"Recommendation to Appoint Four MBK Nominees... Opposition to Cumulative Voting"

Korea ESG Evaluation Institute Supports Korea Zinc's Proposals

Global proxy advisory firm ISS and domestic proxy advisory firm Korea ESG Evaluation Institute have recommended support for the current management's agenda ahead of the Korea Zinc extraordinary general meeting of shareholders, expressing opposition to the claims made by MBK and Youngpoong. ISS positively evaluated Korea Zinc's core business performance and investment returns, recommending approval of most of the current management's proposals, including the establishment of a cap on the number of directors.

ISS: "Korea Zinc Shows Superior Investment Performance Compared to Peers"

In the 'Korea Zinc Extraordinary General Meeting Agenda Analysis Report' released on the 10th, ISS stated, "Korea Zinc is a company playing a key role in the global zinc smelting sector and is recognized as a technology-leading company," adding, "This point is also acknowledged by MBK and Youngpoong." It further noted, "Historically, Korea Zinc has recorded higher operating margins than its peers."

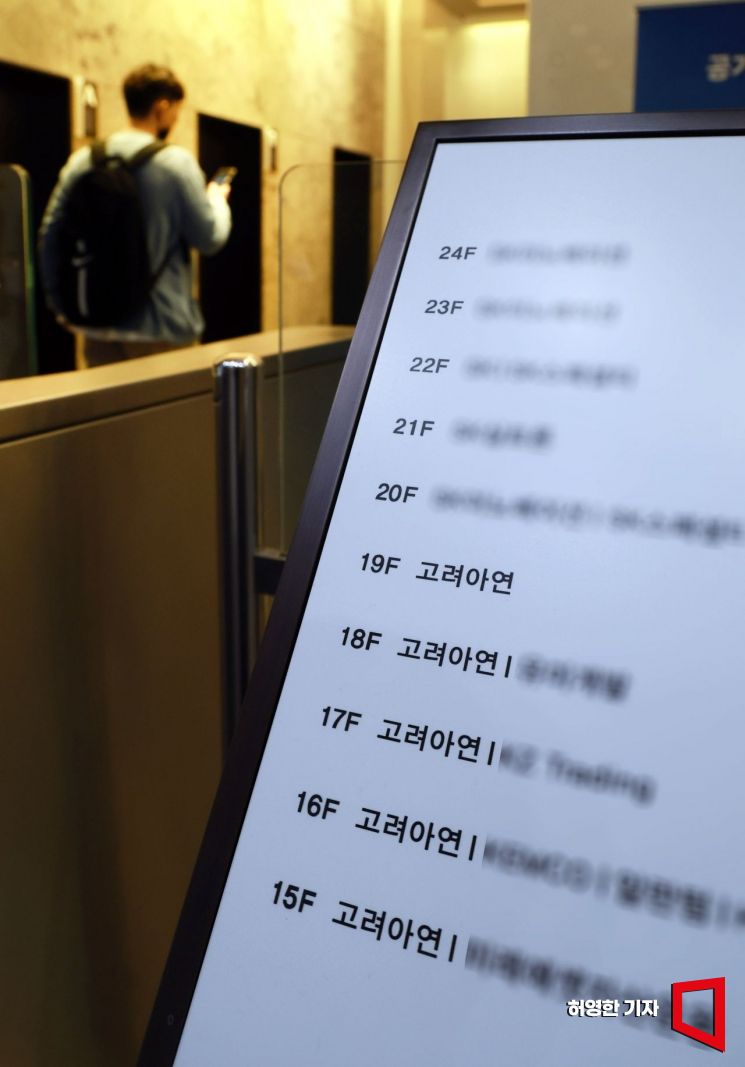

On November 13 last year, people are entering the headquarters building of Korea Zinc in Jongno-gu, Seoul.

On November 13 last year, people are entering the headquarters building of Korea Zinc in Jongno-gu, Seoul.

ISS expressed a different opinion regarding Korea Zinc's total shareholder return (TSR), which was criticized by MBK and Youngpoong. ISS analyzed that from March 2019, when Chairman Choi Yoon-beom was appointed CEO, until September 2024, before MBK and Youngpoong's public tender offer, Korea Zinc's TSR was 45.8%, surpassing the industry median of 37.8%.

On the other hand, MBK and Youngpoong claimed in a recent report that "Korea Zinc's TSR ranks at the bottom among peers," but ISS raised concerns, stating, "MBK did not disclose the list of peer companies used for comparison."

Regarding return on invested capital (ROIC), ISS evaluated that "Korea Zinc's ROIC has outperformed the industry median by 3.6 to 5.5 percentage points over the past few years." As for the investment in Ignio Holdings pointed out by MBK and Youngpoong, ISS stated that it is currently difficult to assess.

"Support for Setting a Cap on the Number of Directors... A 16-Member Board is Appropriate"

ISS recommended approval of the proposal to set a cap on the number of directors presented by Korea Zinc at this extraordinary general meeting. Accepting Korea Zinc's position that a cap is necessary to prevent inefficiencies caused by an oversized board, ISS recommended support for only 4 out of the 14 director candidates proposed by MBK and Youngpoong. ISS predicted that "a board restructured to 16 members will be more agile and functional, adding new perspectives and fostering robust discussions." This implies that ISS considers 16 members to be the appropriate size for the board.

A Korea Zinc official commented, "ISS's statement that limiting the board to 16 members is appropriate can be seen as a brake on MBK and Youngpoong's attempt to take control of the board," adding, "It is understood as a stance to maintain the current management system."

ISS also recommended approval of proposals including ▲stock split ▲formalization of minority shareholder protection in the articles of incorporation ▲appointment of an outside director as board chair ▲change of dividend record date ▲introduction of quarterly dividends ▲and adoption of an executive officer system. However, ISS recommended opposition to the cumulative voting system, which is considered another key agenda item at this extraordinary general meeting.

Korea ESG Evaluation Institute Also Supports Current Management

Earlier on the 7th, Korea ESG Evaluation Institute also recommended support for the current management's agenda through its report. The institute stated, "From the perspective of Korea Zinc's long-term sustainable growth and shareholder interests, the current management's position is desirable," recommending approval of all proposals put forward by the current management.

Korea ESG Evaluation Institute summarized, "The current management shows superiority over Youngpoong in ESG ratings by domestic and international ESG evaluation agencies, which are benchmarks for sustainable management," adding, "Private equity funds like MBK have strengths in corporate restructuring and business reorganization, but since Korea Zinc is not currently facing such a crisis, it is difficult to judge that MBK has an advantage in enhancing corporate value."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)