Google Announcement Triggers Surge... Sharp Drop Follows Jensen Huang's Remarks

Market Experts: "High Volatility Expected Until Earnings Are Proven"

Since Google announced the development of a new quantum computer on December 10 last year, quantum computer-related stocks, which had played a leading role in the domestic stock market, have continued to decline. The atmosphere changed rapidly following remarks by Jensen Huang, CEO of NVIDIA, who said it would take 20 years before a useful quantum computer emerges. Despite optimistic forecasts from Kim Jeongsang, co-founder of quantum computing company IonQ and professor at Duke University, the sell-off has not stopped. Individual investors who invested in quantum computer-related stocks that surged early this year are facing increasing losses.

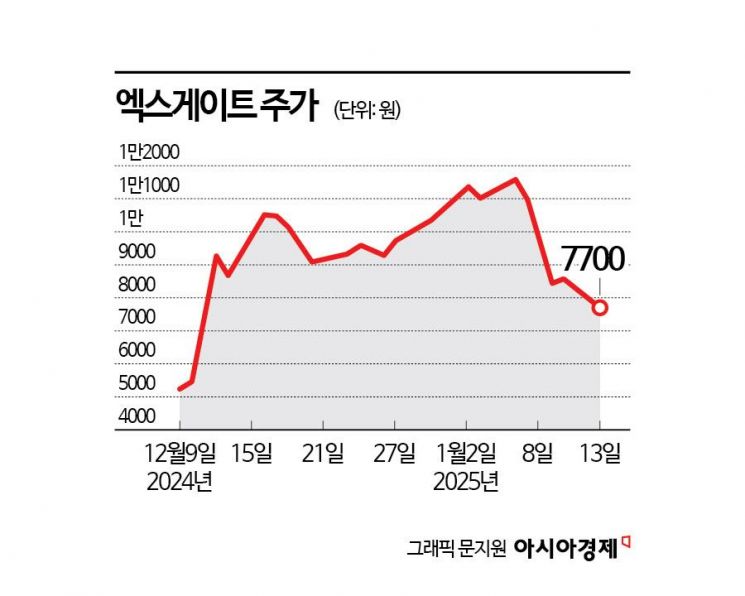

According to the financial investment industry on the 14th, individuals have purchased 4.2 billion KRW worth of Exgate shares this year. The average purchase price was 9,887 KRW. Based on the current stock price of 7,700 KRW, the unrealized loss rate stands at 22.1%. In just four days since the closing price on the 7th, Exgate’s stock price fell by 29.6%. Some retail investors appear to have bought more shares to lower their average purchase price after the sharp short-term drop in Exgate’s stock price.

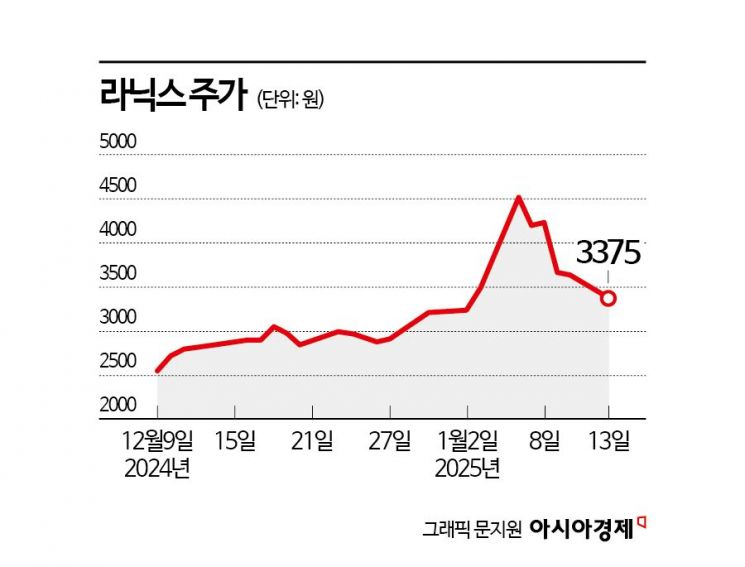

Since the 7th, QSI has dropped 24.1%, while Ranix and Aton have fallen 19.5% and 16.6%, respectively. Individuals have net purchased 6.8 billion KRW worth of Aton shares this year, with an unrealized loss rate of -17.2%.

Just a month ago, on the 11th of last month, quantum computing was regarded as a breakthrough technology on the verge of commercialization in the domestic stock market. Related stocks, including Exgate, soared. Exgate’s stock price jumped 126.3% from 5,480 KRW on the 10th of last month to an intraday high of 12,400 KRW on the 3rd. QSI also rose 106.0%.

As the desire to realize profits grew after the rapid short-term surge, Jensen Huang’s remarks acted as a catalyst. Visiting Las Vegas, USA, where the world’s largest consumer electronics and IT exhibition 'CES 2025' was held, Jensen Huang was asked about the timing of quantum computer utilization and said, "If you choose 20 years, many people will believe it."

Although it has been less than a month since performance was confirmed through the quantum computer equipped with the quantum chip 'Willow,' domestic institutional investors hurriedly reduced their stock holdings.

Due to the frozen investment sentiment toward quantum computers, remarks by Professor Kim, former CTO of IonQ, are also being overshadowed. At the Korean Entrepreneurs Federation (UKF) held in Redwood City, Silicon Valley, USA, on the 10th, Professor Kim delivered a keynote speech on 'Quantum Computing,' stating, "Quantum computers are an opportunity that comes once every 30 years," and "In 20 to 30 years, every individual will have the opportunity to utilize quantum computers."

The volatility of quantum computer-related stocks, which attract great interest from individuals, is expected to continue for the time being. Kiwoom Securities researcher Kim Seunghyuk said, "Quantum computer-related companies have not yet consistently disclosed solid earnings," adding, "While expectations are high and there may be trend-based benefits, stock price movements will show significant volatility until earnings are proven."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)