Stock Price Up 20% Since Low on 9th This Month

US Big Tech Expected to Benefit from ASIC Chip Insourcing

AI Device AP Performance Boost Increases MLCC Capacity

The stock price of Samsung Electro-Mechanics, which had been declining in the second half of this year, is now showing signs of recovery. In the securities industry, there are forecasts that Samsung Electro-Mechanics will demonstrate positive performance next year, supported by the supply of flip-chip ball grid array (FC-BGA) for artificial intelligence (AI) accelerators and multilayer ceramic capacitors (MLCC) driven by the expansion of AI devices.

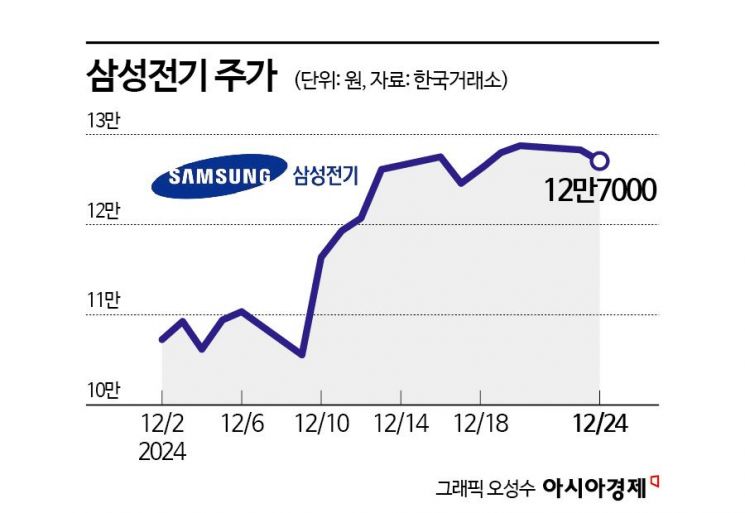

According to the Korea Exchange on the 26th, Samsung Electro-Mechanics closed at 127,000 won on the previous trading day, rising 20.27% from the low point on the 9th. Until July this year, it recorded a 52-week high but then declined, falling to around 100,000 won last month. However, it has recently rebounded due to benefits from the increased penetration rate of AI devices, supply of FC-BGA for AI accelerators, and expectations of improved smartphone demand following strengthened stimulus measures in China.

In the securities industry, there is an expectation that in the domestic stock market, where the IT sector has significant influence, the electrical and electronics sector will rebound before memory semiconductors next year, with Samsung Electro-Mechanics at the center of this trend. Lee Woong-chan, a researcher at iM Securities, said, "It seems difficult for semiconductors, which attracted attention for a while this year but then cooled off, to become leading stocks again next year. They are exposed to competition with China, and capital expenditures (CAPEX) for AI semiconductors may peak next year, while legacy memory remains in a difficult situation." He added, "Samsung Electronics appears to need more time for restructuring, and if we look for alternatives, Samsung Electro-Mechanics, which has undergone a long-term stock price adjustment, seems likely to benefit from China's economic stimulus and increased IT hardware orders related to AI."

Recently, the contrasting performances of Broadcom, which manufactures application-specific integrated circuits (ASICs), and Micron Technology, a memory semiconductor company, in the U.S. stock market are expected to have a positive impact on Samsung Electro-Mechanics. Park Kang-ho, a researcher at Daishin Securities, said, "The divergent earnings forecasts of Broadcom and Micron indicate a future change in leading stocks. The rise of the memory semiconductor sector is expected to be delayed compared to expectations, while Broadcom will experience high growth due to increased sales and investment in the AI-oriented ASIC segment." He added, "U.S. big tech companies such as Google and Meta will expand the integration of AI chips through partnerships with Broadcom." He further noted, "Samsung Electro-Mechanics' AI-oriented FC-BGA sales are expected to be fully reflected next year. Benefits are anticipated as big tech companies, besides Nvidia, internalize AI accelerators and ASIC chips."

Along with FC-BGA, growth in MLCC performance driven by enhanced application processor (AP) capabilities in AI devices is also expected. Park Jun-seo, a researcher at Mirae Asset Securities, said, "Smartphone manufacturers will seek justification for price increases through AI function improvements. In this process, enhancing AP performance is essential." He added, "The capacity of MLCC increases proportionally with AP performance enhancement. Indirect benefits from the increased MLCC mounting capacity are expected."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)