Crisis Looms as Exchange Rate May Exceed 1,500 Won in First Half

Banks Race to Manage RWA

More Cases of Denied Extensions or Partial Repayment Demands for High-Risk Loans

Mr. A, who owns a commercial office purchased with a loan, recently faced the maturity of his loan and tried to extend it. However, the bank responded, "To extend, you must partially repay about 10-20%," explaining that "commercial offices are classified as risky assets due to high vacancy risks and much worse business conditions compared to the housing market." When Mr. A protested, saying, "I have never been delinquent and have always extended the maturity without difficulty, so why is partial repayment required this time?" the bank only repeated that it was "head office policy."

As concerns spread that the exchange rate could surpass the 1,500 won level in the first half of the year, commercial banks are rushing to reduce risky assets. When the exchange rate rises, foreign currency risky assets increase, leading to a rise in risk-weighted assets (RWA). RWA is a figure that re-evaluates a financial institution's assets considering risk levels and reflects the actual risk exposure of banks. Loans with high recoverability, such as mortgage loans, have low risk, but loans to low-credit companies or commercial real estate loans with high vacancy risk and decreased appraisal values are assigned higher risk weights.

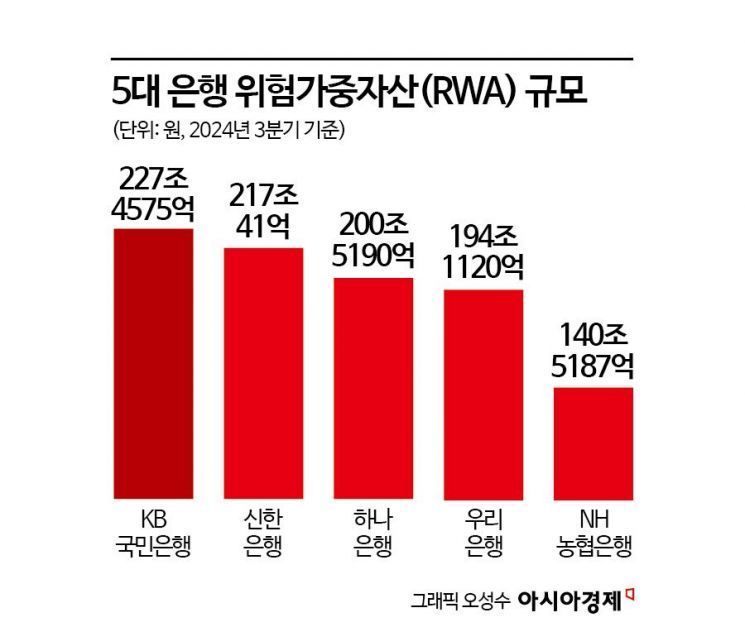

In fact, the RWA of commercial banks rose sharply in 2024. As financial authorities strengthened household loan regulations, banks turned their attention to corporate loans. As of the third quarter of 2024, the RWA of the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup Bank) stood at 979.6113 trillion won. This is about a 7% (62.6703 trillion won) increase compared to the third quarter of 2023 (916.941 trillion won). Considering the annual increase of 34.844 trillion won last year, this is nearly double the increase in just three quarters. Compared to the third quarter of 2023, when RWA decreased by 0.2 percentage points year-on-year, the growth trend has significantly expanded.

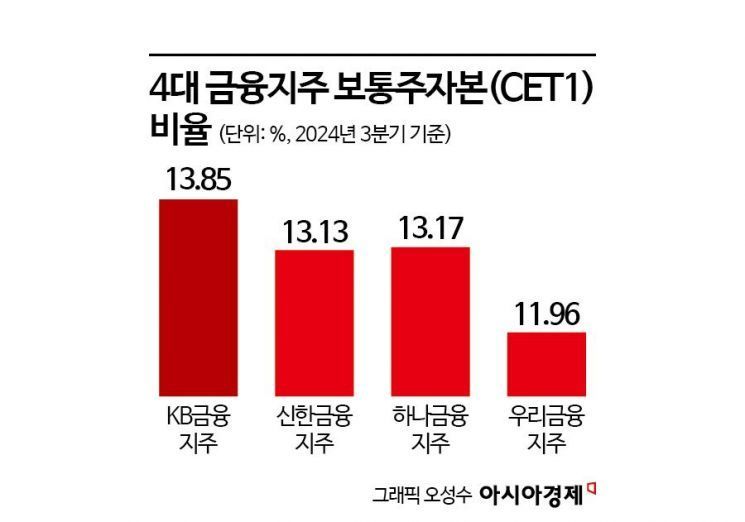

The problem is that an increase in RWA affects the Common Equity Tier 1 (CET1) ratio, inevitably disrupting value-up plans. The CET1 ratio, which indicates the proportion of capital raised through common equity in total capital, is a key indicator of a financial institution's soundness; a higher figure means greater capacity for shareholder dividends. Financial authorities recommend financial holding companies maintain a CET1 ratio of 13% or higher. As of the third quarter of 2024, the CET1 ratios of the four major financial holding companies are approximately 13.85% for KB Financial Group, 13.13% for Shinhan Financial Group, 13.17% for Hana Financial Group, and 11.96% for Woori Financial Group.

Accordingly, banks are managing risk assets at the branch level rather than the head office and are thoroughly monitoring daily RWA fluctuations. KB Kookmin Bank manages risk assets at the branch level rather than the head office. Woori Bank plans to reduce foreign currency assets and selectively provide corporate loans. Hana Bank checks daily RWA fluctuations to comply with the CET1 ratio.

A financial holding company official said, "When the exchange rate rises, foreign currency risky assets increase, leading to RWA growth and CET1 decline, so we are managing RWA as a risk hedge against exchange rate increases. Especially considering the introduction of capital regulations such as stress buffer capital, we have no choice but to focus more on soundness management."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)