Announcement of IPO and Delisting System Reforms

Focusing on Raising the Qualitative Level of the Stock Market

The financial authorities will gradually raise the market capitalization standard for KOSPI delisting, which is currently 50 billion KRW, by 10 times to 500 billion KRW to eliminate so-called 'zombie companies.' They also plan to revise the initial public offering (IPO) system, which has faced repeated complaints from individual investors due to inflated public offering prices, by strengthening the mandatory holding requirements for underwriters.

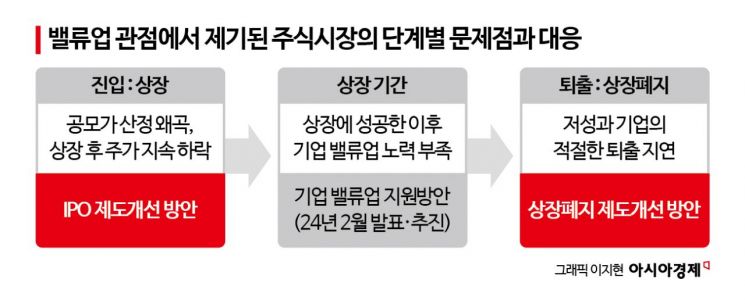

On the morning of the 21st, the Financial Services Commission, Financial Supervisory Service, Korea Exchange, Korea Financial Investment Association, and Korea Capital Market Institute announced these improvement plans at a joint seminar on 'IPO and Delisting System Improvements for Sustainable Capital Market Value-Up' held at the Yeouido Exchange. The main goal is to ensure the appropriate exit of insolvent marginal companies to raise the qualitative level of the domestic stock market, while alleviating irrational overheating phenomena during the IPO process.

This system improvement plan comes in response to numerous calls for institutional improvements in both market entry and exit to enhance capital market value. Kim Byung-hwan, Chairman of the Financial Services Commission, explained, "Since last year, the government has been actively promoting the value-up of our capital market, and the need for improvements in market structure value-up has also been raised. This is another major task for capital market value-up."

First, regarding market entry, the financial authorities noted that the IPO market is operated mainly for short-term profit investments, causing distortions in stock price trends. Accordingly, they will introduce a new priority system for institutional investors' mandatory holding commitments and expand the scoring system. At least 40% of the allocation to institutional investors will be preferentially assigned to those who commit to holding, and if the commitment volume falls below 40%, the underwriter must acquire 1% of the public offering volume and hold it for six months. This will start at 30% this year and be applied at 40% from next year.

They also added a mandatory holding commitment condition of at least 15 days for policy funds such as high-yield funds. This measure aims to reduce cases where policy funds sell public offering shares on the listing day to gain only short-term profits. Sanctions for violations of commitments will be strengthened, focusing mainly on restricting participation in demand forecasting. Additionally, from an institutional perspective, eligibility for demand forecasting participation will be tightened, and the scoring system will be restructured to assign equally relaxed scores from days 1 to 3 to prevent concentration on the first day.

The IPO system improvement plan also includes strengthening the underwriters' responsibilities by enhancing mandatory holding of pre-acquired shares. The gap rate standard between the price at which the underwriter acquires shares and the public offering price will be reduced from the existing 50% to 30%, and the minimum mandatory holding period will be extended from one month to three months. The revision of the Capital Markets Act, which was discarded due to the expiration of the 21st National Assembly session and included the introduction of cornerstone investors and pre-demand forecasting systems, will be re-pursued.

Meanwhile, the disclosed delisting system improvement plan focuses on strengthening requirements and simplifying procedures to eliminate zombie companies. The authorities judged that the system's effectiveness was insufficient due to excessively low market capitalization and sales requirements, so they raised these standards. Over the next three years, the KOSPI market capitalization and sales standards will be raised in three stages from the current 5 billion KRW each to 50 billion KRW and 30 billion KRW, respectively, up to 50 billion KRW and 30 billion KRW. (Note: The original Korean text states 50억원 to 500억원 and 300억원, so the correct translation is from 5 billion KRW to 50 billion KRW and 30 billion KRW to 300 billion KRW.) The KOSDAQ market capitalization and sales standards will also increase from 4 billion KRW and 3 billion KRW to 30 billion KRW and 10 billion KRW, respectively. The market capitalization standards will be raised starting January next year, and sales standards will be raised in stages starting January 2027, one year later.

According to simulations by the financial authorities, when these upward adjustments are fully completed, 62 companies, about 8% of the 788 KOSPI-listed companies, are expected to fall short of market capitalization or sales requirements (excluding overlaps). Similarly, 137 companies, about 7% of the 1,530 KOSDAQ-listed companies, will fall short.

Additionally, a 'two-strike out' system will be introduced for audit opinion failures. Since audit opinion failures have been the top reason for delisting over the past five years, this is part of efforts to enhance the system's effectiveness. Furthermore, to improve delisting procedure efficiency, the improvement period for KOSPI will be shortened from a maximum of four years to two years. For KOSDAQ, the maximum number of appeals and the improvement period will be reduced from three appeals and two years to two appeals and one year and six months. Other investor protection measures included in this system improvement plan are support for trading unlisted shares after delisting and expanded information disclosure during delisting reviews to prevent increased investor damage as the number of delisted companies rises.

Chairman Kim emphasized, "We will review the 'Stock Market System Reform Direction' to create a more efficient market structure that protects investors."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.