Financial Services Commission's 2025 Key Business Plan

Accelerating Inclusion of Virtual Assets into Regulatory Framework... Enhancing Regulatory Consistency

Advancing Phase 2 Legislation... Stablecoins Also on the Discussion Table

The financial authorities have decided to allow the issuance of corporate accounts for virtual assets this year. This move is in line with the global financial markets, led by the United States and Europe, where virtual assets are being incorporated into the regulatory framework. However, they drew a line regarding the introduction of spot virtual asset Exchange-Traded Funds (ETFs), which the industry has high expectations for, stating that it is premature.

Detailed plans to be prepared through discussions by the Virtual Asset Committee

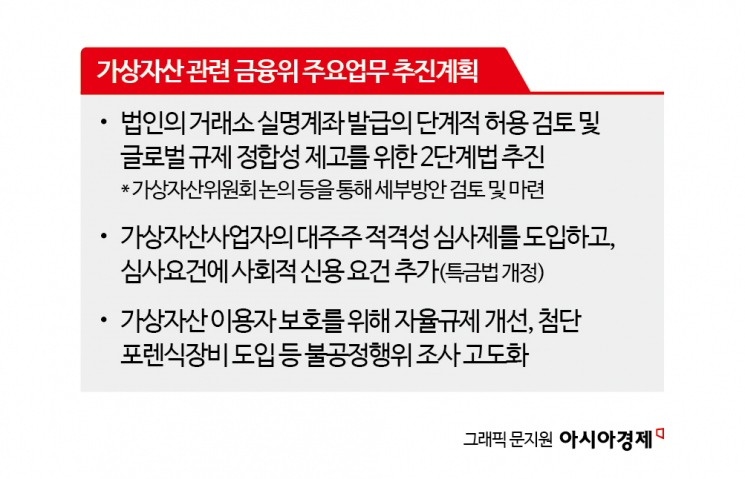

The Financial Services Commission (FSC) stated in its '2025 Major Work Plan' announced on the 8th that it plans to review a phased approach to allow the issuance of real-name accounts for corporate exchanges. However, the detailed plans will be prepared after discussions by the FSC's Virtual Asset Committee, which was launched in the second half of last year. The first Virtual Asset Committee meeting is scheduled for the 15th of this month.

The FSC will also promote the enactment of a second-stage law with the nature of a sectoral law. Although the first-stage law, the 'Virtual Asset User Protection Act,' was enforced on July 1 last year, it has focused on protecting users including investors. There have been calls for a comprehensive bill that reflects the characteristics of virtual assets and can comprehensively address the related ecosystem.

To protect virtual asset users, self-regulation will also be improved. For example, discussions on establishing listing standards and the direction of stablecoins are expected to be conducted concretely. The investigation methods for unfair practices in virtual assets will also be advanced through the introduction of advanced forensic equipment.

The FSC's Financial Intelligence Unit (FIU) will introduce a major shareholder eligibility screening system for virtual asset service providers through amendments to the Act on Reporting and Using Specified Financial Transaction Information. Until now, the screening has been conducted through authoritative interpretations, but this will strengthen the legal basis. In this process, social credit requirements will also be added through amendments to the Act on Reporting and Using Specified Financial Transaction Information. Originally, this was included in the 2024 major work plan but was automatically discarded due to the expiration of the National Assembly's term. It is expected to proceed through a member's bill proposed by Rep. Kang Min-guk of the People Power Party.

Expectations for domestic spot ETF approval like in the U.S.

The industry has expressed expectations that large-scale funds could flow in if corporate accounts for virtual assets are allowed. Korea ranks first in terms of individual investor trading volume but remains third in the global market. This reflects the characteristic of the Korean market, which is centered on individual investors. The world's number one market is undoubtedly the United States, supported by indirect investment capital flowing in through spot virtual asset ETFs offered by large asset management firms.

There is also hope that the concentration of market share in 'Upbit,' the number one operator among the top five Korean won trading exchanges, will ease with the allowance of corporate accounts. In the early December Bitcoin rally last year, Upbit's domestic market share rose to about 78%. This was a 21 percentage point increase from 57% a month earlier. The second-ranked Bithumb fell to 19.3%, while the combined market share of Coinone, Korbit, and Gopax, ranked third to fifth, was below 1%. An exchange official said, "Individual investors naturally flocked to Upbit, which partnered with K Bank, and subsequently, talented personnel moved to Upbit, making it impossible to catch up." He added, "Corporations can offer various partnership conditions, so there are factors that latecomers can compete with."

Consequently, market attention has naturally focused on whether the financial authorities will allow domestic spot virtual asset ETFs. The U.S. Securities and Exchange Commission (SEC) approved the listing of 11 Bitcoin spot ETFs simultaneously after losing a court case last January regarding the rejection of listing approval. Earlier, Jung Eun-bo, CEO of the Korea Exchange, stated at the stock market opening ceremony at the beginning of the year, "We will benchmark overseas cases such as cryptocurrency ETFs to explore new areas of the capital market," and Seo Yoo-seok, chairman of the Korea Financial Investment Association, said in his New Year's address this year, "We will enable the digital asset market, including virtual asset ETFs, to become a future growth engine." On the other hand, Kwon Dae-young, Secretary-General of the FSC, said at a pre-briefing on the previous day's work report, "That seems a bit too far ahead," adding, "The government is fully aware that changes are happening worldwide, so it means that discussions will be held through the Virtual Asset Committee."

Professor Hwang Seok-jin of Dongguk University's Graduate School of International Information Security said, "The taxation issue on capital gains from virtual assets has been deferred for two years, but it needs to be considered going forward," adding, "For companies, accounting issues related to gains and losses on held virtual assets remain, so there is a need for 'open discussions' without restrictions from the start."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)