Stock Price Rises 191% This Year... Record High New Orders

Increased Demand for Air Cooler, a Key Component of Gas Plants

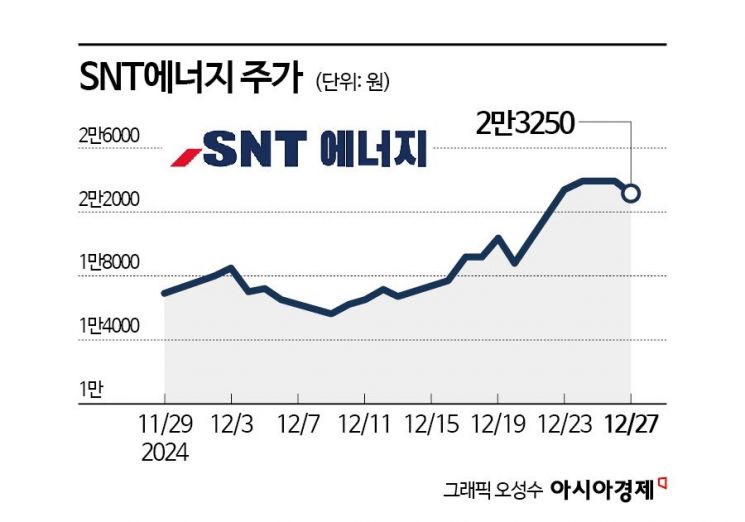

SNT Energy's stock price has reached an all-time high. This is due to growing expectations that SNT Energy will benefit from Donald Trump, the President-elect of the United States, supporting the expansion of oil and natural gas development and production.

According to the financial investment industry on the 30th, SNT Energy's stock price has risen 191.2% since the beginning of this year. Considering that the KOSPI fell 9.4% during the same period, the return compared to the market amounts to 200.6 percentage points (P). On the 26th, SNT Energy recorded an intraday high of 25,500 KRW, marking an all-time high.

SNT Energy produces air-cooled heat exchangers (Air Coolers) used in oil and gas plants. It also manufactures heat recovery steam generators (HRSG), surface condensers, and denitrification facilities necessary for combined cycle power generation and cogeneration. The main product, the air cooler, is a device that cools the heat generated in plants using air, and unlike water-cooled heat exchangers, it is essential in Middle Eastern countries where industrial water is limited. The company operates locally through its subsidiary SNT Gulf in Saudi Arabia. Last year, it strengthened its number one position by merging with competitor KHE.

On the 23rd, SNT Energy announced that it signed an air cooler supply contract worth 71.9 billion KRW with Bechtel Energy. The contract size corresponds to 22.3% of last year's sales, and the contract period extends until September 27, 2026. By securing new orders worth 603.3 billion KRW this year, the company recorded the largest scale of new orders since its establishment.

The development of artificial intelligence (AI) and the resulting surge in electricity demand were also cited as positive factors for SNT Energy's performance outlook. The demand for liquefied natural gas (LNG) to meet AI-driven power demand is expected to increase rapidly.

Minjung Kwak, a researcher at Hyundai Motor Securities, explained, "With the second Trump administration, LNG projects are being resumed in the United States," adding, "SNT Energy's air cooler orders for LNG projects in the U.S., which will be fully implemented from next year, are expected to increase." She continued, "Among the 225 coal power plants operating in the U.S., more than 25% will be shut down by 2040 and converted to LNG power generation," and added, "The method of mixing natural gas and hydrogen for power generation to reduce carbon emissions is increasing, leading to higher demand for air coolers."

Business opportunities are also increasing in the existing Middle Eastern market. Saudi Aramco, the Saudi Arabian national oil company, is pursuing a gas expansion strategy aiming to increase sales gas production by more than 60% compared to 2021 by 2030. Seongheon Lee, a researcher at iM Securities, analyzed, "The Master Gas System is an extensive pipeline network connecting Aramco's major gas production and processing sites throughout Saudi Arabia," and "It will significantly contribute to Saudi Arabia's goal of producing 50% of its electricity from gas by 2030." He emphasized, "Abu Dhabi National Oil Company (ADNOC) in the United Arab Emirates (UAE) aims to more than double LNG production by 2028," adding, "Air coolers are key devices used to condense and cool refrigerants in the LNG liquefaction process."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)