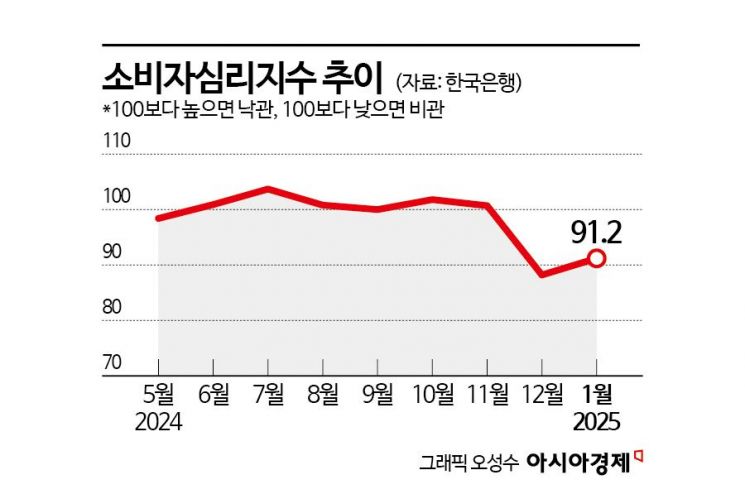

Consumer sentiment, which had significantly deteriorated due to the emergency martial law situation at the end of last year, slightly improved this month. Expectations for the resolution of political uncertainty and easing of tariff policies by the new U.S. administration contributed to an increase centered on economic outlook. However, since the index remains in the low 90s, below the baseline value of 100, it is difficult to interpret this as a trend reversal.

According to the 'January 2025 Consumer Sentiment Survey Results' released by the Bank of Korea on the 22nd, the Consumer Confidence Index (CCSI) for this month rose by 3.0 points from the previous month to 91.2.

The CCSI is a sentiment indicator calculated using six major indices that make up the Consumer Sentiment Index (CSI). The long-term average is set as the baseline value of 100; values above 100 indicate optimism compared to the long-term average, while values below 100 indicate pessimism.

The CCSI had maintained an optimistic trend by staying above 100 continuously from June 2023 (100.9), July (103.7), August (100.8), September (100.0), October (101.8), to November (100.7), but sharply dropped to 88.2 in December 2023. This was due to increased political uncertainty caused by the emergency martial law situation, which dampened consumer sentiment and increased volatility in the domestic financial market. This month, the index rose by 3 points compared to the previous month, marking the largest increase since May 2023 (3.0 points).

Hwang Hee-jin, head of the Statistical Survey Team at the Bank of Korea’s Economic Statistics Bureau, explained, "A level of 91.2 cannot be considered a full recovery. It is still below the baseline value of 100, and all six indices that make up the CCSI remain below their long-term averages. Rather than saying it has recovered significantly, it should be seen as having risen from the very sharp decline in December 2023."

Recovery Centered on Economic Outlook... Expectations for Political Uncertainty Resolution in Six Months

There was no significant change in perceptions of household financial conditions. The Current Living Conditions CSI (87) remained the same as the previous month, while the outlook component rose. The Living Conditions Outlook CSI (89) increased by 3 points from the previous month. The Household Income Outlook CSI (96) and Consumption Expenditure Outlook CSI (103) rose by 2 points and 1 point respectively compared to the previous month. In the consumption expenditure outlook, sentiment toward education expenses and transportation/communication expenses improved. However, since these items are affected by inflation, it is considered difficult to interpret this as a recovery in consumption sentiment itself.

Regarding perceptions of the economic situation, the Future Economic Outlook CSI (65) jumped by 9 points. Team leader Hwang analyzed, "Since this reflects the economic outlook six months ahead, it appears higher than last month because there is an expectation that judicial procedures related to the martial law situation will operate normally and uncertainty will be resolved, leading to economic recovery." During the survey period, there was also an expectation that the tariff policies of the second Trump administration in the U.S. would ease more than feared, which influenced the results. Hwang added, "The outlook index moves even with just the expectation that policies such as tariffs will be favorable, but since there is still uncertainty related to this, we need to observe further."

The Current Economic Conditions CSI (51) fell by 1 point this month following an 18-point plunge last month. The Interest Rate Level Outlook CSI (97) decreased by 1 point from the previous month due to factors such as reductions in commercial bank spread rates. The Employment Opportunity Outlook CSI (69) rose by 4 points compared to the previous month.

Household saving sentiment improved, but sentiment regarding debt conditions worsened. The Current Household Saving CSI (93) and Household Saving Outlook CSI (95) both increased by 1 point from the previous month. However, the Current Household Debt CSI (100) and Household Debt Outlook CSI (98) both decreased by 1 point compared to the previous month.

The Inflation Level Outlook CSI (151) rose by 1 point from the previous month. The Housing Price Outlook CSI (101) fell by 2 points due to a nationwide shift to declining apartment sale prices and reduced transactions. The Wage Level Outlook CSI (118) increased by 3 points compared to the previous month.

The expected inflation rate for the next year fell by 0.1 percentage points due to concerns over sluggish domestic demand amid consumer price inflation remaining in the 1% range. The expected inflation rate three years ahead dropped by 0.1 percentage points to 2.6% compared to the previous month, and the expected inflation rate five years ahead remained unchanged at 2.6%. Perceptions of consumer price inflation over the past year also remained steady at 3.3%, the same as last month.

The major items expected to influence consumer price inflation over the next year were agricultural, livestock, and fishery products (48.2%), public utility charges (44.2%), and petroleum products (42.4%). Compared to the previous month, the response shares for petroleum products (up 4.3 percentage points) and agricultural, livestock, and fishery products (up 2.9 percentage points) increased, while the share for public utility charges decreased by 5.5 percentage points.

This survey was conducted from the 7th to the 14th of this month, targeting 2,500 urban households nationwide (with 2,330 responses).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)