Seoul Metropolitan Area Accounts for 59% of Housing Supply, Concentration in Capital Region Intensifies

33% of Last Year's Scheduled Supply Postponed to This Year

Reduced Housing Supply in Gangnam 3 Districts Compared to Last Year, Mid-Tier Areas in Seoul Scheduled for Supply

This year’s housing supply is recorded at 150,000 units, the lowest since 2010. The supply in the Seoul metropolitan area accounts for 59%, indicating a concentration of the supply market in this region. One-third of the units scheduled for sale last year were postponed, and the top 10 construction companies reduced their planned supply by more than 30% compared to the previous year.

According to a joint survey by Real Estate R114 and Yonhap News Agency on this year’s housing supply, a total of 146,130 units will be supplied across 158 projects nationwide. Even including the remaining units (about 11,000 units) from construction companies that have not finalized their supply plans, the total supply is estimated to fall short of 160,000 units.

Among last year’s planned supply, 36,231 units, equivalent to 33%, were postponed to this year. The carryover units are similar in number between the Seoul metropolitan area (18,167 units) and other regions (18,064 units). The proportion of carryover units is 50%, with the share of postponed units in other regions increasing from 44% the previous year. This is interpreted as a sign of worsening difficulties in the regional housing market.

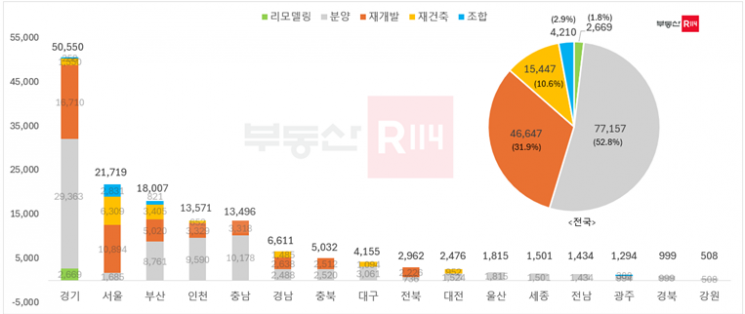

This year’s supply ratio by region is expected to be 59% (85,840 units) in the Seoul metropolitan area and 41% (60,290 units) in other regions, indicating a further intensification of the concentration in the metropolitan area. By area, in the metropolitan region, Gyeonggi Province leads with 50,550 units, followed by Seoul with 21,719 units, and Incheon with 13,571 units. In other regions, Busan (18,007 units) and Chungnam (13,496 units) each have over 10,000 units, with supply concentrated in Eco Delta City in Busan and Cheonan and Asan Tangjeong in Chungnam.

Among this year’s apartment supply, 53% (77,157 units) are from independent projects (including contract work), and 47% (68,973 units) are from redevelopment projects (including remodeling). Redevelopment projects have decreased compared to last year, mainly due to the depletion of redevelopment supply centered in the metropolitan area. Large-scale redevelopment projects with over 1,000 units this year include 'Raemian One Perla' (1,097 units) in Seoul, and in Gyeonggi Province, Goyang Wondang Shopforena (2,601 units), Uiwang Gocheon Najae Redevelopment (1,913 units), and Ddalgiwon 2 District Redevelopment (1,096 units).

While last year saw a high volume of supply in the Gangnam 3 districts, this year the share of mid-tier areas such as Dongjak-gu and Yeongdeungpo-gu is expected to increase. The planned supply areas in Seoul are Dongjak-gu (17%), Yeongdeungpo-gu (13.8%), Seocho-gu (12.1%), Eunpyeong-gu (11.2%), and Guro-gu (8.7%). In Gyeonggi Province, last year’s supply was concentrated in semiconductor-centered areas such as Pyeongtaek, Osan, and Yongin, but this year supply is expected to decrease, cooling the market. The top five supply areas in Gyeonggi are Yangju (9.9%), Gwangmyeong (8.4%), and Guri (8.1%). In Incheon, the share of supply in Namdong-gu is expected to expand. This is due to the depletion of supply in higher-tier areas, and with supply planned in relatively lower-demand areas this year, performance is likely to deteriorate.

The supply volume of the top 10 construction companies by construction capability evaluation also fell below 70% of last year’s level. The top 10 companies’ planned supply this year is 107,612 units, which is 69% of 2024’s 155,892 units. Six companies reduced their supply, three maintained it, and one expanded. DL E&C significantly increased its supply, and POSCO E&C maintained over 20,000 units alone (20,824 units).

This year’s apartment supply market is expected to record the lowest volume ever, as policy, economic, and structural issues interact beyond simple economic fluctuations. The shortage of move-in units and the long-term stagnation of the supply market, along with rising construction costs and policy uncertainty due to impeachment, are factors hindering market stabilization.

Lee Tae-yong, lead researcher at Real Estate R114, explained, "For stable supply, the government and construction industry need to discuss practical and realistic construction cost adjustment measures. If the policy vacuum caused by the approval of the presidential impeachment motion prolongs, trust among market participants will weaken and investment sentiment will shrink, so unwavering policy implementation is necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![The Special Connection Between the Statue of Martyr Lee Jun in Jangchungdan Park and Mayor Oh Sehoon ③ [Current Affairs Show]](https://cwcontent.asiae.co.kr/asiaresize/319/2026012110001599450_1768957215.jpg)