Mid-term Prepayment Fees Imposed on Silbi Loans... Reform Plan Implemented

From the 10th, Financial Company Disclosures Available on Each Financial Association Website

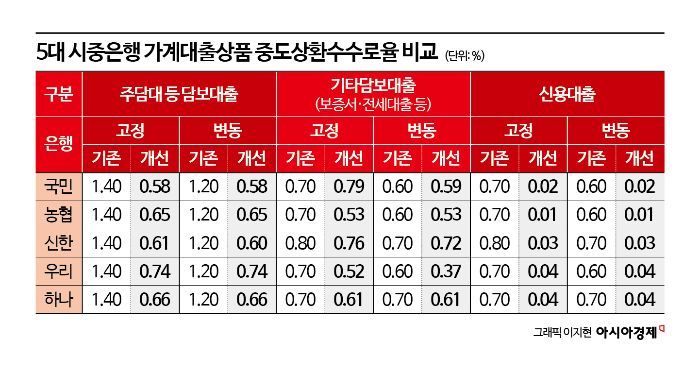

Top 5 Commercial Banks Lower Average Mortgage Loan Fee Rates by 0.75%P for Fixed Rates and 0.55%P for Variable Rates

Financial Services Commission to Promote Fee Reform Plan for Saemaeul Geumgo, Nonghyup, Suhyup, and Forestry Cooperatives in First Half of Year

From the 13th, the early repayment fee rates for new loans will be reduced. The early repayment fee rates for mortgage loans handled by the five major commercial banks are expected to decrease by an average of 0.55 to 0.75 percentage points, and the early repayment fee rates for unsecured loans are expected to drop by an average of 0.61 to 0.69 percentage points.

On the 9th, the Financial Services Commission announced that it will implement a revised early repayment fee system from the 13th, which allows fees to be charged only within actual costs. Prior to this, financial companies subject to the "Financial Consumer Protection Act (FCPA)" will disclose their early repayment fee rates through their respective financial associations starting from the 10th.

Currently, early repayment fees are generally prohibited under the FCPA, with exceptions allowing fees to be charged if the consumer repays within three years from the loan date. Until now, the financial sector has been charging early repayment fees without specific calculation standards. However, in July last year, the Financial Services Commission revised the FCPA supervisory regulations to allow early repayment fees to be charged only within actual costs such as opportunity costs due to disruption in fund management and administrative or recruitment expenses related to the loan. Adding other items to increase the fee is prohibited.

Each financial association completed revisions to the model guidelines applicable to their member companies in accordance with the amended FCPA supervisory regulations at the end of last year. Financial companies have completed simulations for calculating fee rates and have established the necessary systems.

According to the Financial Services Commission, with this revision of early repayment fees, the fixed-rate mortgage loan fee rate in the banking sector dropped from 1.43% to 0.56%, a decrease of 0.87 percentage points. The variable-rate unsecured loan fee rate also fell from 0.83% to 0.11%, a decrease of 0.72 percentage points. In particular, for the five major commercial banks, the average mortgage loan fee rate decreased by 0.55 to 0.75 percentage points, other secured loans by 0.08 percentage points, and unsecured loans by 0.61 to 0.69 percentage points. In the savings bank sector, the fixed-rate mortgage loan fee rate dropped from 1.64% to 1.24%, a decrease of 0.4 percentage points, and the variable-rate unsecured loan fee rate fell from 1.64% to 1.33%, a decrease of 0.31 percentage points.

The revised early repayment fee rates will apply to new contracts from the 13th. Financial companies plan to recalculate the actual costs incurred from early loan repayments annually and disclose the early repayment fee rates on each association's website. The Financial Services Commission expects that with the implementation of this system improvement, early repayment fee rates will be calculated more systematically and charged to consumers at reasonable levels. It is also expected to help consumers switch to more favorable loans or repay loans early.

Going forward, the Financial Services Commission plans to continue discussions to enable mutual finance institutions not subject to the FCPA, such as Saemaeul Geumgo, NongHyup, Suhyup, and the Korea Forest Service, to introduce the revised early repayment fee system within the first half of the year. Jeon Suhan, head of the Household Finance Division at the Financial Services Commission, explained, "We will monitor whether this revision is implemented smoothly in the field and encourage mutual finance institutions like Saemaeul Geumgo, NongHyup, and Suhyup, which are not subject to the FCPA, to apply this revision as soon as possible."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.