Stock Market Rises Sharply for Two Consecutive Days

KOSPI Recovers to 2480 Level, KOSDAQ to 710 Level

Continued Early-Year Uptrend Raises January Effect Expectations

Further Gains Possible if Foreign Buying Persists

As the stock market showed a significant rise at the beginning of the year after recovering from last year's slump, expectations for the 'January effect' are growing. The January effect refers to the stock market's tendency to perform particularly well in January. Considering that the KOSPI tended to rise in January following a decline in the previous year, and that negative factors have already been sufficiently priced in with the market having fallen as much as it could, a continued rebound is expected.

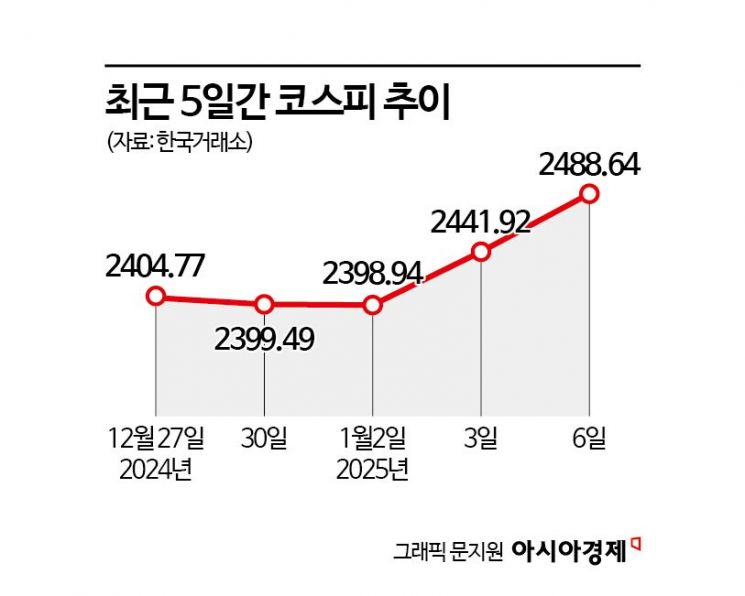

According to the Korea Exchange on the 7th, the KOSPI closed at 2,488.64, up 1.91% from the previous day. The KOSPI, which started the year below the 2,400 level, has recovered to the 2,480 level after two consecutive days of gains exceeding 1%. The KOSDAQ also rose for four consecutive days, regaining the 710 level. It is the first time in about two months since November 12 last year that the KOSDAQ has surpassed 710.

The KOSPI, which had been sluggish throughout last month and ended the year having dropped below the 2,400 level, is seeing a change in sentiment at the start of the year, raising expectations for a rebound. Kang Daeseok, a researcher at Yuanta Securities, analyzed, "The domestic stock market has started this year brightly. It seems to have almost forgotten the pain of being one of the worst-performing countries in the global major stock markets last year."

Considering that the annual returns of the KOSPI and the returns in January of the following year generally showed opposite trends in the past, it seems reasonable to expect the January effect. Kang said, "In the past 25 years, there has been only one case where the market declined annually and also fell in January of the following year," adding, "This can be interpreted as meaning that it is difficult for the market to remain weak consecutively. The domestic political situation, which had been highlighted since the end of last year, is expected to have a diminishing impact on the stock market, and technically, a market rebound has become possible."

Jung Sanghwi, a researcher at Heungkuk Securities, said, "The January effect refers to the concept that the stock market tends to show a strong performance particularly in January, and it is a representative concept related to the seasonality of the stock market," adding, "With the KOSPI having experienced a six-month decline in the second half of last year and the year-end ex-dividend period having ended, expectations for a rebound supported by the January effect are likely to emerge."

Whether the rebound continues seems to depend on foreign investor demand. Foreign investors have been net buyers in the KOSPI for two consecutive days, pushing the index higher. In particular, on the 3rd, they purchased more than 1 trillion won in combined spot and futures contracts, marking the first time since the emergency martial law situation on December 3 last year that foreign investors have net bought over 1 trillion won in KOSPI spot and futures. Cho Junki, a researcher at SK Securities, said, "Last week, the domestic stock market outperformed global markets in terms of returns for the first time in a while. Although difficult domestic and international conditions continue, the market is becoming more sensitive to positive news than negative news," adding, "Although the exchange rate has not dropped significantly, regardless of the reason, as long as foreign buying continues, the resistance from selling pressure is very weak, as was confirmed during the trading session on the 3rd." He further noted, "The peak foreign ownership ratio in the KOSPI last year was 35.04% in July, and as of the closing price on the 3rd, the foreign ownership ratio was 31.43%. Even if it only matches the average of about 32.5% over the past five years, the upside potential that can emerge during this process is quite large."

Technically, a rebound seems possible, but considering fundamentals, some opinions suggest it is difficult to expect the January effect. Jung said, "The stock market performance in January each year tended to be largely determined by the trend of the operating profit cycle at that time," explaining, "When the growth rate of the operating profit cycle was on an upward trend at the beginning of the month, the January stock market performance was generally good, whereas when the growth rate was on a downward trend, the January performance was often poor. Currently, the operating profit cycle shows a slowing growth trend, making it difficult to have a positive outlook for the January stock market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)