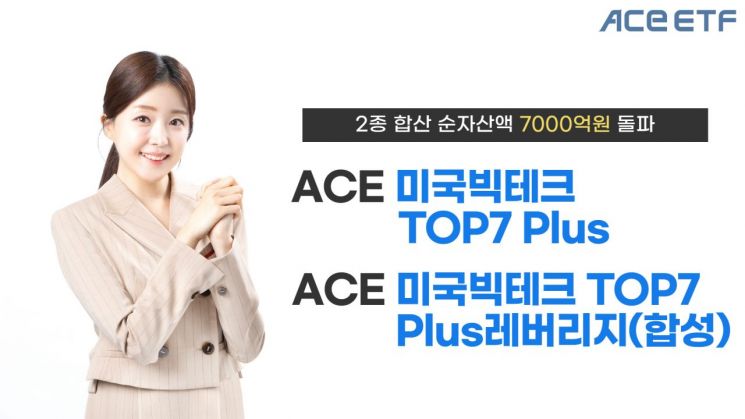

Korea Investment Trust Management announced on the 14th that the combined net asset value of two exchange-traded funds (ETFs) that focus on investing in major U.S. big tech companies has surpassed 700 billion KRW. The two products are the ACE US BigTech TOP7 Plus ETF and the ACE US BigTech TOP7 Plus Leverage (Synthetic) ETF.

According to the Korea Exchange, as of the 9th of this month, the combined net asset value of the ACE US BigTech TOP7 Plus ETF and the ACE US BigTech TOP7 Plus Leverage (Synthetic) ETF exceeded 700 billion KRW. On the 13th of this month, the combined net asset value reached 710.8 billion KRW, with the ACE US BigTech TOP7 Plus ETF and the ACE US BigTech TOP7 Plus Leverage (Synthetic) ETF recording net asset values of 614.2 billion KRW and 96.6 billion KRW, respectively.

These two products were simultaneously listed by Korea Investment Trust Management in September 2023. They are characterized by including the top 10 U.S. big tech companies by market capitalization listed on the NASDAQ stock exchange. Since the ACE US BigTech TOP7 Plus Leverage (Synthetic) ETF is a leveraged version of the ACE US BigTech TOP7 Plus ETF, both products share the same underlying index, the 'Solactive US BigTech TOP7 Plus PR Index.'

The increase in net asset value is attributed to excellent performance. The ACE US BigTech TOP7 Plus Leverage (Synthetic) ETF recorded the highest performance among domestically listed ETFs on an annual basis in 2024, showing a 6-month return of 26.07% (161.79% over the past year). The ACE US BigTech TOP7 Plus ETF also posted an annual return of 82.06% in 2024, along with a 6-month return of 15.76% (70.59% over one year).

Individual investors’ net buying activity is also notable. The ACE US BigTech TOP7 Plus ETF recorded a net purchase amount of 207 billion KRW by individual investors last year and has already seen net purchases amounting to 15.7 billion KRW this year. The ACE US BigTech TOP7 Plus Leverage (Synthetic) ETF ranked 6th in net purchases by individual investors among leveraged products last year, with 46.5 billion KRW.

Nam Yong-su, Head of ETF Management at Korea Investment Trust Management, stated, “The ACE US BigTech TOP7 Plus ETF and the ACE US BigTech TOP7 Plus Leverage (Synthetic) ETF focus on investing in representative technology stocks leading the U.S. stock market. Since they allow diversified investment in leading U.S. stocks with a long-term upward trend, the ACE US BigTech TOP7 Plus ETF is suitable for investment through defined contribution (DC) retirement pensions and individual retirement pensions (IRP).”

Meanwhile, both products mentioned in this article are performance-distributing products, and past returns do not guarantee future returns. Additionally, principal loss may occur depending on management results, so caution is advised.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)