Longest Construction Slump Since Statistics Compilation

Difficult to Expect Industry Improvement Until Early Next Year

Production Indicators Also Decline Across All Sectors After 8 Months

The construction industry has fallen into an unprecedented slump. Construction output, which indicates construction investment and production, has declined for the longest period since statistics began to be compiled. Other production sectors also simultaneously decreased. The government announced that it will mobilize all available resources as the economic recovery outlook has become uncertain.

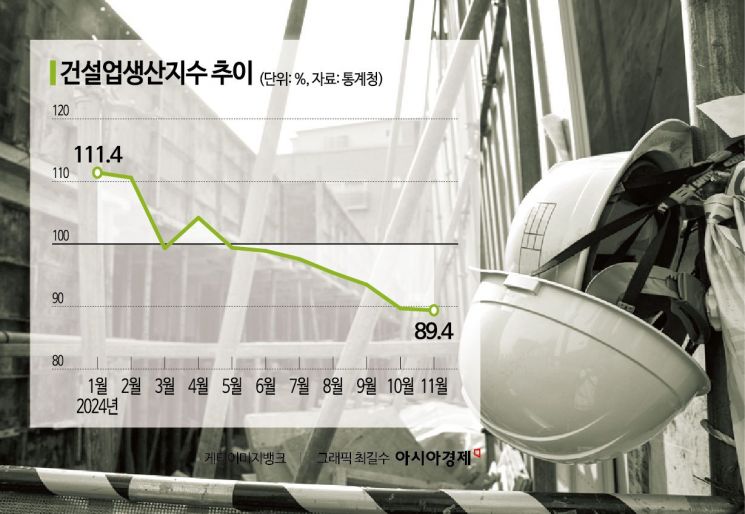

According to the "November 2024 Industrial Activity Trends" released by Statistics Korea on the 30th, construction output last month fell by 0.2% compared to the previous month. This marks the seventh consecutive month of decline since May (-4.6%). This is the longest period of decline since related statistics began to be compiled in August 1997. Construction output has decreased every month except for January (12.7%) and April (4.9%) since it started falling by -0.5% in October last year.

The sluggish construction output was driven by a decline in building construction performance. Last month, civil engineering construction performance increased by 7.7% compared to the previous month, but building construction performance decreased by 2.9% as both non-residential and residential construction declined. Construction performance has been falling for four consecutive months following decreases in October (-1.1%), September (-3.3%), and August (-3.7%). The rise in raw material prices and labor costs, along with increased loan burdens due to high interest rates, appear to have had an impact.

The construction industry downturn is expected to continue next year. Construction orders typically take 4 to 6 quarters to translate into actual performance. Since construction order indicators began to improve from the second quarter, the construction industry outlook is expected to improve only in the second half of next year. Mi-sook Gong, Director of Economic Trend Statistics at Statistics Korea, said, "If construction orders continue for a long time and lead to production, recovery is possible, but such signs are not yet visible," adding, "The situation is unfavorable."

Overall production indicators were also weak. Total industrial production decreased by 0.4% compared to the previous month. Total industrial production had increased by 1.1% in August, marking a turnaround after four months, but it declined for three consecutive months in September (-0.4%), October (-0.2%), and November. Production decreased across all sectors including mining and manufacturing, services, public administration, and construction. This is the first time in eight months since March that all sectors experienced a production decline.

Mining and manufacturing saw increased production in semiconductors (3.9%), but production decreased in automobiles (-5.4%) and electronic components (-4.7%). In particular, the automobile industry was hit by a parts suppliers' strike that began in October, affecting the production of large passenger cars and hybrid passenger cars. In the service sector, production increased in information and communications (3.2%) but decreased in finance and insurance (-2.9%) and water supply, sewage, and waste treatment (-5.7%).

Manufacturing inventories decreased by 0.8% compared to the previous month, and the average operating rate fell by 0.5 percentage points to 71.8%.

Consumption indicators rebounded. Retail sales, which reflect consumption trends, increased by 0.4% compared to the previous month. After two consecutive months of decline in September (-0.3%) and October (-0.8%), retail sales rebounded for the first time in three months. The milder-than-usual autumn weather delayed the purchase period for winter clothing to November, resulting in a 4.1% increase in semi-durable goods such as clothing. However, sales of non-durable goods such as food and beverages (-0.7%) and durable goods such as passenger cars (-0.1%) declined.

Facility investment increased in transportation equipment such as other transportation equipment (0.1%) but decreased in machinery such as special industrial machinery (-2.0%), resulting in a 1.6% decrease compared to the previous month.

The coincident index, which reflects the current economic situation, stood at 97.6, down 0.5 points from the previous month. The coincident index had declined for seven months before stabilizing last month but failed to rebound and declined again. The leading index, which predicts future economic conditions, rose by 0.1 points to 100.8 compared to the previous month.

The government announced plans to strengthen the economy. Kwi-beom Kim, Director of Economic Analysis at the Ministry of Economy and Finance, said, "Total industrial production has decreased, increasing uncertainty about the recovery path," adding, "We will mobilize all available resources including changes to fund operation plans, additional investments by public institutions, and policy finance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)