51% of Listed Companies See Q4 Operating Profit Consensus Downgraded from a Month Ago

Only 67 Companies See Upward Revisions

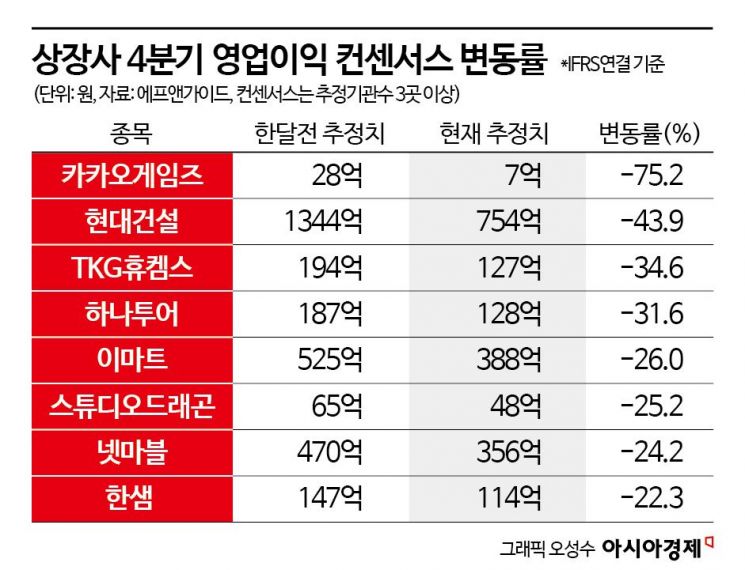

Significant Downgrades for Kakao Games, Hyundai Construction, Hana Tour, and E-Mart

Com2uS Sees the Largest Upward Revision

As the earnings season for the fourth quarter of last year has begun, expectations for corporate earnings are lowering. More than half of major companies have downgraded their earnings outlook compared to a month ago.

According to financial information provider FnGuide on the 15th, among 260 listed companies with consensus estimates from three or more securities firms, 134 companies, or 51% of the total, had their fourth-quarter operating profit consensus downgraded compared to a month ago. Only 67 companies saw upward revisions, while 59 companies showed no change from a month ago.

The company with the largest downward revision in operating profit was Kakao Games. Kakao Games' fourth-quarter operating profit consensus dropped 75.2% from 2.8 billion KRW a month ago to 700 million KRW. Hyundai Motor Securities forecasted that Kakao Games would record an operating loss of 9.5 billion KRW in the fourth quarter, turning to a deficit compared to the same period last year. Hyundai Motor Securities analyst Kim Hyun-yong explained, "We expect an earnings shock significantly below consensus," adding, "The main cause of the revenue decline is the 23.2% year-on-year decrease in mobile due to a prolonged absence of new releases." Hyundai Motor Securities reflected the possibility of an earnings shock in the fourth quarter and the absence of major new releases in the first half of this year in their earnings forecast, lowering Kakao Games' target stock price by 10% to 17,000 KRW.

Other companies with significant downward revisions in earnings outlook include Hyundai Construction (-43.9%), TKG Huchems (-34.6%), Hana Tour (-31.6%), E-Mart (-26.0%), and Studio Dragon (-25.2%). Yuanta Securities analyst Jang Yoon-seok said, "Hyundai Construction's fourth-quarter sales are expected to decrease by 1% year-on-year to 8.5 trillion KRW, and operating profit is expected to fall 75% to 36.4 billion KRW, below the lowered consensus," adding, "It is estimated that large-scale costs occurred due to the reflection of settlement costs at domestic and overseas completion sites throughout 2024, along with the cost rate adjustment related to the CEO changes at Hyundai Construction and Hyundai Engineering."

On the other hand, Com2uS saw the largest upward revision in consensus. Com2uS' fourth-quarter operating profit consensus rose 511% from 100 million KRW a month ago to 600 million KRW. Securities firms expect Com2uS' fourth-quarter results to meet or exceed consensus. Hanwha Investment & Securities analyst Kim So-hye said, "Com2uS' fourth-quarter results are estimated to be in line with consensus," adding, "With earnings and valuation having bottomed out, a stock price rise driven by new release momentum is expected." Hanwha Investment & Securities raised Com2uS' target stock price from 55,000 KRW to 60,000 KRW, reflecting upward revisions in game business profit estimates.

Other companies with relatively large upward revisions in consensus include Kumho Construction (16.7%), Hanwha Ocean (9.1%), HD Hyundai Mipo (8.7%), Kiwoom Securities (8.4%), and Krafton (7.1%). NH Investment & Securities analyst Jung Yeon-seung said about Hanwha Ocean, "Fourth-quarter results are expected to exceed consensus due to a strong exchange rate and increased dry dock volume," adding, "The performance improvement cycle is expected to continue this year with strong new orders."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.