The lithium-ion battery separator market is projected to expand to approximately 19 trillion KRW in size in 10 years. However, concerns about oversupply due to large-scale expansions by Chinese companies have also been raised.

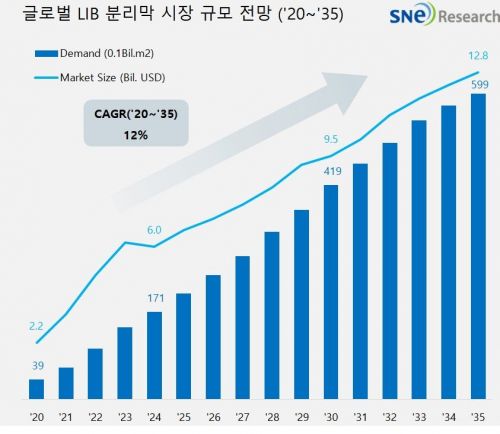

On the 13th, SNE Research, a secondary battery market research firm, forecasted in its report titled "2025 Lithium Secondary Battery Separator Technology Trends and Implications" that the global lithium secondary battery separator market will grow from 3.9 billion ㎡ in 2020 to 59.9 billion ㎡ in 2035, with an average annual growth rate of over 12%. In terms of value, it is expected to increase from 2.2 billion USD (approximately 2.6 trillion KRW) to 12.8 billion USD (approximately 19 trillion KRW) during the same period.

SNE Research explained, "This growth is driven by the expansion of electric vehicle adoption and increased demand for energy storage systems (ESS), with the demand for high-performance batteries acting as a catalyst for innovation in separator technology." Leading companies are accelerating the development of separator technologies suitable for next-generation batteries such as all-solid-state batteries.

However, the growth rate of the market size is expected to slow down compared to the increase in demand. This is because separator prices are continuously declining due to technological innovation and intensified production competition.

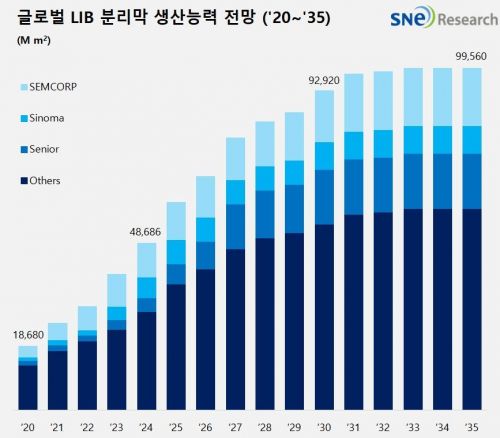

According to the report, global separator production capacity is expected to more than double from 48.6 billion ㎡ in 2024 to approximately 99.5 billion ㎡ in 2035. This has raised concerns about oversupply in the market.

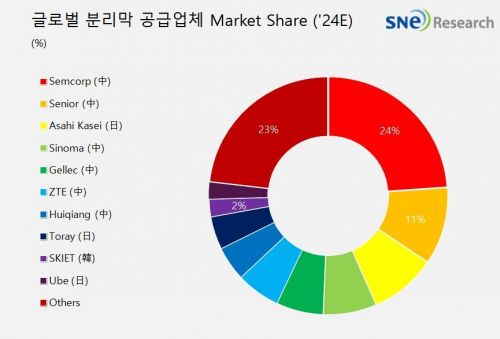

In particular, Chinese companies are leading large-scale expansions. Major Chinese manufacturers such as SEMCORP (Euncheop Gobun·恩捷股?), Senior (Seongwon Jaejil·星源材?), and Sinoma (Jungjae Gwagi·中材科技) are aggressively expanding their production capacities.

Domestic battery companies are engaged in fierce price competition with Chinese companies amid a slowdown in demand caused by the electric vehicle chasm. Domestic companies are looking for opportunities in new ESS and North American markets.

SK Innovation’s separator subsidiary, SK IE Technology (SKIET), a leading domestic separator company, holds a production capacity of 1.87 billion ㎡ as of 2024, accounting for 2% of the global market share. Its Cheongju plant in Chungbuk has a production capacity of 520 million ㎡, and its plant in Changzhou, Jiangsu Province, China, has a capacity of 670 million ㎡.

In Europe, the Poland plant is about to operate at full capacity, and through a production capacity of approximately 154 million ㎡, SKIET plans to strengthen its presence in the European electric vehicle market. SKIET has announced that it is considering entering the North American market in response to the U.S. Inflation Reduction Act (IRA). If the North American entry is confirmed, the company aims to complete the construction of a separator factory by 2027 and start commercial production in 2028.

Additionally, WCP (Double U C P) currently operates six production lines in Chungju. Its production capacity is about 820 million ㎡ annually. Most of the output is supplied to Samsung SDI. When lines 7 and 8 begin operation, an additional 310 million ㎡ will be added, increasing total production capacity to 1.13 billion ㎡.

Overseas bases plan to complete the establishment of separator production and coating line facilities with an annual capacity of 1.2 billion ㎡ in Hungary by 2025, targeting mass production in 2026. WCP aims for North American mass production in 2029, assuming the IRA law remains in effect.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)