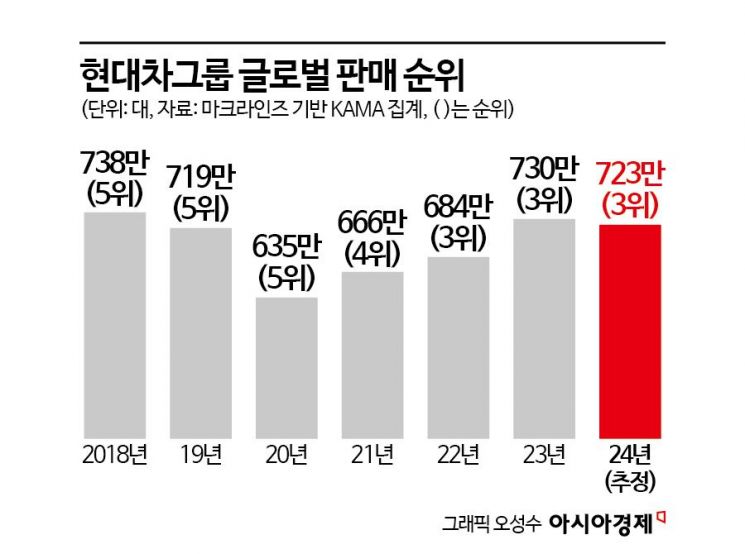

Hyundai Motor Group, From 5th in 2018 to 3rd in 2022

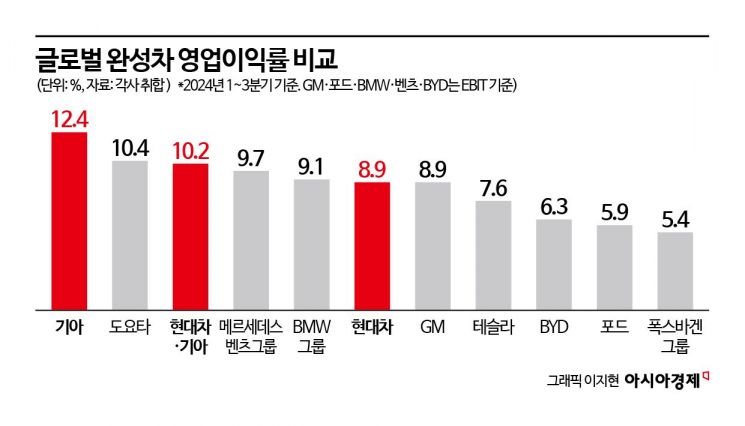

Hyundai Motor Company and Kia Achieve Industry-Leading Operating Profit Margins

Cost Competitiveness Secured Through Low Fixed Costs

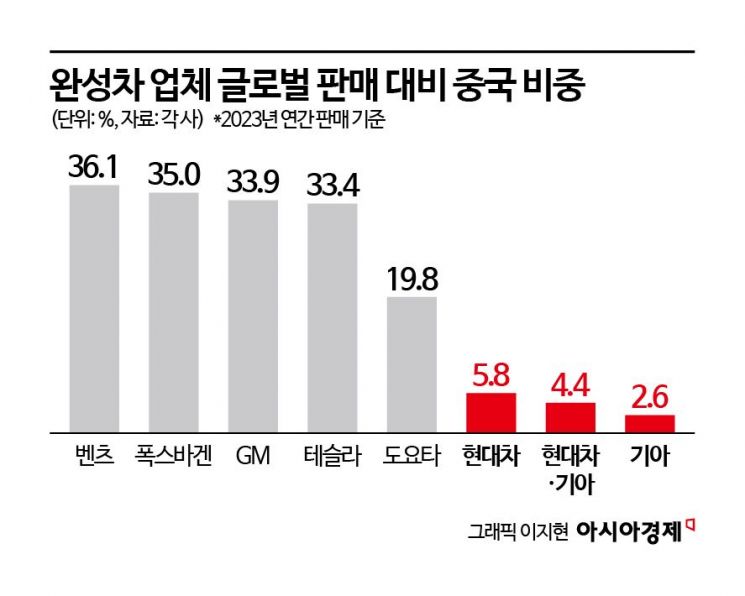

Volkswagen and Nissan Struggle in China and the US

Rising Expectations for Hyundai Motor Group's Climb in Global Rankings

"By 2026, Hyundai Motor Group will become the global number one." (April 2023, Samsung Securities Report)

In April 2023, a securities report attracted significant market attention. The report titled "By 2026, the global number one company will change," was released by Eunyoung Lim, the best analyst in the automotive sector at Samsung Securities. The main content forecasted that while the current industry leaders Toyota and Volkswagen were struggling in the Chinese market, Hyundai Motor Company and Kia, ranked third, would break through with sales in the U.S. and India and rise to first place.

At the time, the industry received this claim with skepticism. It was already surprising that Hyundai Motor Group had risen to third place by wisely navigating the COVID-19 pandemic period, but to surpass Toyota and Volkswagen to become number one seemed overly optimistic to many.

