Non-Severe Non-Covered Benefit Limit Reduced from 50 Million to 10 Million KRW

Inducing Transition from 1st and 2nd Generation Actual Expense Insurance to 5th Generation

The government has unveiled the blueprint for the reform of indemnity health insurance it is promoting. The main points are to distinguish between severe and non-severe cases through the 5th generation indemnity insurance and to increase the co-payment rate for non-reimbursable items.

On the 9th, the Financial Services Commission disclosed this indemnity insurance reform plan at the 'Policy Forum on Non-Reimbursable Management and Indemnity Insurance Reform Measures' held by the Presidential Commission on Medical Reform.

Indemnity insurance has about 40 million subscribers and is called the 'second health insurance.' Continuous calls for improvement have been made due to moral hazard such as excessive treatment by some hospitals and patients' medical shopping, resulting in an annual indemnity insurance deficit of 2 trillion won.

The Special Committee on Government Medical Reform held a policy forum on "Non-reimbursable Service Management and Actual Expense Insurance Reform Measures" on the 9th at the Korea Press Center located in Jung-gu, Seoul.

The Special Committee on Government Medical Reform held a policy forum on "Non-reimbursable Service Management and Actual Expense Insurance Reform Measures" on the 9th at the Korea Press Center located in Jung-gu, Seoul.

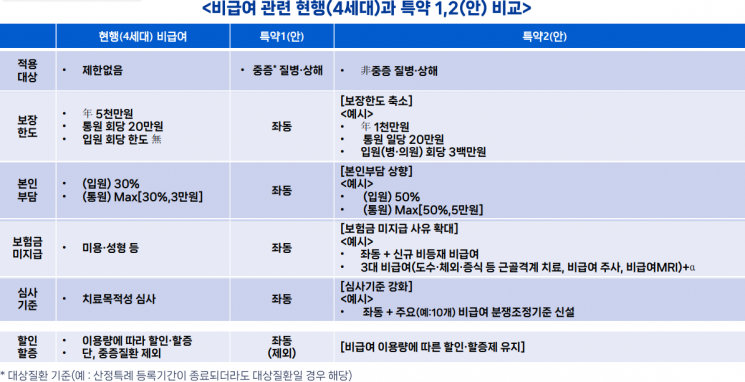

The core of the indemnity insurance reform plan revealed that day is the establishment of the '5th generation indemnity insurance.' For reimbursable items covered by health insurance, compensation and co-payment rates will be differentiated by distinguishing between severe and non-severe diseases. Non-reimbursable items will also be differentiated in terms of coverage levels by distinguishing between severe and non-severe cases. The non-reimbursable special contracts defined in the 5th generation indemnity insurance are subdivided into 'Special Contract 1,' which covers non-reimbursable medical expenses for severe diseases and injuries, and 'Special Contract 2,' which covers non-reimbursable medical expenses for non-severe cases. Special Contract 1 has the same coverage limits and co-payment levels as the 4th generation. However, Special Contract 2 significantly reduces coverage levels compared to the existing ones. For existing 1st and 2nd generation indemnity subscribers, the plan is to encourage migration to the 5th generation indemnity through contract repurchase and legislative amendments.

Under the 5th generation indemnity insurance, the co-payment rate increases when mild patients visit emergency rooms of large hospitals. At the end of last year, the government raised the health insurance co-payment rate from 20% to 90% when mild patients visit emergency rooms of large hospitals dedicated to critical care. If the medical bill was 1 million won, the patient must pay 900,000 won. Previously, through indemnity insurance, the patient would be reimbursed 720,000 won of the 900,000 won, so the actual out-of-pocket expense was 180,000 won (20% co-payment rate). Regardless of the health insurance co-payment rate, indemnity insurance could set its own co-payment rate, so the patient’s burden was low. However, the 5th generation indemnity insurance plans to link the health insurance co-payment rate with the indemnity insurance co-payment rate. Therefore, the indemnity insurance co-payment rate is expected to rise above 90%. In this case, the patient’s payment will increase from 180,000 won to 810,000 won (90% of 900,000 won). However, the government does not intend to apply this linkage to reimbursable medical expenses for severe diseases.

For non-severe and non-reimbursable diseases, the indemnity insurance coverage limit will be drastically reduced from the current 50 million won to 10 million won. The co-payment rate will increase from the existing 30% to 50%. The coverage limit for mild outpatient treatment will be reduced from 200,000 won per outpatient visit to 200,000 won per day. Mild hospitalization, which previously had no limit, will have a coverage limit of 3 million won per admission.

Comparison of coverage items between 4th and 5th generation indemnity insurance related to non-reimbursable expenses, released by the government on the 9th.

Comparison of coverage items between 4th and 5th generation indemnity insurance related to non-reimbursable expenses, released by the government on the 9th.

The Financial Supervisory Service will also establish dispute mediation standards for major non-reimbursable items such as cataracts, non-reimbursable injections, and spinal surgeries, which frequently cause insurance payment disputes. These standards will apply equally to all generations of indemnity insurance.

For 1st and 2nd generation subscribers, who were identified as major causes of insurance payout leakage, indemnity contract repurchase will be promoted. There are 6.54 million cases in the 1st generation and 9.28 million cases among early subscribers in the 2nd generation, totaling 15.82 million cases, which cannot be forcibly terminated until the contract expires at age 100 due to the absence of policy change clauses. Therefore, if consumers wish, insurance companies will be allowed to compensate and terminate contracts according to standards recommended by financial authorities. Ko Young-ho, head of the insurance division at the Financial Services Commission, said, "Since indemnity contract repurchase is a private contract, the consent of the contracting parties is essential. Because contract repurchase alone has limitations in converting early indemnity subscribers to the 5th generation indemnity, we will consider applying policy change clauses to early indemnity through legislative amendments to minimize subscriber disadvantage."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)