Life Insurers at 211.7%, Non-life Insurers at 227.1%

Insurers Issued KRW 3.4 Trillion in Capital Securities in Q3 Alone

Financial Supervisory Service: "Insurers' K-ICS Remains Stable"

In the third quarter of last year, insurance companies' ability to pay insurance claims improved compared to the previous quarter. This was due to proactive measures such as the large-scale issuance of capital securities by insurers.

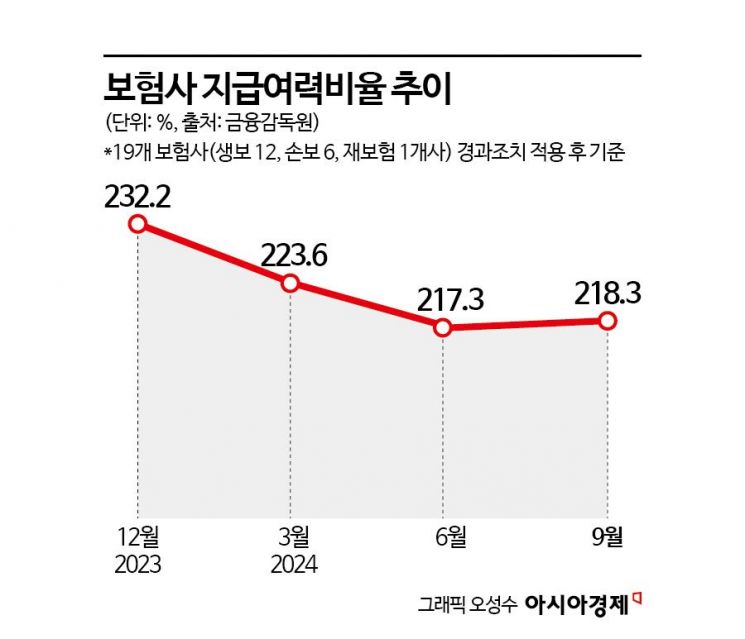

According to the 'Status of Insurers' Solvency Ratio (K-ICS·K-ICS) as of the end of September 2024' announced by the Financial Supervisory Service on the 14th, the K-ICS of insurers applying transitional measures rose by 1 percentage point from the previous quarter to 218.3%. The life insurers' K-ICS decreased by 0.9 percentage points to 211.7%, while non-life insurers' K-ICS increased by 3.1 percentage points to 227.1%.

K-ICS is a capital soundness indicator that represents an insurer's ability to pay insurance claims. It is calculated by dividing available capital by required capital. Available capital refers to the amount of capital held by the insurer, such as capital stock and retained earnings. Required capital is the amount of capital that insurers must maintain to pay claims to policyholders. The Financial Supervisory Service recommends that insurers maintain a K-ICS of 150% or higher. If the K-ICS falls below 100%, prompt corrective actions such as management improvement orders may be imposed.

The increase in insurers' K-ICS was due to a larger decrease in required capital compared to available capital. As of the end of September last year, available capital for K-ICS was KRW 258.09 trillion, a slight decrease of 0.57% (KRW 1.5 trillion) from the previous quarter. During the same period, required capital decreased by 1% (KRW 1.2 trillion) to KRW 118.6 trillion. Regarding available capital, eight insurers issued capital securities worth KRW 3.4 trillion in the third quarter alone, and retained earnings increased by KRW 5.7 trillion, providing some cushion. However, accumulated other comprehensive income decreased by KRW 11.2 trillion, leading to an overall decline in available capital. The accumulated other comprehensive income of Samsung Life Insurance and Samsung Fire & Marine Insurance decreased by KRW 8 trillion compared to the previous quarter, influenced by market interest rate and Samsung Electronics stock price declines. The decrease in required capital was decisively affected by a KRW 3.9 trillion reduction in stock risk amount due to the drop in Samsung Electronics' stock price.

By sector, NH Nonghyup Life Insurance had the highest K-ICS among life insurers at 419.7%. The largest increase in K-ICS from the previous quarter was recorded by Hana Life Insurance, which rose 63.8% to 226.6%. Conversely, Kyobo Lifeplanet saw the largest decline, with K-ICS dropping 52.7% to 186.4% compared to the previous quarter.

Among non-life insurers, the Japanese insurer Tokio Marine had the highest K-ICS at 696.6%. Tokio Marine also posted the highest K-ICS growth rate among all non-life insurers, rising 137% from the previous quarter. On the other hand, digital non-life insurer Kakao Pay Insurance experienced the largest decline, with K-ICS falling 504.5% to 667.4% compared to the previous quarter.

A Financial Supervisory Service official said, "Insurers' K-ICS is maintaining a stable level," adding, "Given the ongoing uncertainty in financial markets, we plan to thoroughly supervise vulnerable insurers to ensure they secure sufficient solvency."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)