10 Major Securities Firms MTS Usage Status

Samsung Surpasses Mirae Asset and KB to Finish 2nd

Meritz Overtakes Kyobo with Aggressive Retail Strategy

Last year, the rankings of mobile trading services (MTS) in the securities industry experienced intense fluctuations. While the online powerhouse Kiwoom Securities maintained its top position, Samsung Securities, Mirae Asset Securities, and KB Securities fiercely competed for the 2nd to 4th places, with Samsung Securities ultimately securing 2nd place. Meritz Securities, which introduced a groundbreaking commission policy related to overseas stocks, also achieved some success by surpassing Kyobo Securities.

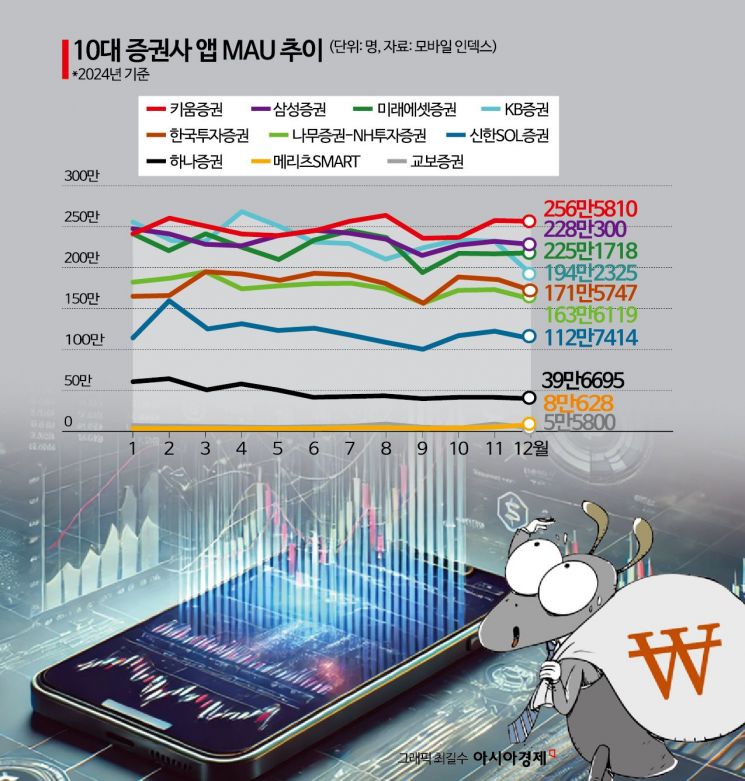

According to Mobile Index on the 10th, based on the estimated monthly active users (MAU) in December last year, Kiwoom Securities ranked first among domestic securities firms' applications with 2.57 million users. This estimate was based on the top 10 securities firms by equity capital. Even when other securities firms generally showed sluggish performance in November and December, the year-end period, Kiwoom Securities continued its upward trend, approaching 2.6 million users.

In the same month, Samsung Securities ranked 2nd with 2.28 million users, Mirae Asset Securities 3rd with 2.25 million, and KB Securities 4th with 1.94 million. KB Securities had recorded the highest number of users among all securities firms in January, April, and May last year but showed a weak performance in the second half of the year, dropping below 2 million users in December. During this period, it consecutively lost its position to Kiwoom Securities and Samsung Securities.

A notable point is the uprising of Meritz Securities, which was in the lower ranks. Meritz Securities, which pursues an aggressive retail strategy with a zero commission policy on U.S. stocks, increased its users from 30,000 in January to 80,000 in December, more than doubling. It surpassed Kyobo Securities to rise to 9th place. Meritz Securities does not charge major transaction fees for trades made through its online-only investment account 'Super365' until December 2026. This includes domestic and U.S. stock trading fees as well as dollar exchange fees. This policy is interpreted as a strategy to strengthen retail business despite incurring hundreds of millions of won in commission losses.

Looking at the number of new app installations in December, large securities firms performed well. Leading with Kiwoom Securities (119,069 installs), followed by Mirae Asset Securities (95,823), Samsung Securities (73,493), Korea Investment & Securities (68,995), KB Securities (52,956), NH Investment & Securities (41,903), Meritz Securities (36,865), Shinhan Investment Corp. (30,640), Hana Securities (16,943), and Kyobo Securities (1,502).

App usage rates in December were relatively low due to the sluggish domestic market. As the KOSPI index faltered amid 'Trump risk' and the emergency declaration on December 3rd, it even dropped to an intraday low of 2,360.18 on the 9th. Among the top 10 securities firms, only Mirae Asset Securities and Meritz Securities saw an increase in users from November to December. An industry insider estimated, "Although the U.S. stock market rose at year-end, the majority of investors are domestic, so app access rates decreased in a market with increased volatility."

Meanwhile, among MTS users, the most active users were estimated to be investors in their 30s and 40s. Those in their 40s accounted for 30.5%, 30s for 24.6%, 20s for 19.4%, 50s for 18.9%, under 10s for 3.6%, and 60s and above for 3%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)