Individual Investors Net Buy Clobot 16.5 Billion KRW in December

41% Return on Average Purchase Price

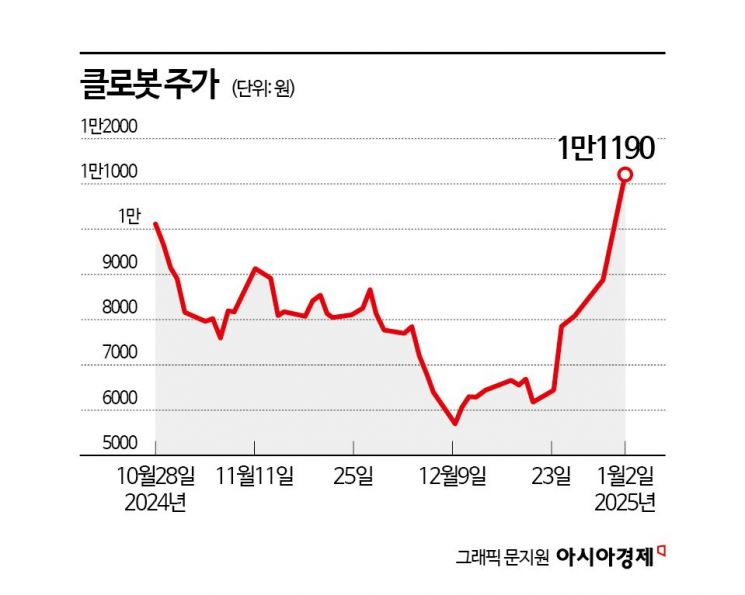

Clobot Stock Price Rebounds 81% in Six Days

Shares of Clobot, a service robot software development company, have recently rebounded sharply, bringing smiles to individual investors. Although the stock price fell significantly compared to the initial public offering (IPO) price on the listing day of October 28 last year, damaging its reputation, growing interest in robots in the domestic stock market has brought the stock price close to recovering the IPO price.

According to the financial investment industry on the 3rd, individual investors purchased Clobot shares worth 16.5 billion KRW during December last year. The average purchase price per share was 7,913 KRW, recording an estimated return of 41.4% based on the previous day's closing price of 11,190 KRW.

Founded in 2017, Clobot is a service robot software development company. It succeeded in commercializing the first domestic universal autonomous driving solution and robot control solution for indoor autonomous robots.

In early October last year, just before listing on the KOSDAQ market, Clobot signed a strategic partnership with Boston Dynamics. Subsequently, through a consortium with LG CNS, it signed a contract for the 'Multi-type Robot Production and 5G Digital Twin Control Construction Project' with Incheon International Airport Corporation. They agreed to supply AI-based guidance, security, and docent robot services along with a digital twin-based control system. During the two-day general subscription from October 16, subscription deposits totaling 5.057 trillion KRW were collected.

Despite the heated demand for the IPO subscription, the stock price closed at 10,070 KRW on the first trading day, down 22.5% from the IPO price of 13,000 KRW. By December 9 last year, the stock price had dropped to as low as 5,660 KRW. Despite the price decline, individual investors steadily attempted to average down their holdings.

Clobot supplies solutions to over 130 clients and has attracted cumulative investments worth 32 billion KRW from Hyundai Motor Group Zero One, Naver D2SF, Lotte Ventures, and others. Given that sales are being generated based on its technological capabilities, individual investors appear to have consistently purchased the stock.

Concerns about 'overhang' (potential large-scale selling pressure) hampered the stock price until the end of last month, but the stock has recently rebounded rapidly. Clobot's stock price rose 81.4% over the past six trading days, driven by renewed investor sentiment in robot-related stocks.

At the end of last year, Boston Dynamics released a video showing its bipedal robot 'All New Atlas' transformed into Santa performing stunts. The All New Atlas is a humanoid robot powered solely by electricity rather than hydraulics, allowing more precise control compared to previous models and enabling a wider range of movements using artificial intelligence (AI). Samsung Electronics' acquisition of Rainbow Robotics also had a positive impact on robot-related stocks.

As robot technology rapidly advances, expectations are growing that the related market will expand and demand for Clobot's solutions will increase. Yoon Cheol-hwan, a researcher at Korea Investment & Securities, explained, "Due to the early stage of the business and the characteristics of the robot industry, there is a large variance in gross profit margin (GPM) across major business segments. Clobot's company-wide profitability structure estimates the breakeven point (BEP) sales at around 50 billion KRW." He added, "If the effects of new launches in service sectors such as delivery, patrol, and logistics, as well as overseas expansion through collaboration with clients, proceed as expected, the company is likely to surpass the breakeven point between 2025 and 2026."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)