KT's IPTV Growth Stalls

Impact on Business Expected if a Giant OTT Emerges

Government Ramps Up Efforts to Foster K-OTT

KT's poor performance in internet TV (IPTV) is becoming an obstacle to the merger of TVING and Wavve. KT is the 'second-largest shareholder of TVING' and the 'number one IPTV operator in South Korea.' The integration of domestic OTT (over-the-top) services is essential to curb Netflix's dominance, but KT is reportedly unable to finalize the merger due to concerns over a decline in IPTV subscribers. Critics say KT is wasting time hesitating to create a giant OTT platform.

A senior official from the Ministry of Science and ICT, speaking on condition of anonymity on the 22nd, said, "KT is caught in a dilemma over the TVING-Wavve merger, weighing pros and cons and unable to make a decision," adding, "This is why the merger is not progressing at the expected pace."

The main reason is KT's sluggish IPTV performance. According to the Ministry of Science and ICT's survey, KT's IPTV service (Genie TV) held a 24.38% share of the paid broadcasting market as of the first half of last year. While maintaining the top position, this is hardly different from the 24.39% share in the first half of 2023. Compared to competitors SK Broadband (which increased by 0.18 percentage points) and LG Uplus (which increased by 0.16 percentage points), KT's performance is lackluster.

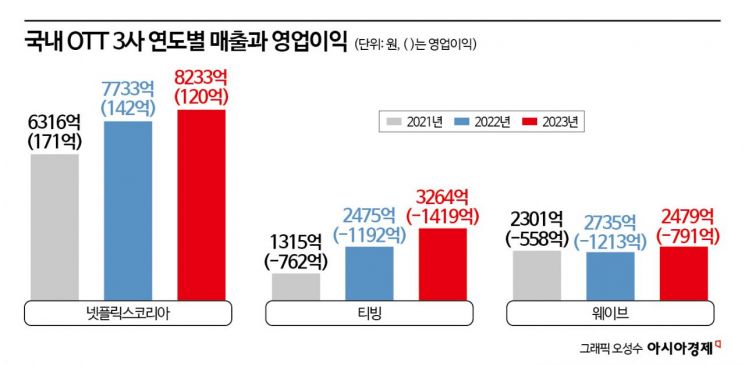

The stagnation in Genie TV's market share is attributed to the rapidly growing OTT market led by Netflix. As OTT usage increases, 'cord-cutting'?the cancellation of paid broadcasting subscriptions?is accelerating. Netflix holds a 35% share of the domestic market and generates hundreds of billions of won in revenue. According to Netflix's Q4 earnings report last year, revenue rose 16% year-on-year to $10.247 billion (approximately 14.7249 trillion won). Operating profit increased 52% year-on-year to $2.273 billion (approximately 3.2652 trillion won), with an operating margin of 22.2%.

In contrast, domestic OTTs TVING and Wavve, which incur losses of several hundred billion won annually, are preparing to transform into 'Netflix challengers' through a merger to create synergy.

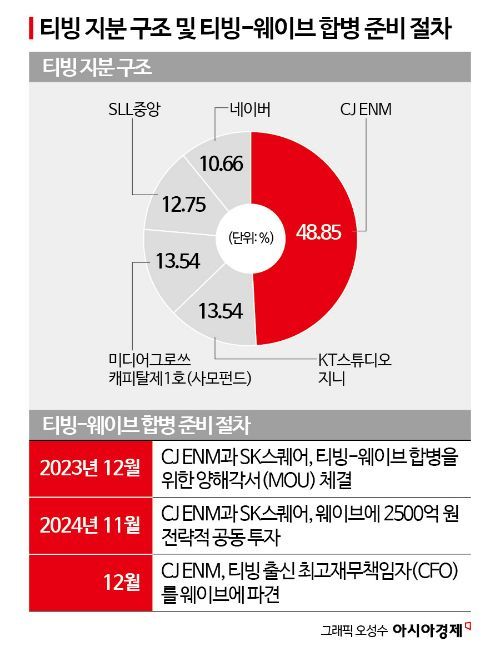

The key to the merger lies with KT. KT's subsidiary, KT Studio Genie, holds a 13.54% stake in TVING, making it the second-largest shareholder. Unless KT actively supports the merger, the 'TVING-Wavve merger' will be difficult. KT stated, "We are examining how the TVING-Wavve merger could benefit KT and whether it would enhance shareholder value as a TVING shareholder."

However, industry consensus is that KT will not be able to delay much longer as the government is actively promoting K-OTT development. In December last year, the Ministry of Science and ICT announced the 'K-OTT Industry Global Competitiveness Enhancement Strategy.' A ministry official said, "We are indeed expecting the emergence of globally competitive K-OTT platforms," adding, "I understand the merger is in its final stages, and we hope it will be completed smoothly and quickly."

A media industry insider analyzed, "Since the government policy to nurture domestic OTTs has been announced, KT will not oppose the merger until the end." He added, "If KT agrees, the merger process can be finalized," and "KT is devising a strategy to secure favorable conditions in the media and content market leadership."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)