Ministry of Economy and Finance Announces Measures to Improve Foreign Exchange Supply

Partial Approval of Foreign Currency Loans for Non-KRW Uses

As the exchange rate remains at an all-time high since the global financial crisis, the government is easing regulations to facilitate smooth foreign exchange supply and demand. The limit on banks' forward foreign exchange positions, which has been blocking foreign currency inflows, will be increased by 50%, and foreign currency loans for won-denominated purposes will be allowed only for corporate facility funds.

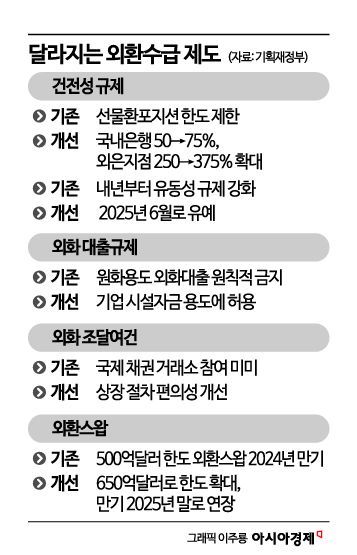

The Ministry of Economy and Finance announced the 'Foreign Exchange Supply and Demand Improvement Plan' with these details on the 20th. Accordingly, under the current Foreign Exchange Transactions Act, the forward foreign exchange position limit for domestic banks, which is 50% of their capital, and for foreign bank branches in Korea, which is 250%, will be increased to 75% for domestic banks and 375% for foreign bank branches, respectively. The forward foreign exchange position refers to the value obtained by subtracting forward foreign currency liabilities from forward foreign currency assets, and the government regulates the limit. With the increased limit, banks can bring in more foreign currency accordingly.

The government explained that it changed its policy stance considering changes in the international financial and foreign exchange market environment. Until now, foreign exchange authorities have freely allowed foreign currency outflows while strictly managing inflows. As a result, there were situations in the foreign exchange market where banks had sufficient capacity but faced procurement difficulties. Since foreign exchange reserves exceed $400 billion, about twice as much as during the financial crisis, and the capital market is sufficiently mature, the government believes it is now necessary to balance foreign exchange supply and demand.

The soaring exchange rate in recent days also appears to have been taken into account. The won-dollar exchange rate began to surge on the 3rd following President Yoon Seok-yeol's declaration of martial law. After the U.S. Federal Reserve's Federal Open Market Committee (FOMC) meeting on the 18th (local time), it surpassed the 1,450 won per dollar mark. This is the highest level since the global financial crisis. Since the money market and foreign exchange market are interconnected, expanding the forward foreign exchange position could have some effect on stabilizing the exchange rate, according to the government's plan. In fact, when the exchange rate rose to its highest level in 10 years in March 2020, the Ministry of Economy and Finance also took out the card of expanding forward foreign exchange positions.

The regulation limiting foreign currency loans for won-denominated purposes will also be eased. Under domestic law, borrowing foreign currency to use won is generally prohibited. This measure is to prevent a rapid increase in external debt. However, the government decided to partially allow foreign currency loans from foreign exchange banks to large, medium, and small enterprises. However, it will only be permitted when used for facility funds that help the real economy, and small business owners are excluded from the target. If necessary, the borrower's capacity to bear foreign exchange risk will be considered, and the policy will be limited to export companies with low foreign exchange risk.

In addition, the government will expand settlement in counterparties' currencies without dollar exchange. When Korea trades with other countries, payments are usually received in dollars, but going forward, it will encourage receiving payments directly in the counterparties' currencies. The government also plans to encourage participation in the Luxembourg Stock Exchange, the largest international bond exchange. By relaxing strict procedures, it aims to support domestic institutions in more conveniently procuring foreign currency.

The government postponed strengthening foreign currency liquidity stress test regulations. Although it planned to take separate measures if financial companies failed to pass the regulations from the end of next year, the implementation date has been delayed to June next year. The foreign exchange authorities and the National Pension Service have expanded the foreign exchange swap limit from $50 billion to $65 billion. The maturity, which was scheduled to end this year, has been extended to the end of next year.

The Ministry of Economy and Finance stated, "We will carefully monitor the implementation effects, national credit rating, and foreign exchange market, and proceed with the gradual expansion of the system."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)