Stock Price Rises 69% Over Past Three Days

Strategic Partnership with Netflix for Content Supply

Improved Performance and Expected IP Concentration Effect

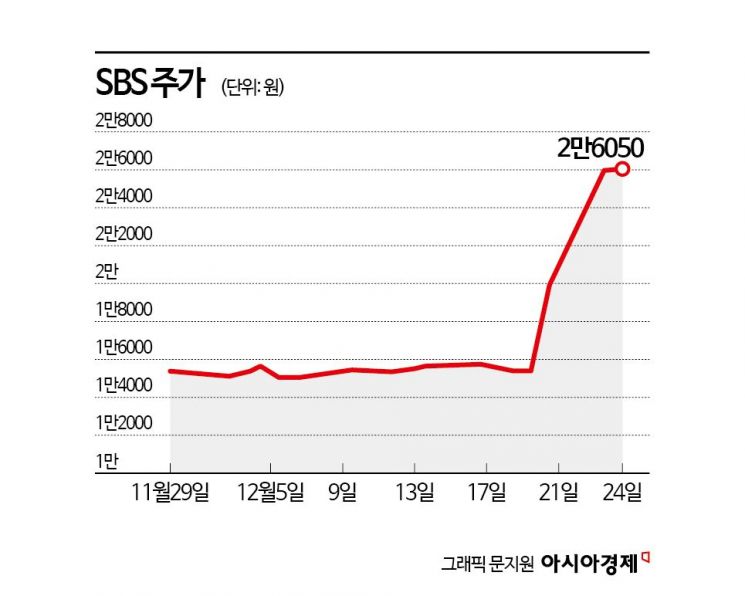

In the domestic stock market, SBS's stock price rose the most sharply over the three trading days just before Christmas. SBS's stock, which had been steadily declining throughout the year, surged following news of a strategic partnership with Netflix. The securities industry estimated that SBS's corporate value would increase further. Institutional investors responded positively by concentrating their purchases of SBS shares.

According to the financial investment industry on the 26th, SBS's stock price rose 69.3% over the three trading days from the 20th to the 24th. The stock price, which had been below 16,000 won, surpassed the 26,000 won mark. During the same period, the KOSPI rose by 0.2%. The return compared to the market reached 69.5 percentage points (P). Domestic institutions net purchased 6.2 billion won worth of SBS shares during this period. This is a significant difference compared to the 45.0% increase in Shinsegae I&C, whose stock price surged thematically over the past three days. Shinsegae I&C's stock price surged following news that Chung Yong-jin, chairman of the Shinsegae Group, met with Donald Trump, the U.S. president-elect.

Earlier, on the 20th, SBS announced that it had signed a strategic partnership with Netflix regarding content supply. For the next six years, SBS will supply Netflix with new dramas as well as entertainment and cultural content. Shin Eun-jung, a researcher at DB Financial Investment, introduced, "From January next year, entertainment programs such as 'Running Man' and 'Gol Ddaerineun Geunyeodeul' as well as currently airing dramas will be broadcast on Netflix in Korea," and "In the second half of next year, two dramas will be sold with worldwide simultaneous broadcasting rights."

SBS did not disclose the contract size with Netflix to maintain business confidentiality. However, the securities industry expects it to be an unprecedented, record-breaking contract. The six-year contract period is the longest among contracts Netflix has signed in Korea. The fact that the entire broadcaster's programming will be serviced was also cited as a positive factor.

Lee Ki-hoon, a researcher at Hana Securities, analyzed, "Since the contract amount was not disclosed, SBS's performance can only be estimated conservatively," and added, "If the expectations are correct, operating profit in 2027 will be around 100 billion won even without a special recovery in the advertising market."

Content previously aired by SBS is currently being broadcast on Wavve. Annual sales of about 40 billion won are generated. This sales scale is linked to Wavve's subscriber numbers and SBS's viewership share. As of November, Netflix's monthly active users (MAU) were about 11.6 million, approximately three times the 4.25 million of Wavve. The researcher emphasized, "Even with conservative estimates, it will be around 300 billion won over six years," and added, "The overseas supply of new content is a sufficiently positive issue even if it is at the level of the drama supply contract previously signed with Disney."

The contract with Netflix is expected not only to improve performance but also to increase SBS's corporate value in a virtuous cycle. Ji In-hae, a researcher at Shinhan Investment Corp., said, "Expected benefits include an increase in the number of productions, concentration of intellectual property (IP) in small and medium-sized dramas, and increased investment attraction," and explained, "Drama proposals costing less than 2 billion won per episode are likely to be concentrated on SBS." He predicted, "Additional revenue such as product placement (PPL) for brand promotion will increase," and "This will lead to cost reductions in production due to expanded influence."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)