Battery Stocks Hit New 52-Week Lows Early This Year

Successful 3-Day Joint Rebound After New Lows

Positive Momentum from Hyundai EV Subsidies

Recovery Expected to Be Limited This Year Due to Policy Uncertainty

As secondary battery stocks, which had been hitting new lows one after another since the beginning of the year, started to rebound together, attention is focused on whether the upward trend will continue. Although there are expectations for recovery this year due to last year's deep slump, forecasts suggest that the strength of the recovery will fall short of expectations due to demand slowdown and policy uncertainties.

According to the Korea Exchange on the 6th, secondary battery stocks have recorded intraday 52-week lows one after another since the beginning of this year. On the 3rd, Samsung SDI fell to an intraday low of 232,000 won, marking a 52-week low. LG Chem also dropped to 239,000 won, rewriting its 52-week low, and L&F fell to 76,700 won, also setting a new 52-week low. Earlier, on the 2nd, POSCO Holdings, POSCO Future M, EcoPro BM, and EcoPro recorded intraday 52-week lows.

Although secondary battery stocks, which had been sluggish throughout last year, started the new year with intraday lows, they succeeded in rebounding afterward. On the 3rd, Samsung SDI closed up 3.13% from the previous session, LG Chem rose 4.54%, POSCO Holdings 3.60%, POSCO Future M 6.09%, L&F 5.29%, EcoPro BM 7.11%, and EcoPro 10.14%, respectively.

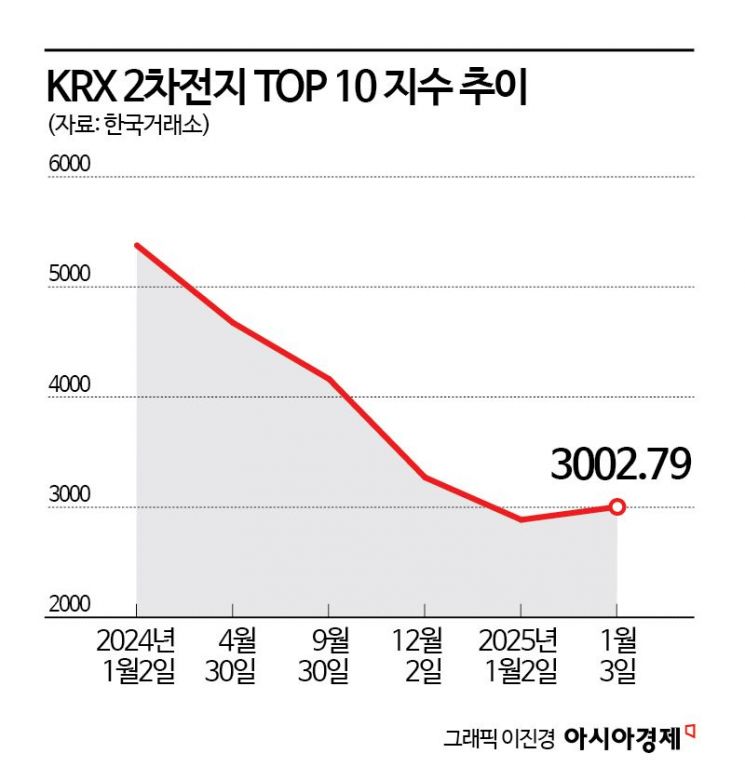

The KRX Secondary Battery TOP 10 Index also climbed back above the 3,000 level, closing at 3,002.79, up 4.06%. The KRX Secondary Battery TOP 10 Index had fallen below the 2,900 level, closing at 2,885.55 on the 2nd. The index was in the 5,000 range at the beginning of last year but continued to decline throughout the year, falling below 3,000 by the end of the year.

Secondary battery stocks, which showed weakness and recorded new lows early in the session following news that Tesla's electric vehicle deliveries decreased for the first time in about 10 years last year, showed a rare strong simultaneous rally as investor sentiment thawed with news that Hyundai Motor Group's electric vehicles would receive subsidies in the U.S. According to the U.S. Department of Energy, Hyundai's Ioniq 5 and Ioniq 9, Kia's EV6 and EV9, and Genesis GV70 electrified models are included in this year's Inflation Reduction Act (IRA) subsidy program. As a result, they are expected to receive subsidies (consumer tax credits) of up to $7,500. Ji-won Kim, a researcher at KB Securities, explained, "Domestic secondary battery stocks strongly rebounded following the news that five Hyundai Motor Group electric vehicles were included in the U.S. IRA subsidy program. Additionally, the Chinese Ministry of Commerce's announcement of strengthened export controls on battery component manufacturing and some processing technologies for critical minerals led to a broad rally across the secondary battery value chain."

Although the rebound was successful due to positive news and the inflow of bargain buying following the continued price decline, the sustainability of the rebound remains uncertain. The outlook for secondary battery stocks this year is not very bright. Yong-wook Lee, a researcher at Hanwha Investment & Securities, said, "2025 has begun, and the electric vehicle and secondary battery industries are expected to recover by overcoming the downturn that started in 2023," but added, "However, the extent of improvement may be revised downward from initial expectations. Due to demand slowdown and policy uncertainties, new car launches and electric vehicle strategies by automakers in the U.S. and Europe are being delayed."

In particular, the inauguration of the second Trump administration is considered a factor that will increase uncertainty in the electric vehicle and secondary battery industries. The researcher pointed out, "Uncertainty surrounding President Donald Trump is likely to further delay automakers' electric vehicle strategies," adding, "If the strategies of upstream automakers slow down, the earnings outlook for domestic secondary battery companies will inevitably be revised downward."

Jumin Woo, a researcher at NH Investment & Securities, forecasted, "Although the global electric vehicle sales growth rate outside China is expected to improve to 10% this year compared to 2% last year, it will be difficult to significantly increase the operating rates of secondary battery companies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)