After Insurance Accounting Guidelines Announcement

Foreigners Net Sell Insurance Stocks Worth 160 Billion Won

Stock Prices Plunge Amid Dividend Uncertainty for Insurers

Domestic insurance companies, which have posted record-breaking performance this year, are being shunned by foreign investors. While the impeachment crisis and high exchange rates have had an impact, experts point to the uncertainty in insurance accounting as the biggest factor causing investment anxiety. Frequent changes in accounting standards by financial authorities have also undermined the government's value-up (corporate value enhancement) policies.

Foreign Investors Selling Off 'K-Insurance' Stocks

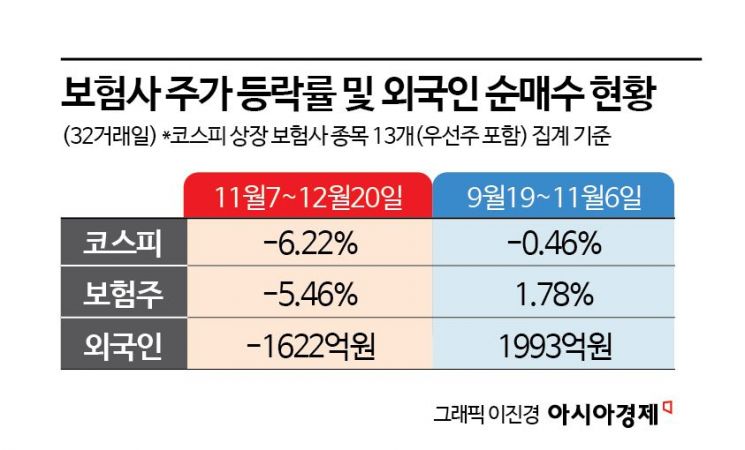

On the 24th, Asia Economy analyzed the investment trends in domestic listed insurance companies before and after the recent announcement of insurance accounting improvement measures by financial authorities, such as guidelines on surrender rates for no-lapse and low-lapse insurance policies. The analysis revealed a notable withdrawal of foreign investors. From the guideline announcement on the 7th of last month to the 20th of this month, over 32 trading days, the stock prices of 11 KOSPI-listed insurance companies fell by an average of 5.46%. During this period, foreign investors net sold insurance company stocks (including preferred shares across 13 stocks) worth 162.2 billion KRW.

Before the guideline announcement, over 32 trading days, these insurance stocks had risen by 1.78%. Even as the KOSPI index fell by 0.46% during that time, foreign investors net bought about 199.3 billion KRW worth of insurance stocks, helping to support the index. Considering that insurance companies posted record-high earnings this year and that insurance stocks become more attractive as dividend stocks toward year-end, the recent foreign investor withdrawal is considered unusual. A corporate relations (IR) officer at a domestic insurance company said, "Recently, many inquiries have come from well-known overseas investment banks (IBs) about the potential earnings volatility caused by frequent changes in accounting standards," adding, "When we explain that some profit indicators might change, they all respond that this is the first time they have seen such a thing."

The anxiety of foreign investors toward domestic listed insurance companies was clearly evident on the 20th. On that day, Hyundai Marine & Fire Insurance hit a 52-week low following securities analysts' forecasts that dividends would be difficult. The stock price plunged as much as 9.6% intraday. Foreign investors net sold Hyundai Marine & Fire Insurance shares worth 1.9 billion KRW in a single day, the second-largest daily net foreign selling this month. Lee Byung-geon, head of the research center at DB Financial Investment, said, "Unless there is a significant change in the current direction of accounting-related regulatory revisions, Hyundai Marine & Fire Insurance will find it difficult to resume dividends for 2 to 3 years after next year," adding, "At least one improvement measure, such as interest rate hikes or increases in actual loss insurance premiums, must be implemented."

Surrender Value Reserve System Blocking Dividends... Improvement Measures Lack Effectiveness

Hyundai Marine & Fire Insurance, which has earned around 1 trillion KRW in annual net income, suddenly found itself unable to pay dividends after 22 years due to changes in accounting systems following the introduction of the new International Financial Reporting Standard (IFRS 17). A representative example is the surrender value reserve system. This system requires insurers to set aside funds in preparation for insurance contract cancellations and was introduced when IFRS 17 was implemented. With IFRS 17 changing insurance liabilities to fair value measurement, the liabilities decreased, raising the possibility of insufficient surrender values. As a result, financial authorities mandated insurers to conservatively accumulate funds. These reserves are excluded from distributable profits.

