Top 5 Construction Companies Increase Contract Wins Over Previous Year

Hyundai Engineering & Construction Surpasses 6 Trillion KRW with Yeouido, Sinbanpo 2nd Phase

POSCO E&C Secures 10 Projects for 4.7 Trillion KRW, Including 4 Remodeling Deals

Samsung C&T Achieves 3.6 Trillion KRW, Focusing on Redevelopment

Major Construction Firms Intensify Focus on Seoul

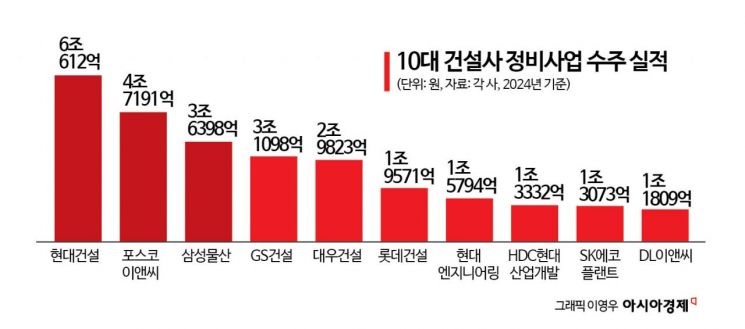

Among the top 10 construction companies last year, Hyundai Engineering & Construction recorded the highest performance in securing maintenance project contracts. Surpassing 6 trillion KRW, it secured an overwhelming first place. POSCO E&C, which aggressively pursued contracts from the first half of last year, ranked second with nearly 5 trillion KRW in contract wins. Amid rising construction costs and deteriorating profitability leading to selective bidding by construction companies, maintenance project contracts were mainly secured in Seoul and the metropolitan area rather than in provincial regions.

Top 5 Construction Companies Increase Contracts Compared to Previous Year

According to the construction industry on the 21st, the contract performance for maintenance projects such as reconstruction, redevelopment, and remodeling by the top 10 construction companies ranked by construction capability evaluation was as follows: Hyundai Engineering & Construction with 6.0612 trillion KRW, POSCO E&C with 4.7191 trillion KRW, Samsung C&T with 3.6398 trillion KRW, GS Engineering & Construction with 3.1098 trillion KRW, and Daewoo Engineering & Construction with 2.9823 trillion KRW. All top 5 companies recorded contract amounts exceeding 3 trillion KRW, showing an increase compared to the previous year. Hyundai Engineering & Construction and POSCO E&C, which maintained the first and second places for two consecutive years, widened the gap with other companies by consecutively securing large-scale projects in Banpo, Yeouido, and Noryangjin.

Besides the top 5, Lotte Engineering & Construction (1.9571 trillion KRW), Hyundai Engineering (1.5794 trillion KRW), HDC Hyundai Development Company (1.3332 trillion KRW), SK Ecoplant (1.3073 trillion KRW), and DL E&C (1.1809 trillion KRW) also recorded contract performances exceeding 1 trillion KRW. Two years ago, Lotte Engineering & Construction secured 517.3 billion KRW and HDC Hyundai Development Company 179.4 billion KRW, but last year both joined the 1 trillion KRW club. DL E&C’s contract amount sharply declined to about half compared to its 2023 contract performance (2.3274 trillion KRW).

Hyundai Engineering & Construction succeeded in securing contracts in key Seoul maintenance project areas such as Gangnam and Yeouido, including Sinbanpo 2nd phase (1.283 trillion KRW) and Yeouido Hanyang Apartments (774 billion KRW). Among the nine maintenance projects secured, including Songpa Garak Samik Mansion, Banghwa 3rd district, and Majang Serim, seven were won in the metropolitan area. The total contract amount last year was 6.0612 trillion KRW.

POSCO E&C secured a total of 10 projects, recording 4.7191 trillion KRW in maintenance project contracts. It won large-scale projects exceeding 1 trillion KRW such as Busan Chokjin 2-1 district (1.3274 trillion KRW) and Noryangjin 1st district redevelopment (1.0927 trillion KRW) after competitive bidding with Samsung C&T. Emerging as a strong player in remodeling projects, POSCO E&C also succeeded in securing four new contracts last year, including Goyang Byeolbit Village 8th complex, Mullae Daewon Apartments, Mullae Hyundai 2nd phase, and Maehwa Village 2nd complex.

