Estimated Net Profit of Eight Listed Domestic Insurers Reaches 1.342 Trillion KRW

Up 25.9% Year-on-Year

Flu Outbreak, Heavy Snowfall, and Accounting Changes May Lead to Results Falling Short of Expectations

There is a prevailing outlook that the performance of major domestic insurance companies in the fourth quarter of last year will improve compared to the same period the previous year. However, concerns remain that actual results may fall short of expectations due to the flu outbreak at the end and beginning of the year, an increase in car accidents caused by heavy snowfall, and changes in insurance accounting.

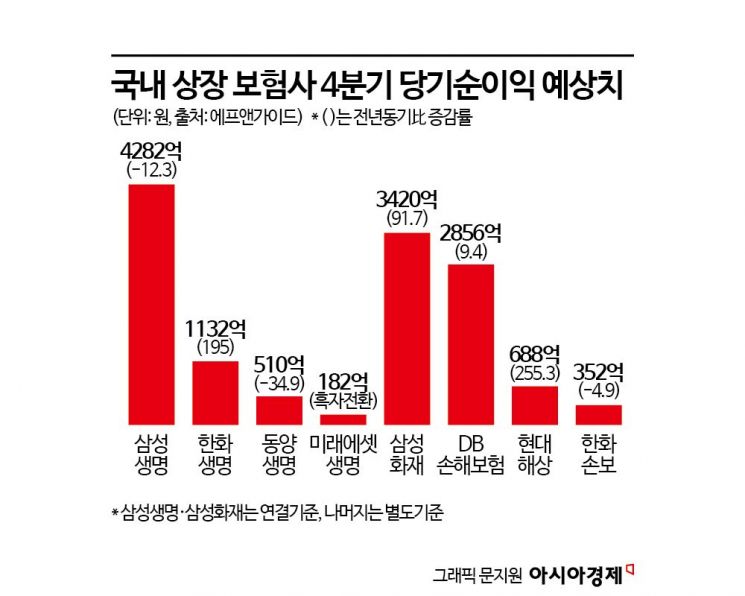

According to financial information provider FnGuide on the 20th, the estimated net profit for the fourth quarter of last year for eight insurance companies listed on the domestic stock market is 1.342 trillion KRW, a 25.9% increase compared to 1.0663 trillion KRW in the same period last year. Samsung Life Insurance and Samsung Fire & Marine Insurance estimates are based on consolidated figures, while the others are based on separate financial statements.

Samsung Life Insurance, the eldest son of Samsung Financial Group, is expected to report a net profit of 428.2 billion KRW in the fourth quarter of last year, down 12.3% from the same period last year. Samsung Fire & Marine Insurance is expected to increase by 91.7% to 342 billion KRW. Within the insurance industry, there is significant interest in whether Samsung Fire & Marine Insurance can catch up with Samsung Life Insurance for the first time in last year's annual results. The cumulative net profits for the first three quarters of last year were 2.1659 trillion KRW for Samsung Life Insurance and 1.8689 trillion KRW for Samsung Fire & Marine Insurance. According to securities analysts, Samsung Life Insurance is still likely to maintain its leading position.

Hanwha Life Insurance, the second largest life insurer, is expected to post a net profit of 113.2 billion KRW in the fourth quarter of last year, a 195% increase compared to the same period last year. Seol Yong-jin, a researcher at SK Securities, explained, "New contracts are expected to rise sharply due to the effects of discontinuing short-term payment whole life insurance and no/low-surrender value insurance," adding, "Loss contract burden costs are also expected to decrease due to high-interest whole life insurance."

DB Insurance's net profit for the fourth quarter of last year is expected to increase by 9.4% to 285.6 billion KRW compared to the same period last year. During the same period, Hyundai Marine & Fire Insurance's net profit is estimated to increase by 255.3% to 68.8 billion KRW. Although both companies are expected to improve their performance, the atmosphere at the beginning of the year is gloomy. This is because the worst wildfire in 60 years occurred in the southern California region of Los Angeles (LA), making losses at local business sites inevitable. DB Insurance, which holds 37 contracts in the affected area, is analyzed by the securities industry to face losses of around 60 billion KRW. Hyundai Marine & Fire Insurance holds four contracts in the wildfire area but states that there has been no significant damage yet due to the distance from the fire, although the flames have not been fully contained, so caution remains necessary.

Whether there is a deficit in the automobile insurance sector is also expected to be a variable that shakes up performance forecasts. Samsung Fire & Marine Insurance, which holds the largest market share in automobile insurance, recorded an average loss ratio of 82.2% from January to November last year. The loss ratio in November was 92.8%, a sharp increase of 4.9 percentage points compared to 87.9% in the same period last year. DB Insurance (87.5%) and Hyundai Marine & Fire Insurance (97.8%) also saw a sharp rise in loss ratios in November compared to the same period last year. This was due to a surge in car accidents caused by heavy snowfall, the worst in 117 years. Typically, the break-even point for automobile insurance loss ratios is 80%, and for large companies, it is considered 82%. Park Hye-jin, a researcher at Daishin Securities, estimated that Samsung Fire & Marine Insurance (-92 billion KRW), Hyundai Marine & Fire Insurance (-75 billion KRW), and DB Insurance (-70 billion KRW) likely posted deficits in the automobile insurance sector last year.

The rapid increase in influenza (flu) patients starting from the end of last year is also a factor darkening insurance companies' performance. According to statistics from the Korea Disease Control and Prevention Agency, after the flu advisory was issued on December 20 last year, the number of suspected flu patients in the first week of this year (December 29 last year to January 4 this year) reached 99.8 per 1,000 outpatients, the highest since 2016. An increase in flu patients leads to a surge in claims for indemnity insurance, which expands the gap between expected and actual losses for insurance companies.

The no/low-surrender value insurance lapse rate guideline regulation announced by financial authorities in November last year is also expected to negatively impact the performance of the non-life insurance industry. Insurance companies are currently recalculating last year's financial figures according to this guideline. This is expected to reduce the Contractual Service Margin (CSM), an indicator of insurance company profitability. Kang Seung-geon, a researcher at KB Securities, analyzed that changes in the lapse rate estimation model for no/low-surrender value insurance will result in a CSM decrease of 1.9 trillion KRW for non-life insurers and 500 billion KRW for life insurers.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)