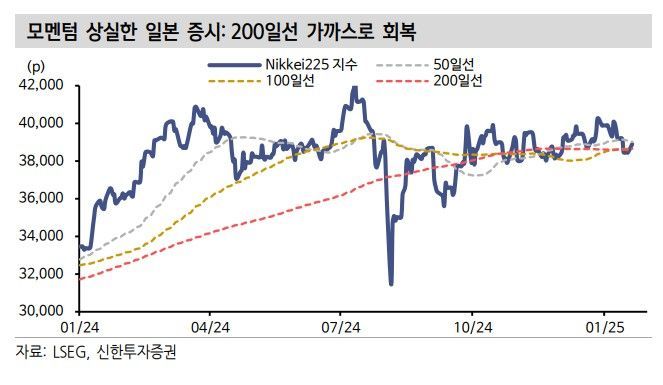

Shinhan Investment Corp. analyzed on the 21st that the Japanese stock market has lost its short-term upward momentum and is showing a sluggish trend this year, suggesting that at the national level, the Taiwan stock market could be a better option.

On the same day, researchers Hanbi Oh and Sunghwan Kim of Shinhan Investment Corp. stated in their report titled "Japanese Stock Market, a Period of Short-term Decline in Attractiveness," "Compared to major global stock markets, the Japanese stock market has shown the poorest returns since the beginning of the year."

The report analyzed that the relative underperformance of the Japanese stock market is due not only to external factors such as the global surge in interest rates but also to growing concerns over the earnings of major companies, including Fast Retailing's sharp decline due to weak performance in China, amid caution over interest rate hikes.

It also pointed out that "there are numerous uncertainties to face in the short term," citing tariff policies following the inauguration of U.S. President Donald Trump. The report noted, "Since the fourth quarter, corporate survey indicators for domestic demand-based sectors less affected by tariffs, such as real estate and transportation, have remained relatively robust, whereas export industries like electric equipment and automobiles have underperformed," indicating that tariff-related uncertainties are weighing heavily on corporate sentiment.

Furthermore, it stated, "It is difficult to say that these concerns have been fully reflected in the stock market," expressing worries that "the 12-month forward earnings per share (12MFEPS) for automobile and pharmaceutical & bio sectors, which have high overseas sales ratios, have been revised down by 5% and up by 7%, respectively, but if tariff noise intensifies, additional downward pressure on earnings and stock prices cannot be ruled out."

In addition, caution over interest rate hikes was also cited as a downward pressure on the stock market. The Bank of Japan (BOJ) is expected to hold a monetary policy meeting this week and raise interest rates. The analysis suggests that not only the pressure for yen appreciation due to the rate hike but also the accompanying wage increases will not necessarily have a positive effect on the stock market.

The report concluded, "Regarding the mid- to long-term outlook, positive prospects are maintained due to strong U.S. demand and proactive shareholder return policies, but in the short term, the scope for expansion in earnings or valuation is limited, so aside from the possibility of a technical rebound, the investment appeal is not significant."

It also explained, "At the national level, the Taiwan stock market could be a better choice than Japan," adding, "Since TSMC accounts for 37% of the market capitalization of the Taiwan Weighted Index, the benefits related to AI are more direct, and the resulting corporate earnings improvement is steep, placing Taiwan's earnings momentum among the top among major countries." It further suggested selective investment in financial stocks, including banks, insurance, and securities sectors, which are relatively less affected by tariffs, as alternative investment options within Japan.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)