Since the Beginning of the Year, North America Fund Returns Reach 39.05%

Highest Returns Among Major Regional and Country Funds

Strong Returns Attract Capital... Approximately 18 Trillion Won Inflows

Overseas Fund Growth Expected to Continue Amid North America Fund Strength

This year, as the U.S. stock market reached an all-time high and showed remarkable strength, North American fund returns approached 40%. Consequently, nearly 18 trillion won flowed into North American funds. With investors' interest in overseas markets expected to continue next year, the growth trend of overseas funds is also anticipated to persist.

Funds have also poured into North American funds amid the U.S. stock market's dominance. Since the beginning of the year, 17.7785 trillion won has flowed into North American funds. Getty Images

Funds have also poured into North American funds amid the U.S. stock market's dominance. Since the beginning of the year, 17.7785 trillion won has flowed into North American funds. Getty Images

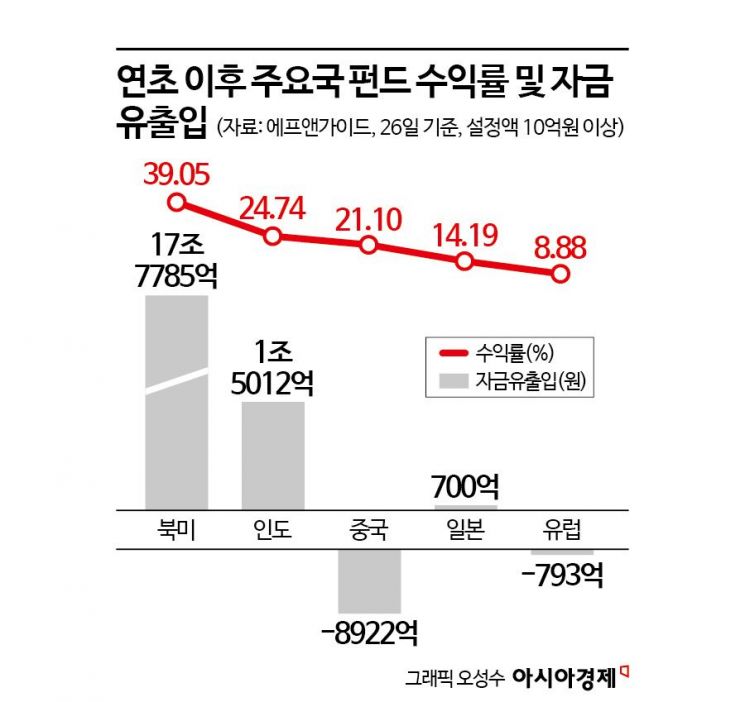

According to financial information provider FnGuide on the 28th, as of the 26th, North American funds recorded a year-to-date return of 39.05%. This is the highest return among regionally classified funds by FnGuide. Other regions showed returns as follows: Europe, Middle East, and Africa (EMEA) 31.87%, Asia Pacific 26.45%, Greater China 26.37%, and India 24.74%. Only Latin America (-22.21%) and Brazil (-21.57%) posted negative returns.

The U.S. stock market demonstrated a truly remarkable upward trend this year. The S&P 500 rose 26.58% year-to-date, the Dow Jones increased by 14.95%, and the Nasdaq surged 33.37%. The Nasdaq index surpassed 20,000 dollars for the first time ever. Kim Hoo-jung, a researcher at Yuanta Securities, analyzed, "As all investors know, the most impressive aspect this year was the dominance of U.S. stocks. The strength of U.S. stocks continued due to expectations around artificial intelligence (AI) and big tech (large information technology companies), and in November, U.S. stocks maintained their strength again with the Trump trade."

Funds also poured into North American funds amid the U.S. stock market's dominance. Since the beginning of the year, 17.7785 trillion won has flowed into North American funds. Besides North America, only India (1.5012 trillion won) and Japan (70 billion won) saw fund inflows since the start of the year. Conversely, 89.22 billion won exited Chinese funds, 39.84 billion won from Vietnam, and 7.93 billion won from Europe. The assets under management of North American funds grew from 11.8226 trillion won at the beginning of the year to 23.9144 trillion won. Oh Kwang-young, a researcher at Shin Young Securities, stated, "North American funds attracted capital mainly in index funds tracking the S&P 500 and Nasdaq indices, as well as some dividend stock funds. Especially in November, with the emergence of the Trump trade, monthly inflows exceeded 1 trillion won, marking 18 consecutive months of growth since June last year."

The strength of North American funds drove the overall growth of overseas funds. Researcher Oh analyzed, "One characteristic of this year's fund market is that overseas funds, which showed somewhat slower growth last year and lower growth than domestic funds, recovered their growth trend with large-scale inflows mainly into overseas equity funds, showing higher growth rates than domestic funds." After 2025, overseas funds had shown soaring growth amid high popularity, but last year, growth slowed to 8.7%, the lowest since 2014. Oh explained, "This was due to a slowdown in growth of alternative investment products such as real estate and special assets, which have a high proportion within overseas funds, as well as re-investment funds. However, despite a decline in overseas alternative investments this year compared to last year, overseas funds showed a recovery in growth rates backed by large-scale inflows into overseas equity funds. This was because the North American stock market showed an all-time high level of strong performance, attracting investors' attention and causing a surge in fund inflows."

As more investors turn their attention to overseas investments, the growth of overseas funds led by North American funds is expected to continue next year. Researcher Oh predicted, "With Donald Trump's potential re-election advocating 'America First' and domestic political uncertainties, investors will continue to turn their eyes to overseas stock markets, and overseas funds, especially overseas equity funds, will maintain their growth trend."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.