HBM Unit Price Five Times Higher Than DRAM Average

Share Expected to Expand to 46% This Year... Difficult for Competitors to Overtake

Last year, the proportion of high-bandwidth memory (HBM) in SK Hynix's total memory semiconductor sales, including DRAM semiconductors and NAND flash, is expected to reach an all-time high.

The world's largest electronics and IT exhibition, 'CES 2025,' was held at the Las Vegas Convention Center (LVCC) Central Hall in Nevada, USA. On the 6th (local time), the 5th generation high-bandwidth memory (HBM) product, HBM3E 16-stack physical model, was exhibited at the SK exhibition hall. Photo by Yonhap News.

The world's largest electronics and IT exhibition, 'CES 2025,' was held at the Las Vegas Convention Center (LVCC) Central Hall in Nevada, USA. On the 6th (local time), the 5th generation high-bandwidth memory (HBM) product, HBM3E 16-stack physical model, was exhibited at the SK exhibition hall. Photo by Yonhap News.

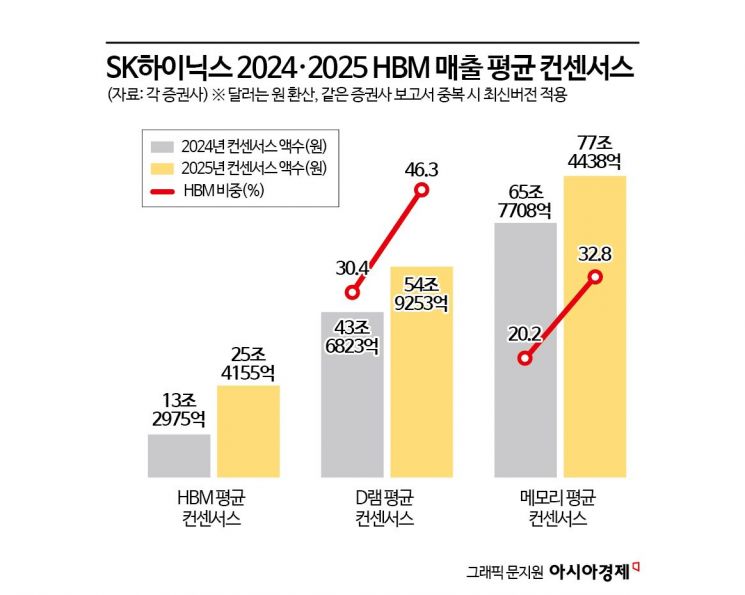

According to the average of four SK Hynix stock reports prepared by securities firms since December last year that presented HBM performance estimates, SK Hynix's estimated annual HBM sales last year amounted to 13.2975 trillion KRW. Considering the estimated total memory sales of 65.7708 trillion KRW, HBM accounted for more than 20%. This is the first time securities firms have separately compiled HBM performance. Compared to the estimated DRAM sales (43.6823 trillion KRW), the HBM sales ratio is 30.4%, the highest ever.

The unit price of HBM is about five times higher than the average unit price of DRAM, including Double Data Rate (DDR). Simply put, selling HBM chips earns five times more money. According to Korea Investment & Securities, the estimated average selling price per Gb of HBM this year is $1.470, which is 4.2 times higher than DRAM's $0.349.

SK Hynix will announce its performance for last year on the 23rd. If it follows the consensus (estimates) of the securities industry, the gap in HBM with Samsung Electronics is expected to widen.

Kim Hyung-jun, Head of the Next-Generation Intelligent Semiconductor Business Unit (Emeritus Professor at Seoul National University), said, "SK Hynix delivered HBM3E mainly to Nvidia data centers, but Samsung Electronics sold the 4th generation (HBM3) to Chinese companies and others, which widened the profitability gap between the two companies."

SK Hynix's proportion of HBM sales is expected to increase further this year. The securities industry forecasts SK Hynix's average HBM sales this year to be 25.4155 trillion KRW, an increase of 12.118 trillion KRW compared to last year. Considering the estimated DRAM sales of 54.9253 trillion KRW, nearly half (46.3%) of the sales will come from HBM.

Experts predict that HBM will be used not only in artificial intelligence (AI) data centers but also in mobile, autonomous vehicles, and robot sets, making it difficult for competitors to catch up with SK Hynix over the next 5 to 10 years.

Kim Yong-seok, Chair Professor of the Semiconductor Department at Gachon University, said, "Mobile devices do not perform as massive computational loads as AI data centers, so the demand for HBM from mobile set manufacturers will not increase significantly. The HBM market for robots and autonomous vehicles will develop faster, but even that will take several years."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)