Next, Samsung C&T secured 3.6398 trillion KRW. Except for Jamwon Riverside remodeling (232 billion KRW), redevelopment project contracts dominated. These included Anyang Sports Complex East redevelopment project (833.1 billion KRW), Namyeong 2nd district (661.9 billion KRW), and Singil 2nd district (553.6 billion KRW). It also secured two provincial redevelopment projects, Busan Gwang-an 3rd district and Sajik 2nd district.

GS Engineering & Construction also succeeded in securing over 3 trillion KRW in maintenance project contracts. After the brand image deteriorated due to the underground parking collapse accident at Geomdan Apartments, it formed consortia with other construction companies to pursue contracts. It jointly secured Geoyeosaemaeul and Singil 2nd district with Samsung C&T and Gajaeul 7th district with Hanwha Construction Division. Additionally, it secured Machun 3rd district and Geoyeosaemaeul. However, it failed to secure contracts in prime project areas such as Gangnam, Seocho, or Yeouido.

Daewoo Engineering & Construction secured 2.9823 trillion KRW. It succeeded in two contracts in the Gangnam area, Gaepo Jugong 5th complex (588.9 billion KRW) and Sinbanpo 16th complex (246.9 billion KRW). It secured five projects in Seoul including Samik Garden Mansion, Yeongdeungpo 1-11 district, Mapo Seongsan Moa Town 1st district, and two projects in Busan, Goejeong 5th district and Dadae 3rd district.

Lotte and Hyundai Engineering Join the 1 Trillion KRW Club

Lotte Engineering & Construction secured a total of five projects only in Seoul and Gyeonggi, recording a total contract amount of 1.9571 trillion KRW. It secured projects including Sinbanpo 12th complex, Yongsan Sanho Apartments, Anyang Sports Complex North housing reconstruction project, Jeonnong 8th district, and Cheonho Woosung Apartments.

Hyundai Engineering also secured five projects only in Seoul and Gyeonggi, including Jeonnong 9th district, Banghwa 3rd district, Ansan Gojan Yeonrip 2nd district, and Sadang 5 housing reconstruction. It also succeeded in remodeling project contracts at Gangnam Samsung Seogwang Apartments. The total contract amount was 1.5794 trillion KRW.

HDC Hyundai Development Company recorded 1.3332 trillion KRW from four contracts, three of which were in provincial areas. Besides Jangan Hyundai Apartments, it secured redevelopment projects in Daejeon Gayang 1st district, Yongdu 3rd district, and Jeonju near the Military Manpower Administration district. It is the only company among the top 10 construction companies to have secured more than three contracts outside the metropolitan area.

SK Ecoplant secured seven maintenance projects with contract amounts around 200 billion KRW each, including Sinbanpo 27th complex. In Seoul, these included Sinbanpo 27th complex, Mia 11th district, Junghwa Woosung Town, and Cheonho-dong 397-419, as well as Bucheon Bugae 5th district, Daejeon Gayang 1st district, and Daejeon Doma Byeondong 6-1 district.

DL E&C secured three projects only in Seoul, including Jamsil Woosung 2nd complex, Dogok Gaepo Hanshin, and Jayang 7th district. Its maintenance project contract amount was 1.1809 trillion KRW, ranking tenth. Compared to the previous year, its contract amount halved. However, by securing major maintenance projects in Seoul, it is evaluated as having adopted a ‘selection and concentration’ strategy.

Concentration of Maintenance Project Contracts in Seoul Continues

The concentration of maintenance project contracts in Seoul by major construction companies is expected to continue this year. In Hannam 4th district, Samsung C&T and Hyundai Engineering & Construction faced off for the first time in 15 years. Similar competition may unfold in Jamsil Woosung. Additionally, in prime maintenance project areas such as Yeouido, Yongsan, and Gaepo, fierce competition among construction companies to maintain high-end brand complexes is expected as contractor selection approaches.

An industry insider explained, "The trend of securing contracts centered on Seoul and the metropolitan area is expected to continue this year. To maintain brand competitiveness, companies will focus on securing contracts mainly in major Seoul project sites such as Gangnam. For provincial maintenance projects, companies tend to avoid bidding unless the project’s profitability is clearly guaranteed. Maintenance projects involve payment after construction completion, and in the current environment where cash liquidity is crucial, securing maintenance projects without assured profitability can be burdensome."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)