Fair Trade Commission New Year Work Report

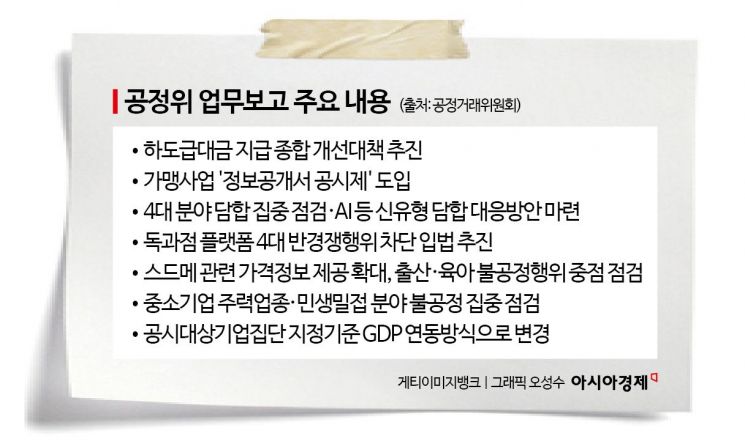

The government is preparing comprehensive improvement measures, such as expanding the scope of payment guarantees and direct payments by ordering parties, to prevent chronic delays in subcontract payments. A disclosure system will also be introduced to allow prospective entrepreneurs to verify necessary information in writing before signing franchise contracts.

On the 8th, the Fair Trade Commission (FTC) announced measures to strengthen the stability of subcontract payment in its "This Year's Work Report." At a briefing at the Sejong Government Complex the previous day, Vice Chairman Cho Hong-seon stated, "Given the recognition that the pace of economic recovery will be delayed due to external and internal uncertainties such as the launch of the second Trump administration and domestic political instability, we focused on measures to alleviate difficulties in people’s livelihoods."

First, to prepare for situations where the primary contractor fails to pay (or is unable to pay), exceptions to payment guarantees will be reduced, and the scope of direct payments by ordering parties will be expanded. Under current law, if the primary contractor fails to pay subcontract payments more than twice, the subcontractor can request direct payment from the ordering party; however, there have been calls to lower the threshold from twice to once.

The prohibition of third-party seizure of subcontract payments will be institutionalized, and measures to ban unreasonable retention money agreements will also be pursued. The FTC stated, "To this end, we plan to revise the Subcontracting Act and related notices within the first half of this year."

To prevent a recurrence of the T-Mef settlement incident that occurred in July last year, measures such as shortening the payment settlement period for e-commerce operators and establishing an obligation for separate management of payments will be promoted within the first half of this year. The Large-scale Distribution Business Act will be amended to require e-commerce operators to pay sales proceeds to tenant businesses within 20 days and to deposit more than half of the sales proceeds in financial institutions.

The business conditions of franchise agents will also be improved. An "Information Disclosure Public Notice System" will be introduced so that prospective entrepreneurs can timely verify necessary information, the right to organize franchisee associations will be guaranteed, and procedures will be tightened to ensure prior notice is given when contracts are terminated.

An investigation into unfair practices related to restaurant tech, such as reservation apps and table ordering devices, will also be conducted. Consumer dispute resolution standards related to no-shows will be revised, and the establishment of standard terms and conditions to eradicate illegal online advertising agency activities will be promoted.

To prevent unfair practices by platform giants, amendments to the Fair Trade Act will be pursued. The aim is to block four major anti-competitive acts by dominant monopoly platforms in six service areas: brokerage, search, social media services (SNS), video, operating systems (OS), and advertising. The four major anti-competitive acts include self-preferencing, tying sales, multi-homing restrictions, and demands for most-favored-nation treatment. Vice Chairman Cho said, "We will focus on inspecting unfair practices by subscription-based, vertical, and mobile platform companies, as well as deceptive consumer practices by overseas online brokerage platforms."

To prevent the abusive practices of studio, dress, and makeup (so-called Seudeume) companies that cause distress to prospective couples, price information for Seudeume services will be disclosed through the Korea Consumer Agency’s True Price platform. Unfair practices related to childbirth and childcare will be intensively inspected. An integrated platform enabling one-stop damage compensation and access to funeral service information will also be established.

To prevent "eat-and-run" incidents by overseas platform companies, including Chinese e-commerce platforms that have been controversial for counterfeit and hazardous product imports, mandatory designation of domestic agents and guidelines to prevent distribution of hazardous and uncertified products will be established. The domestic agent system will be limited to persons with addresses or business offices in Korea to prevent formalistic operation, and if the overseas headquarters forms executives and exerts dominant influence over business operations through a domestic corporation, that domestic corporation will be designated as the domestic agent.

Additionally, unfair internal transactions in key small and medium-sized enterprise sectors such as the food service industry and in livelihood-related areas such as real estate will be intensively inspected. The FTC stated, "We will focus on monitoring the diversion of work to insolvent affiliates facing market exit risks and unverified new affiliates, as well as the private gain of controlling families through disguised succession of management rights."

In the first half of this year, the FTC plans to comprehensively analyze changes in shareholding structures, internal transaction volumes, and sales fluctuations, and strengthen monitoring focusing on internal transactions showing signs of legal violations. The FTC explained, "We will build an anomaly detection system using the Corporate Group Portal and activate information sharing with expert advisory committees and related agencies such as the National Tax Service to enhance our capacity to handle increasingly complex unfair internal transaction cases."

Reflecting the changed economic environment, the criteria for designating large business groups will also be finalized within this year. Although the economy continues to grow, the designation criteria for large business groups remain rigidly set at "total assets of 5 trillion won or more." The FTC plans to complete the revision of the disclosure target business group designation criteria from the current total assets of 5 trillion won or more to a GDP-linked method within this year, although the exact percentage of GDP to be used has not yet been determined.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.