Over 20 Years, 67% of Bank Branches Disappeared

Analysis of the Sweden Case

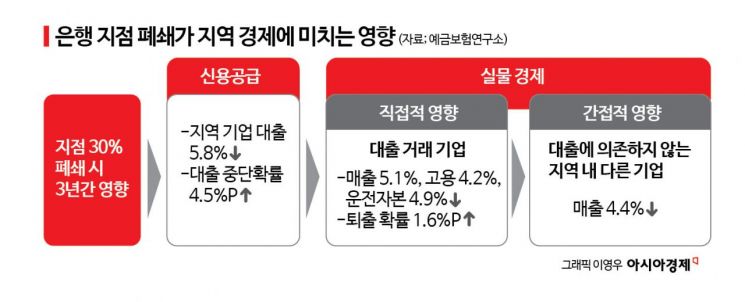

If 30% Close, Local Business Loans Decrease by 5.8% Over 3 Years

Both Borrowing and Non-Borrowing Companies Affected

Korea Also Lost 30% Over 10 Years

A research report has revealed that as the number of bank branches decreases, local economic activities shrink. The weakening of relational finance, which comprehensively evaluates management information beyond credit ratings, leads to reduced funding for small local businesses and negatively impacts employment.

On the 2nd, the Deposit Insurance Research Institute under the Korea Deposit Insurance Corporation stated this in its report titled "The Impact of Bank Branch Reduction on Credit Supply and the Real Economy: The Case of Sweden." The institute analyzed the Swedish case, where about 67% of bank branches were closed from 2001 to last year, to practically assess the impact of bank branch closures on credit supply to local businesses and the local real economy. Sweden has a structure dominated by a few large banks, with six banks occupying 75% of the loan market. Since 2001, as digitalization of retail financial services reduced the need for face-to-face transactions, banks strategically began to reduce the number of branches. The number of bank branches, which was 1,900 in 2001, decreased to 750 last year.

Looking at the Swedish case, as bank branches decreased, corporate loans declined. When 30% of bank branches close, loans to local businesses decrease by 5.8% over three years. The likelihood of already executed corporate loans being discontinued also increases by 4.5 percentage points, indicating a contraction in credit supply to local businesses. Small businesses with lower sales or asset sizes are particularly affected. For small businesses, unstructured information such as corporate reputation obtained during branch operations plays a key role in loan decisions, so they inevitably suffer more from branch closures, according to the institute.

This reduction in credit supply also affects the real economy. As corporate loans decrease, sales, employment, and working capital of bank loan transaction companies decline by 5.1%, 4.2%, and 4.9%, respectively, and the probability of business exit (cases where companies become insolvent and are sold to third parties or go through bankruptcy procedures leading to liquidation) increases by 1.6 percentage points. Other companies in the region that do not receive bank loans are also negatively affected. Among these, significant impacts were found only in companies highly dependent on local demand, such as service industries, whose sales decreased by 4.4%, compared to companies like manufacturing with high external demand. The negative effects on these companies are primarily due to reduced total demand and consumption in the region caused by employment declines in bank loan transaction companies, which hurt the sales and operations of service businesses. Additionally, if bank loan transaction companies delay accounts payable payments to cope with credit contraction, companies supplying raw materials experience worsened cash flow and difficulties due to reduced investment.

The institute stated, "The reduction of bank branches leads to the weakening of relational finance and decreased funding for small local businesses, which can adversely affect employment and other areas, necessitating policy preparation. This provides implications for Korea, where the proportion of small and medium-sized enterprises is large and financial digitalization and consolidation are rapid." The number of bank branches in Korea is also decreasing. According to statistics from the Bankers Association Consumer Portal, the number of bank branches (excluding specialized banks) was 5,405 in the third quarter of 2014 but dropped to 3,767 in the third quarter of this year, a decrease of about 30% over ten years. According to the study, corporate loans in the region are expected to decrease over the next three years, negatively impacting the real economy.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)