The problem is that this system excessively ties up insurers' capital. In the first half of this year, the cumulative surrender value reserves of domestic insurers reached 38.5 trillion KRW, a 19.6% increase compared to 32.2 trillion KRW at the end of last year. Compared to the end of 2022, before IFRS 17 was implemented (23.7 trillion KRW), it surged by 62.4%. An industry insider explained, "The surrender value reserve was introduced to prevent insurers from using the increased capital expected from IFRS 17 implementation elsewhere," adding, "While we understand the purpose of protecting policyholders and the rationale for the system, it is a major problem that insurers cannot pay dividends even after earning trillions of won."

The increase in insurers' surrender value reserves has not only reduced dividends but also corporate tax payments. Insurers paid 3.4 trillion KRW in corporate taxes in 2022, but only 800 billion KRW last year. This is because the surrender value reserves are recognized as deductible expenses under the Corporate Tax Act, deferring tax payments for a certain period.

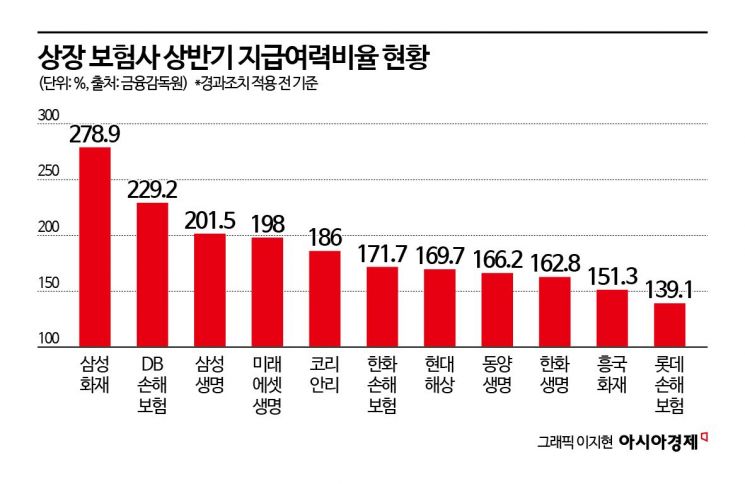

When the financial authorities noticed that insurers' earnings were at record highs but corporate taxes were decreasing, they announced improvement measures for the surrender value reserves in October. If an insurer's solvency ratio (K-ICS) ? a financial soundness indicator ? exceeds 200% (pre-transition period standard), only 80% of the existing reserves must be set aside this year. However, among listed insurers, only three companies?Samsung Life Insurance, Samsung Fire & Marine Insurance, and DB Insurance?had K-ICS above 200% as of the first half of the year. Most, including Hyundai Marine & Fire Insurance (169.7%), Hanwha Life Insurance (162.8%), and Hanwha General Insurance (171.7%), do not benefit from this relief. An industry insider said, "The authorities' hasty accounting policies have resulted in reduced dividends and tax revenues," adding, "It is also hard to accept that the previous regulatory easing was based on a 150% K-ICS threshold, but now they require meeting 200%."

Despite Record Earnings, Bond Issuance... No-Lapse and Low-Lapse Insurance Surrender Rate Application Also a Major Variable

Listed insurers are striving to meet the K-ICS requirements because suddenly stopping dividends, which they have consistently paid, could severely damage investor trust. Hanwha Life Insurance, whose dividend prospects have become uncertain, issued 800 billion KRW worth of subordinated bonds on the 12th. Hanwha Life Insurance has issued capital securities totaling 1.9 trillion KRW this year alone, all concentrated in the second half. Recently, other listed insurers have also been raising capital, such as Hanwha General Insurance issuing 350 billion KRW in August and Tongyang Life Insurance issuing 300 billion KRW in subordinated bonds in October. It is an ironic situation where, despite record earnings, insurers have to borrow money and pay interest.

Experts expect that the no-lapse and low-lapse insurance surrender rate guidelines, which will be applied from this year's year-end accounting settlement, will also negatively affect dividends. The authorities imposed a 'principle model' with conservative assumptions on insurers when presenting the guidelines. If insurers use an 'exception model' based on their own statistics, they must undergo stringent inspections by the Financial Supervisory Service. Jung Tae-joon, a researcher at Mirae Asset Securities, predicted, "The biggest variable affecting expected dividend yields is the decrease in insurance contract service margin (CSM) due to changes in no-lapse and low-lapse insurance surrender rate assumptions," adding, "Second-tier companies will be most affected."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)