However, what drives corporate success is the momentum of business expansion. No matter how solid the walls built by a global number one company are, if the growth rate reflected in numbers stagnates, it must step down from the throne. In this regard, Hyundai Motor Group's financial performance in 2023 was rising at a frightening pace, setting new records for three consecutive years. Researcher Lim said, "After COVID-19, Hyundai Motor Group was in a high-growth period, so many people thought (being number one in 2026) might be possible," adding, "Interest in Hyundai Motor Group's value chain companies increased, considering the possibility that automobiles would become the number one export item following semiconductors."

How has the outlook changed as of 2025? Researcher Lim said, "I still believe Hyundai Motor Group can achieve global sales number one," but added, "However, Toyota's sales decline in China is not as fast as expected, and the prolonged electric vehicle chasm may delay the originally anticipated timing by one to two years."

The author also believes that the likelihood of Hyundai Motor Group becoming the global sales leader in 2026 is low. However, the overall trend in the global finished vehicle market is unfolding as mentioned in the report two years ago. Local Chinese electric vehicle manufacturers are rapidly rising in the Chinese market, causing significant impacts on major traditional automakers with high Chinese sales proportions such as Toyota, Volkswagen, GM, and Nissan. Hyundai Motor Group's achievement of first place is not solely due to its own performance; it also depends on the underperformance of competitors, which ultimately raises its ranking.

Current Position of Hyundai Motor Group in the Global Market

As of January 2025, what position does Hyundai Motor Group hold in the global market? The global sales volume, indicating quantitative growth, has not significantly increased recently. Compared to 2015, when Hyundai Motor Group recorded its highest sales ever at 8.01 million units, driven by high growth in the Chinese market, the global sales volume in 2024 was 7.23 million units, about 10% lower.

However, growth is remarkably steep when looking at the global ranking and operating profit, which indicate the quality of sales. While competitors' sales volumes declined more significantly due to the COVID-19 pandemic and semiconductor supply shortages, Hyundai Motor Group's sales ranking naturally rose.

According to MarkLines data processed by the Korea Automobile Mobility Association (KAMA), Hyundai Motor Group's global sales ranking rose from 5th in 2020 to 4th in 2021, and then to 3rd in 2022. In 2023, it maintained 3rd place with 7.3 million units sold, and in 2024, with about 7.23 million units, it is expected to comfortably hold 3rd place while narrowing the gap with 2nd place Volkswagen (9.03 million units). However, from 2025 onwards, significant changes are expected among the top 5 automakers due to mergers such as Nissan-Honda and other alliances.

More important than sales ranking are performance indicators such as revenue and operating profit. Hyundai Motor Group's past strategy was 'low margin, high volume.' While it previously focused on selling many cars at low profit margins, recently Hyundai Motor Group has adopted a high-profit strategy by increasing the unit price per vehicle even if total sales volume decreases. Hyundai Motor Company and Kia have recorded record-high sales and operating profits for three consecutive years since 2022. Comparing operating profit margins, they are comparable to premium brands (Mercedes-Benz, BMW) that sell much higher-priced vehicles. Operating profit margin is a ratio indicating how much actual profit a company retains from its revenue.

Comparing operating profit margins of global automakers: based on cumulative sales and operating profit up to Q3 2024, among 10 automakers (Kia, Toyota, Mercedes-Benz, BMW, Hyundai Motor Company, GM, Tesla, BYD, Ford, Volkswagen), Kia had the highest operating profit margin at 12.4%. It surpassed premium brands like Mercedes-Benz (9.7%) and BMW Group (9.1%), as well as Tesla, which surprised the industry by achieving double-digit operating profit margins solely from electric vehicles. In terms of profitability, Hyundai Motor Group can already be considered global number one. Based on cumulative data from Q1 to Q3 2024, Toyota Group's operating profit margin was 10.4%, and Hyundai Motor Group's was 10.2%, showing similar levels.

Secrets Behind Hyundai Motor Company and Kia's Double-Digit Operating Profit Margins

It is remarkable that Hyundai Motor Company and Kia, as mass-market brands, have double-digit operating profit margins. Kia's outstanding performance, in particular, stands out. The secret to Kia's profitability lies in cost competitiveness due to low fixed costs. The amortization period for development costs and capital investments poured into internal combustion engine vehicles has ended, so now internal combustion engine vehicles generate profit the more they are sold. Labor costs at overseas factories have also decreased due to automation and informatization, continuously lowering Kia's fixed costs.

However, the low profitability of electric vehicles remains a challenge. Kia is defending against profitability declines from the transition to electric vehicles by utilizing hybrids as a stepping stone. Hyundai Motor Group is the only automaker with a full portfolio developed in-house, from internal combustion engines to hybrids (HEV, PHEV included) and electric vehicles. Toyota lacks preparation for electric vehicles, and Volkswagen has no hybrid options. Hybrids have higher profitability than electric vehicles and can be sold at prices 10-20% higher than internal combustion engine vehicles. Moreover, from the first half of 2024, battery pack prices have dropped by more than 50% year-over-year, enhancing Kia's cost competitiveness. According to Samsung Securities, Kia's cost of sales per vehicle was $20,050 in Q1 2024, lower than BYD's $21,700. However, the selling price in the global market is over 20% higher for comparable models. For example, BYD's small electric SUV Atto 3 launched in the Korean market starts at 31.5 million KRW, while Kia's comparable model EV3 is priced around 39.95 million KRW.

