Valentine Importer Pernod Ricard Korea's Cost of Sales 23%

Cost of Sales 47.3 Billion KRW... Less Than Annual Advertising Expense of 48.7 Billion KRW

Operating Profit Margin 30%... Up to 6 Times Higher Than Competitors

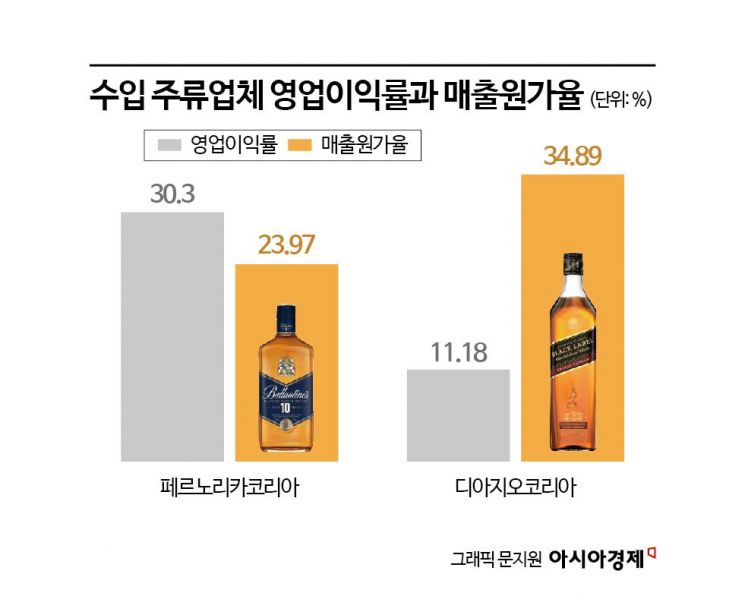

The cost of goods sold (COGS) ratio for Pernod Ricard Korea, the liquor company importing blended Scotch whisky Ballantine's, was confirmed to be in the 20% range. COGS refers to the direct costs incurred in producing the goods sold by a company, and for whisky importers, it means the purchase cost of the products. This indicates that the company imported whisky cheaply and earned more than four times the profit.

Actor Hyun Bin is posing at the opening event of the Valentine Hour Lounge pop-up store held on August 30 at IFC Mall in Yeouido, Seoul. Photo by Yonhap News

Actor Hyun Bin is posing at the opening event of the Valentine Hour Lounge pop-up store held on August 30 at IFC Mall in Yeouido, Seoul. Photo by Yonhap News

According to the Financial Supervisory Service's electronic disclosure system (DART) on the 26th, Pernod Ricard Korea, a corporation with a fiscal year ending in June, recorded a COGS of 47.3 billion KRW for the 2023 fiscal year (July 2023 to May 2024). During this period, sales amounted to 175.1 billion KRW, resulting in a COGS ratio of 23.97%. This is more than 10 percentage points lower than the COGS ratio of 34.89% reported by Diageo Korea, a competitor importing Johnnie Walker.

Imported liquor is distributed domestically in the order of 'overseas manufacturer (headquarters) → Korean importer → wholesaler → retailer.' Pernod Ricard Korea, as the Korean importer, purchased whisky cheaply from the overseas manufacturer and sold it at a higher price to domestic wholesalers.

In fact, Pernod Ricard Korea's operating profit during the same period reached 53.1 billion KRW. The operating profit margin was 30.3%, nearly three times higher than Diageo Korea's operating profit margin of 11.18%.

Notably, Pernod Ricard Korea's COGS during the same period was less than the company's advertising expenses (48.7 billion KRW). Pernod Ricard Korea has continued aggressive marketing by selecting actors Jung Woo-sung and Lee Jung-jae in 2017, Ju Ji-hoon and Choi Min-ho in 2022, and Hyun Bin this year as models. Over the past year, the company spent more on promoting whisky than on importing it, increasing the burden on consumers. An anonymous industry insider said, "Unlike domestic liquor manufacturers, imported liquor companies do not incur costs in producing the products, so their COGS is quite low, and they focus heavily on advertising and promotional events."

As whisky demand increased due to the spread of the home drinking trend during the COVID-19 pandemic, Pernod Ricard Korea has steadily raised prices over recent years. In October last year, the retail price of Ballantine's 12-year-old in convenience stores rose by 10.9%, from 47,900 KRW to 53,100 KRW, and Royal Salute 21-year-old increased by 8%, from 345,200 KRW to 372,900 KRW.

On the 27th of last month, Franz Horton, CEO of Pernod Ricard Korea (left), Miguel Pascal, Executive Director of Marketing (right), and Sandy Hislop, Valentine Master Blender, introduced the Valentine 40-Year Masterclass Collection The Waiting at Casa Alexis Dosan in Gangnam-gu, Seoul. Photo by Jo Yongjun

On the 27th of last month, Franz Horton, CEO of Pernod Ricard Korea (left), Miguel Pascal, Executive Director of Marketing (right), and Sandy Hislop, Valentine Master Blender, introduced the Valentine 40-Year Masterclass Collection The Waiting at Casa Alexis Dosan in Gangnam-gu, Seoul. Photo by Jo Yongjun

This month, Pernod Ricard Korea reduced the ex-factory prices of key whiskies, including Ballantine's, by up to 13%. The affected products included Ballantine's 10, 17, and 21 years, Royal Salute 21 Year Signature, 21 Year Malt, 21 Year Grain, and some limited editions. Pernod Ricard Korea explained that the price cuts were made "to coexist with struggling customers in a difficult market environment and to allow consumers to enjoy products at reasonable prices."

However, there are views that the price reductions were made to retain demand amid a shrinking domestic whisky market following the transition to an endemic phase. An industry insider said, "Since whisky import prices are flexible, it is unclear whether the price cuts were genuinely made for the coexistence of wholesalers and consumers," adding, "Because importers decide prices independently, there is a sufficient possibility of future price increases or other changes depending on market conditions."

Earlier, Franz Horton, CEO of Pernod Ricard Korea, said at a press conference for the launch of the 'Ballantine's 40 Year Masterclass Collection - The Waiting' held on the 27th in Nonhyeon-dong, Gangnam-gu, Seoul, "In the short term, the Korean whisky market may seem to be declining, but from a long-term perspective, it is more active than ever and will continue to grow."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)