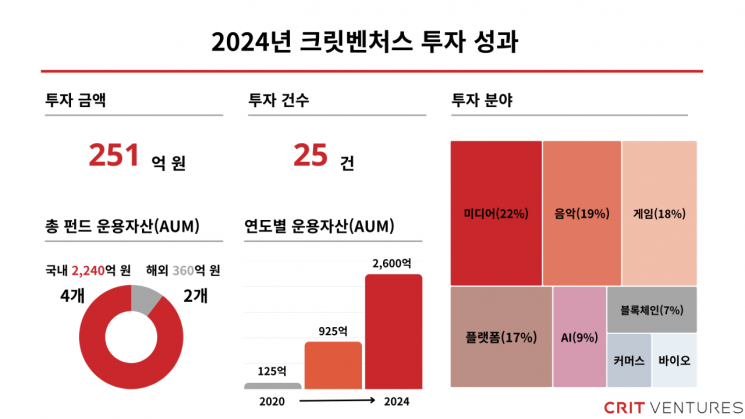

Crit Ventures announced on the 16th that it executed 25 investments totaling 25.1 billion KRW last year, including 22.5 billion KRW domestically and 2.6 billion KRW overseas (approximately 1.8 million USD).

Over the past year, Crit Ventures invested evenly across K-content sectors such as games, music, and media, as well as in business model innovations based on new technologies including platforms, commerce, artificial intelligence (AI), and blockchain. The investment amount proportions by sector were ▲Media 22% ▲Music 19% ▲Games 18% ▲Platform 17% ▲AI 9% ▲Blockchain 7% ▲Commerce 4% ▲Bio 4%.

Key invested companies include ▲Kmedia (global distribution) and ▲BeMyFriends (global fandom platform) in the K-pop sector; ▲Averton (MMORPG) and ▲Supervillain Labs (AI) in the gaming sector; ▲Brave Company (creator commerce) in the media-commerce convergence sector; ▲Guru Company (webtoon service platform) and ▲Colly (goods commerce platform) in the platform sector; and ▲Girin Labs (Ripple wallet) in the blockchain sector.

In particular, last year, Crit Ventures focused on the global expansion of K-content by making a sole investment of 2.7 billion KRW in K-pop global distributor Kmedia. Headquartered in California, USA, Kmedia is a startup founded by experts with experience in global K-pop businesses such as Mnet and Dingo, and operates Hello82, the world’s largest K-pop digital channel.

Along with equity investment, Crit Ventures also invested 5 billion KRW in Kmedia’s global distribution project for the idol group ATEEZ’s album, achieving an internal rate of return (IRR) of 17%. Following the collaboration, ATEEZ reached No. 1 on the Billboard 200 and remained on the chart for six consecutive weeks.

Regarding exit performance, portfolio companies Nomus and Studio Samik successfully went public on KOSDAQ last year, resulting in successful exits, and a total of 8.7 billion KRW was recovered, including from music production projects.

Song Jae-jun, CEO of Crit Ventures, stated, “The content industry is a field where Korea’s global competitiveness stands out, and its global market share continues to rise. We will actively discover and support startups that aim to combine industrial competitiveness with new technologies and business models and expand globally.”

Meanwhile, Crit Ventures was established in August 2020 by CEO Song, who previously served as CEO of Com2uS and is currently the Global Chief Investment Officer (GCIO) of the Com2uS Group. The assets under management (AUM) total 260 billion KRW, combining 224 billion KRW in Korea and 36 billion KRW globally.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)