The Fall of 'Industry No. 2' Volkswagen

Experts predict that Hyundai Motor Group could challenge the global sales number two position as early as the second half of this year. While Hyundai Motor Group's strong performance is a factor, the underperformance of Volkswagen Group, currently ranked second globally, is also significant. The gap between Volkswagen Group (2nd, 8.26 million units) and Hyundai Motor Group (3rd, 6.84 million units) narrowed to about 1.4 million units at the peak of the semiconductor supply crisis in 2022. As of 2024, the gap is about 1.8 million units, significantly reduced compared to 3.8 million units before the COVID-19 pandemic in 2019.

In 2020, Volkswagen Group experienced a sales decline of over 1.67 million units (15%) in a single year due to the combined effects of COVID-19 and semiconductor shortages. This indicates that if a major market shock occurs, the global finished vehicle market can increase or decrease by about one million units annually, enough to change rankings given the narrow gap.

Recently, Volkswagen Group is facing its greatest crisis in 88 years since its founding. It has lost dominance in the Chinese market, leading to declining profitability. Consequently, the group is reducing production capacity and jobs in its home country, Germany. It plans to cut about 30% (35,000 employees) of its German workforce by 2030 and convert or sell relatively small factories in Osnabr?ck and Dresden into autonomous driving centers. This will reduce Volkswagen Group's production capacity in Germany by 734,000 units annually.

The electric vehicle ID.3 being manufactured at Volkswagen's Dresden plant. Provided by Volkswagen Group

The electric vehicle ID.3 being manufactured at Volkswagen's Dresden plant. Provided by Volkswagen Group

The cause of Volkswagen Group's decline, which held the global number one position until 2019, can be found in China. China is the world's largest finished vehicle sales market and the fastest-growing electric vehicle demand market. Volkswagen quickly planned an electrification transition in response to changes in the Chinese market. However, aggressive competition from Chinese local electric vehicle manufacturers such as BYD, GAC (Guangzhou Automobile Group), Xpeng, and Nio caused Volkswagen to lose its footing in the electric vehicle market. Additionally, Volkswagen faces challenges in its other major market, Europe, where the pace of electrification is slowing. While Hyundai Motor Company and Toyota can endure this period with hybrids, Volkswagen, which only has internal combustion engine and electric vehicle options, faces greater difficulties. Researcher Lim said, "Volkswagen Group is struggling greatly in China and also facing difficulties in Europe due to Chinese electric vehicle companies. Without hybrid models, it is now difficult to develop internal combustion engine vehicles."

Volkswagen Group sold 2.93 million units in China in 2024 (including internal combustion engine and electric vehicles), a 9.5% decrease from the previous year. Compared to 2019, just before the COVID-19 pandemic, sales have dropped by more than 30%. As of 2023, China accounts for 35% of Volkswagen Group's global sales. Companies highly dependent on the Chinese market, such as Mercedes-Benz (36%), GM (34%), and Tesla (33%), are also facing significant challenges. In contrast, Hyundai Motor Group's Chinese market share is only 4.4%, about one-quarter of Toyota's 19.8%, the global sales leader.

'Japan's Electric Vehicle Powerhouse' Nissan Also Struggling

Not only Volkswagen Group but also the timing of the Nissan-Honda alliance merger is expected to be a variable affecting Hyundai Motor Group's ranking. If Honda and Nissan merge, they will compete with Hyundai Motor Group for third place in global sales volume. Simply adding sales, Hyundai Motor Group sold 7.3 million units globally in 2023, while the Honda-Nissan-Mitsubishi alliance sold 8.13 million units.

However, both Nissan and Honda are struggling in a slump. Nissan launched the world's first mass-produced electric vehicle, the Leaf, in 2010 but failed to dominate the electric vehicle market. It did not demonstrate breakthrough battery technology to significantly extend driving range and lagged behind Tesla and Chinese electric vehicle companies in software. Nissan's operating profit from April to September last year decreased by 90% compared to the same period the previous year. It laid off about 9,000 employees, approximately 7% of its global workforce, and closed some factories, reducing global production capacity by 20%.

However, the merger driven by this crisis is considered hasty and unlikely to generate synergy. Frankly, at this point, it is difficult to say that Honda, Nissan, and the other alliance Mitsubishi are leading future mobility technologies such as electric vehicles and autonomous driving. Carlos Ghosn, former chairman of the Renault-Nissan Alliance who led Nissan's revival, said, "The two companies have strengths and weaknesses in the same fields, so their business complementarity is not clear," and evaluated, "The merger was done from a political perspective rather than an industrial one."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.