US 10-Year Treasury Yield at 4.589%... Highest Since Late May

Slowing Pace of Rate Cuts, Concerns Over Expanding Fiscal Deficit

Morgan Stanley Forecasts 10-Year Yield at 3.35% Next Year

Meanwhile, Deutsche Bank Sees 4.65% Amid Inflation Concerns

Long-term U.S. Treasury yields have surged to their highest level in seven months. This is due to the Federal Reserve (Fed) slowing the pace of interest rate cuts and expectations of an expanding fiscal deficit following the inauguration of the Trump administration's second term. However, experts remain divided on whether this rise in yields will continue.

According to the U.S. Treasury and Investing.com, the 10-year U.S. Treasury yield closed at 4.589% on the 23rd (local time) near the New York Stock Exchange close, up 6.3 basis points (1bp=0.01 percentage point) from the same time the previous day. This is the highest level since May 29 (4.616%).

The 10-year Treasury yield has been rising since the 9th (Treasury prices falling). As expectations grew that the Fed would reduce the number of rate cuts next year and that the U.S. fiscal deficit would worsen under the Trump administration's second term, investors rushed to sell long-term bonds.

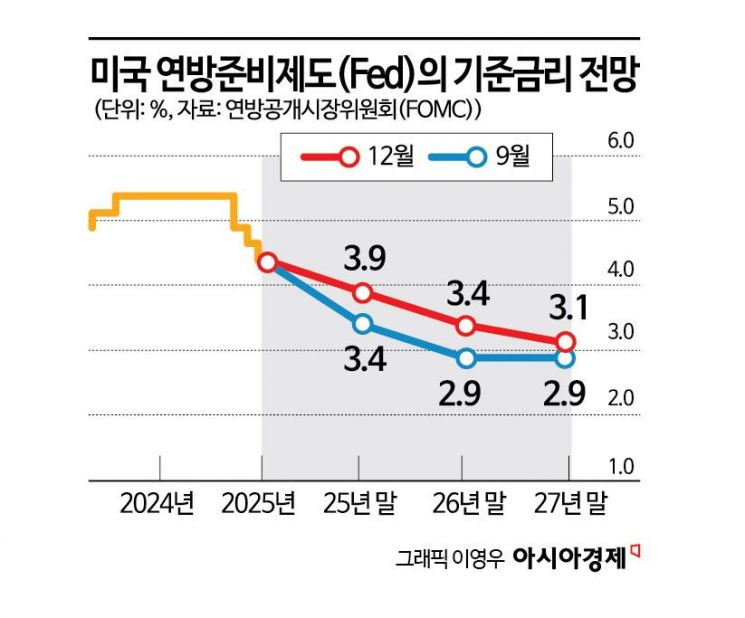

Earlier, on the 18th, the Fed projected in its dot plot that the year-end benchmark interest rate would be 3.9%, 0.5 percentage points higher than the September forecast of 3.4%. Assuming the Fed cuts rates by 0.25 percentage points each time, this means the number of rate cuts is halved compared to the September forecast (four cuts). Chris Arens, strategist at Stifel Nicolaus & Co., analyzed that “due to fiscal concerns and uncertainty, investors are demanding a higher term premium on long-term Treasuries.”

Long-term bond yields are influenced not only by monetary policy but also by future economic growth prospects. The spread between the 10-year and 2-year U.S. Treasury yields nearly converged to zero earlier this month but widened to 24 basis points at one point on this day. This was due to economic indicators related to U.S. consumer and business investment released that all fell short of market expectations.

The Conference Board's December Consumer Confidence Index dropped sharply by 8.1 points to 104.7 from the revised previous month’s 112.8. The December Expectations Index plunged 12.6 points to 81.1, barely holding above the “recession threshold” of 80. On the same day, the U.S. Commerce Department reported that November durable goods orders fell 1.1% month-over-month, significantly missing the Wall Street Journal (WSJ) expert consensus of a 0.3% increase and marking the largest decline since June. Durable goods orders include high-priced items such as aircraft, home appliances, and computers.

Despite the Fed’s rate-cutting stance, uncertainty stemming from President-elect Trump’s policies has led to divided opinions on whether long-term yields will rise or fall from current levels next year.

First, the average forecast of 12 experts compiled by Bloomberg for the year-end 10-year Treasury yield next year is 4.25%. This implies a potential decline of 33.9 basis points from current levels. Particularly, Morgan Stanley, which holds the most optimistic view on bonds on Wall Street, expects the Fed to accelerate rate cuts again due to downward pressure on economic growth, forecasting the 10-year yield to fall to 3.55% by the end of next year.

On the other hand, those expecting long-term yields to rise argue that President-elect Trump’s high tariff measures and immigration control policies could fuel inflation and accelerate bond issuance. Deutsche Bank, which expects the Fed to keep rates steady next year, forecasts the 10-year Treasury yield to rise to 4.65%. Bloomberg reported that “some analysts even see the 10-year yield reaching 5% next year.”

Meanwhile, corporate credit spreads (the difference between corporate bond yields and Treasury yields), which had been narrowing amid the Fed’s rate-cutting trend this year, are widely expected to widen through the end of next year. BMO projects that the current corporate credit spread of 82 basis points will widen to 105 basis points by year-end. As a result, many companies are expected to issue bonds early next year to secure financing at slightly lower rates.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)