Exchange Rate Continues to Rise, Heightening Concerns Over Inflation

High Exchange Rate Drives Up Import Prices, Leading to Higher Consumer Prices

If It Reaches 1,500 Won... Analysis Predicts Consumer Prices Will Rise by 7% and Exports Will Drop by 9%

On the 13th, when the exchange rate surpassed 1,470 won, employees at the Hana Bank dealing room in Jung-gu, Seoul, were working. Photo by Jo Yong-jun

On the 13th, when the exchange rate surpassed 1,470 won, employees at the Hana Bank dealing room in Jung-gu, Seoul, were working. Photo by Jo Yong-jun

Concerns are growing that the soaring won-dollar exchange rate will stimulate consumer prices. If the exchange rate, which has currently risen to the 1,470 won level, surges further to the 1,500 won level, there is a forecast that consumer prices could increase by more than 7% compared to the current level. It is also suggested that the high exchange rate could have adverse effects on the overall economy, including exports and production.

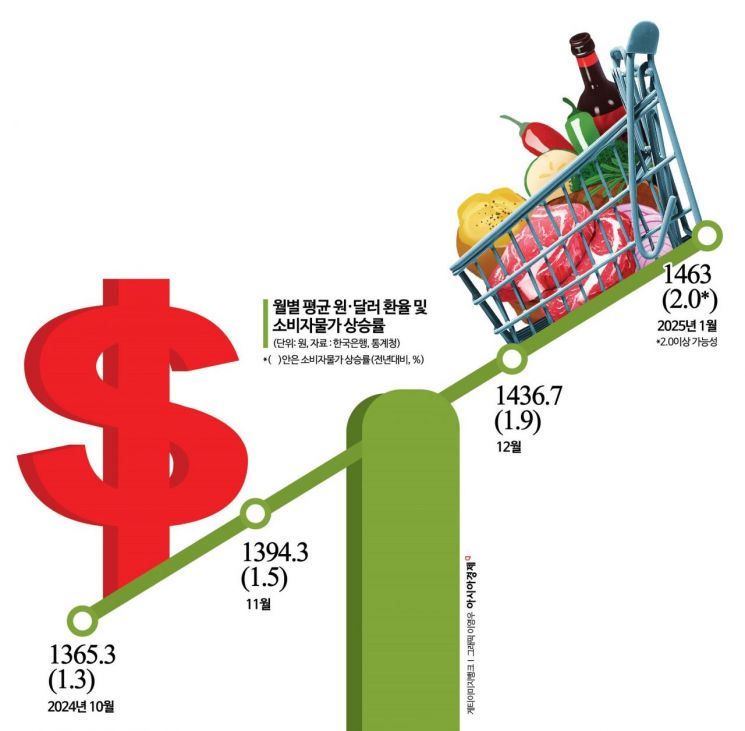

In the Seoul foreign exchange market, the won-dollar exchange rate recorded 1,470.8 won at the closing price as of 3:30 p.m. on the 13th, up 5.8 won from the previous trading day. The average won-dollar exchange rate, which was 1,436 won last month, rose to an average of 1,463 won this month. Compared to the average exchange rate of 1,365 won recorded in October last year, it has surged by nearly 100 won in less than three months.

A high exchange rate is a major factor that raises consumer prices and worsens the economy. According to an analysis by the IBK Industrial Bank Economic Research Institute, the rise in the exchange rate quickly drives up major price indices, including import prices, and domestic companies importing raw materials may face immediate cost increases.

The institute predicted that if the average won-dollar exchange rate this month surges by 4.3% from last month to 1,500 won, consumer prices could rise by up to 7% three months later.

This raises the possibility of additional price increases amid the current rise in consumer prices due to the high exchange rate. The consumer price inflation rate announced by Statistics Korea last month was 1.9% year-on-year, a sharp increase compared to 1.5% in November last year and 1.3% in October. The high exchange rate was evaluated as the biggest factor, and this trend is likely to continue until January. A Bank of Korea official forecasted, "As the high exchange rate continues, the consumer price inflation rate this month may rise compared to the previous month."

High Exchange Rate Is Also Negative for Exports

Excessively high exchange rates have actually been negative for our exports. The conventional wisdom that exporters benefit when the exchange rate rises does not hold under excessive high exchange rates. The IBK Industrial Bank Economic Research Institute stated that while an increase in the won-dollar exchange rate below the 1,300 won level clearly boosts exports, when the exchange rate rises above that level, a negative relationship occurs.

Due to the rise in domestic prices caused by the sharp increase in the exchange rate, production costs rise, which can lead to a reverse effect of decreasing exports. With the expansion of direct production through overseas factories mainly by large corporations, the impact of exchange rates on exports has also diminished compared to before.

The high exchange rate raises the prices of imported raw materials such as oil and gas, increasing corporate production costs, which negatively affects manufacturing production. According to the institute's analysis, if the exchange rate rises to the 1,500 won level, exports decrease by up to 9.0% nine months later, and manufacturing production decreases by up to 9.3% seven months later.

Jang Han-ik, a research fellow at the IBK Industrial Bank Economic Research Institute, said, "Although the current exchange rate level is already historically high, the possibility of further increases remains open due to concerns over a downgrade in the national credit rating amid the prolonged impeachment political situation," emphasizing, "To minimize negative impacts, more proactive efforts such as concluding a Korea-US currency swap agreement are important."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)