Turbulent Global Government Bond Market

Growing Concerns Over Fiscal Deficits in Major Countries

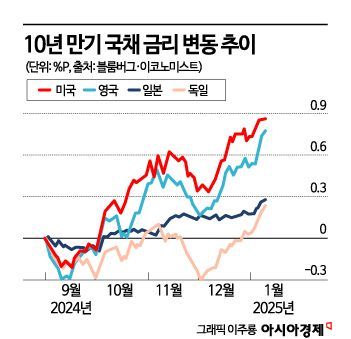

Global bond yields are soaring ahead of the return of President-elect Donald Trump. This is due to weakened justification for major central banks to cut benchmark interest rates amid renewed inflation concerns. Coupled with worsening fiscal conditions in major countries, the prevailing view is that global market interest rates will remain high for the time being.

Turbulent Global Government Bond Market

According to major foreign media including Bloomberg on the 12th (local time), the yield on the US 10-year Treasury bond, a global market benchmark, rose to 4.76% on the 10th, marking the highest level since April last year. Despite the US central bank, the Federal Reserve (Fed), cutting rates in November and December after a big cut in September last year?the first in four and a half years?Treasury yields have been on the rise. Bloomberg emphasized, "It is on the verge of reaching '5%', a level not seen since before the global financial crisis, briefly surpassed in 2023."

The UK Economist reported, "UK government bond yields are soaring to extreme levels." The UK 10-year bond yield, which showed the steepest rise among developed countries at the beginning of the year, rose to 4.93%, the highest level since the 2008 financial crisis. The German 10-year government bond yield rose for eight consecutive trading days, reaching 2.56%, the highest since June last year. The Japanese 10-year yield also rose to 1.198%, marking the highest level in 14 years since 2011.

The Economist analyzed that despite the global trend of benchmark rate cuts by major countries starting last year, "the real economy has not improved at all," and "borrowing costs faced by businesses and households have remained almost unchanged.” The US mortgage rate is approaching the psychological resistance level of ‘7%’ for homebuyers. The Eurozone non-financial corporate loan rate surged from 0.7% in June last year, when the European Central Bank (ECB) cut its benchmark rate for the first time in 1 year and 11 months, to 1.0% in November of the same year.

The biggest factor behind the rise in global government bond yields is the possibility of President-elect Trump fulfilling his promises on immigrant deportations, tariffs, and tax cuts. If the number of immigrants providing low-wage labor decreases and supply chain disruptions occur due to protectionism, this could lead to price increases and a retreat from the rate-cutting trend. Additionally, Trump has announced plans to extend the 'Tax Cuts and Jobs Act (TCJA),' which expires this year. Enacted during Trump’s first term in 2017, this law primarily lowered the corporate tax rate from 35% to 21%, but Trump pledged to reduce the corporate tax rate further to 15%.

According to MarketWatch, Paul Krugman, a 2008 Nobel laureate in economics and professor at the City University of New York, emphasized, “The rise in long-term government bond yields reflects a terrible suspicion that people believe and will act on the ridiculous things Trump says about economic policy.”

Growing Concerns Over Fiscal Deficits in Major Countries

Concerns over fiscal deficits in major countries are increasing. As debt grows, governments have no choice but to increase the issuance of government bonds. The Economist explained, "This year, governments of the Group of Seven (G7) are expected to record a fiscal deficit of 6% of gross domestic product (GDP)," adding, "Considering low unemployment and sufficient economic growth, this is an abnormally high figure."

Bloomberg predicted that if President-elect Trump’s election promises are fulfilled, the US government bond market could double in size over the next 10 years to reach 50 trillion dollars, twice the current level. Bloomberg expressed concern that "Scott Bessent, nominated as Treasury Secretary for Trump’s second administration, and Trump’s close associate Elon Musk both criticize fiscal deficits but also support policies that risk increasing the deficit."

For this reason, the market expects the high interest rate trend to continue for the time being. Gregory Peters, Co-Chief Investment Officer of Fixed Income at PGIM, said, "In this environment, it would not be shocking at all if the US 10-year yield surpasses 5%."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)