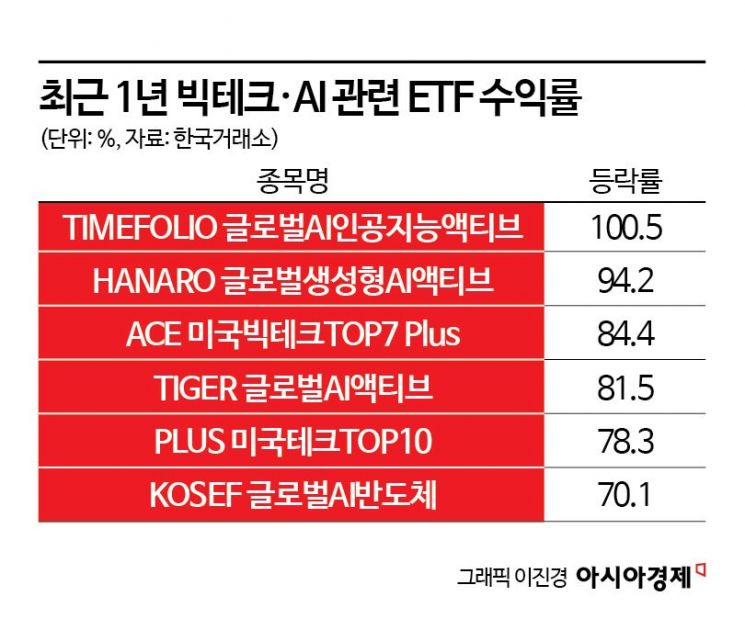

Big Tech and AI-Related ETF Returns Outperform Market

Increase Big Tech and AI Holdings During Market Corrections

Leadership Changes Likely Confined Within Big Tech Sector

Big tech (large information technology companies) and artificial intelligence (AI) related stocks are drawing attention as to whether they will lead the U.S. stock market again this year following last year. Securities firms predict that even if new trends emerge, they are likely to be AI-themed, and the leading stocks will shift positions within big tech.

According to the Korea Exchange on the 7th, TIMEFOLIO Global AI Artificial Intelligence Active ETF rose 100.5% over the past year based on the previous day's closing price. This exchange-traded fund (ETF) selects and invests in companies leading the global AI industry such as Tesla, Nvidia, Palantir Technologies, and Broadcom. Other ETFs investing in big tech and AI hardware and software, including HANARO Global Generative AI Active (94.2%), ACE U.S. Big Tech TOP7 Plus (84.4%), TIGER Global AI Active (81.5%), PLUS U.S. Tech TOP10 (78.3%), and KOSEF Global AI Semiconductor (70.1%), also significantly outperformed the Nasdaq index (35.1%) during the same period.

Securities firms assessed that the strong U.S. stock market trend continuing since the end of 2022 may experience volatility in the first half of this year, and during this period, it is advisable to increase the proportion of big tech and AI-related stocks, which have shown strength compared to other sectors. Kim Seong-hwan, a researcher at Shinhan Investment Corp., said, "The U.S. market in the first quarter is expected to show a 'battle for the high ground' pattern due to issues arising from the strong upward trend so far," adding, "It will face resistance around a 12-month forward price-to-earnings ratio (PER) of 22 times and a 10% deviation from the 50-week moving average, but the upward trend will not reverse into a downtrend."

Kim also explained, "Throughout the first quarter, investors should buy leading stocks with solid earnings in a time-divided manner, and the advantage in earnings still lies with technology stocks and AI," adding, "The sectors with the fastest upward revisions in earnings per share (EPS) market expectations all bear the colors of big tech and AI. This shows that the strong economic benefits from digital advertising, experiential consumption, and AI investment boom are concentrated in big tech."

Hwang Su-wook, a researcher at Meritz Securities, also emphasized that technology-focused investments will remain valid this year. He said, "The growth outperformance of the technology sector within the S&P 500 and the Magnificent 7 (M7) is expected to continue through the second quarter," adding, "Since big tech leads technology, even if new trends emerge within AI, we should continue to consider stocks that 'pass the baton' within big tech." He further added, "Because there has been no major change in the overall market trend, investors should respond to short-term corrections by buying, and AI-related portfolios still have an advantage."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)