KOSPI Drops 10% While Won-Dollar Rises 13%

Decline Exceeds Economic Cycle Level

"Foreign Buying Will Depend on Won's Direction"

There is an analysis that the trigger for the KOSPI rebound is the reversal of the won-dollar exchange rate decline. The securities industry diagnosed that the current KOSPI has fallen beyond its fundamentals, which is due to an excessive depreciation of the won.

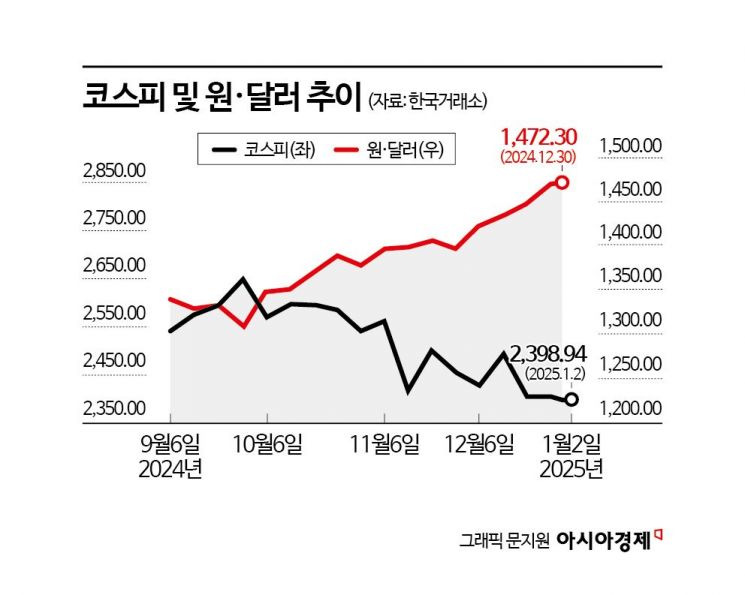

According to the Korea Exchange on the 3rd, the KOSPI closed at 2,398.94, down 0.55 points (-0.02%) from the previous trading day, marking a 10.11% decline from the peak in October last year. During the same period, the won-dollar exchange rate rose by 12.56%, showing that the continuous weakness of the won is negatively affecting the KOSPI.

The won-dollar exchange rate has risen to the highest level since the financial crisis due to concerns about trade regulations from the next U.S. administration, recent hawkish moves by the U.S. Federal Reserve (Fed), and domestic political instability. Lee Euntaek, a researcher at KB Securities, pointed out, "The rise in the won-dollar exchange rate can be positive in terms of profitability for export companies, but the problem is that the negative impact on supply and demand is greater than the positive effect on fundamentals such as export performance."

Lee also said that the current KOSPI level is experiencing an excessive decline due to the high exchange rate. He noted, "The problem with the Korean stock market is the valuation decline caused by supply and demand outflows. Corporate profits are not yet at a stage to discuss a recession, but valuations have fallen to levels only recorded at past economic cycle lows."

In the securities industry, there is an analysis that the won is currently at its most undervalued state and that the KOSPI could rebound simply with a reversal of the exchange rate. Yang Haejung, a researcher at DS Investment & Securities, explained, "Looking at the currency values of Korea, Japan, and China against the dollar last year, the won depreciated the most. Although China’s economy was sluggish, the yuan’s depreciation was not significant, and the won depreciated more than the yen, which had been the most depreciated currency so far." She added, "The depreciation of the won has been advantageous for exports, but the KOSPI clearly has not reflected this." She further stated, "In the past, when the won’s depreciation was excessive, there was a reversal, and during this process, the stock market also rose. If the current depreciation of the won is excessive, a reversal will occur, and foreign buying depends on this."

Ultimately, attention should be paid to whether the additional sharp rise in the won-dollar exchange rate will be limited and whether a trend reversal will occur. Kim Yonggu, a researcher at Sangsangin Securities, advised, "Until the volatility of the won-dollar exchange rate eases, the likelihood of a rebound in the domestic stock market is low. If the additional rise in the exchange rate is limited around 1,500 won, it is better to respond by holding rather than selling off, and buying rather than waiting."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)