Wine Imports Down 10% YoY This Year

Growth in White and New Zealand Wines Amid Market Slump

Next Year Expected to See Market Polarization and Pause

As inflation and economic recession deepen, coupled with recent political instability, consumer spending has contracted, leading to a shrinkage in the domestic wine market this year. While import volumes decreased from most countries, only New Zealand wines, known for their cost-effectiveness, showed growth.

According to the Korea International Trade Association (KITA) on the 20th, the domestic wine import value reached $385.82 million (approximately 560 billion KRW) as of October this year, down 9.6% from $426.81 million during the same period last year. Import volume also declined. Wine imports totaled 4.752 million cases, a 10.0% decrease compared to 5.278 million cases in the previous year. One case contains twelve 750ml bottles, totaling 9 liters.

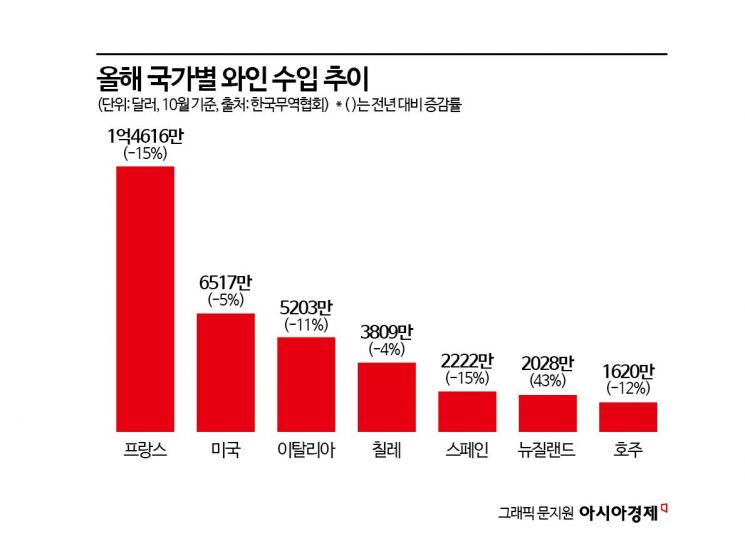

By country, France, considered the birthplace of wine, ranked first overwhelmingly. The import value of French wine was $146.16 million (about 210 billion KRW), more than twice that of the second-ranked United States ($65.17 million). Italy followed with $52.03 million, and Chile ($38.09 million) and Spain ($22.22 million) also made the top five. In terms of import volume, Chile, known for its cost-effective wines, led with 871,000 cases, followed by Spain (871,000 cases) and France (758,000 cases).

However, as the overall import scale shrank, most countries saw declines in both import value and volume. French wine imports dropped 15% in value and 20% in volume compared to the same period last year, while Spain experienced double-digit decreases in import value (-15%) and volume (-25%). U.S. wine imports fared relatively well, limiting the decline in import value to 5%. Chile, which recorded the highest import volume, saw a slight 2% increase in volume despite a 4% decrease in import value.

The decline in wine imports and consumption this year is linked to the domestic economy struggling amid increasing internal and external uncertainties. With ongoing inflationary pressures and reduced income due to the recession, consumers have less capacity to spend on wine. A representative indicator of this trend is the drop in the average import price per bottle, which was once considered evidence that the domestic wine market was maturing and moving toward premiumization.

This year, the average import price per bottle was $6.77, down from $6.74 during the same period last year. An industry insider explained, "The price per bottle had been steadily rising over recent years and continued this trend until August, after which it began to decline. Internally, we attribute this primarily to reduced consumption caused by the economic downturn."

Amid the overall contraction in import volume, New Zealand wines stood out with strong performance. New Zealand's wine import value rose 43% to $20.28 million (about 30 billion KRW) compared to $14.19 million last year, and import volume increased 60% to 311,000 cases from 195,000 cases in the previous year. In the overall rankings, New Zealand surpassed its prolific neighbor Australia in production volume to climb to sixth place.

The strength of New Zealand wines in the domestic market is attributed to their excellent pairing with Korean cuisine and high accessibility. Leading this trend is the white grape variety Sauvignon Blanc, which, although originally from Bordeaux, France, is more widely recognized domestically as a signature New Zealand variety. New Zealand Sauvignon Blanc is particularly praised for its more intuitive taste and aroma compared to its French counterpart, making it easier for beginners to enjoy.

Another wine industry insider commented, "New Zealand Sauvignon Blanc, with its moderate acidity and clean taste, pairs well with the spicy flavors common in Korean food, making it a great choice for a light drink. This trend has been further accelerated by convenience stores, which have aggressively introduced private brand wines priced between 10,000 and 20,000 KRW, receiving positive responses and firmly establishing their presence recently."

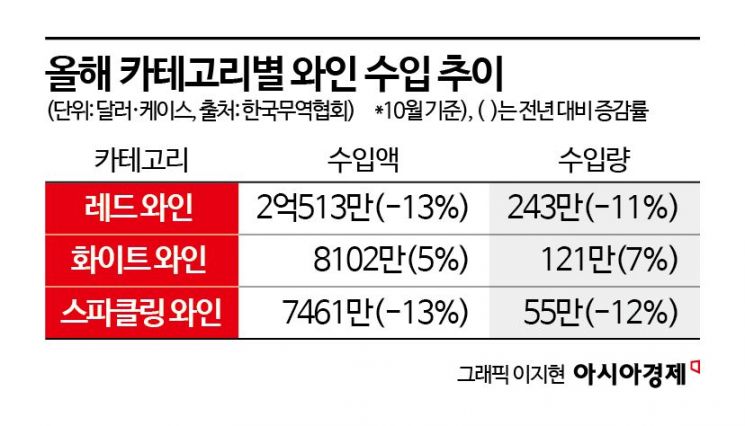

This trend is also reflected in category-specific statistics. This year, red wine import value was $205.13 million (about 300 billion KRW), down 13% from $236.66 million last year, with import volume shrinking 11% to 2.428 million cases. Conversely, white wine import value increased 5% to $81.02 million (about 120 billion KRW), and import volume rose 7% to 1.206 million cases. While domestic wine consumption was once dominated by middle-aged men favoring red wine, the consumer base has broadened in recent years, and preferences have diversified, leading to a steady rise in white wine consumption, which is relatively lower in alcohol and easier to enjoy.

The domestic wine market, which faltered this year, is expected to continue experiencing polarization next year, with a period of consolidation anticipated. The industry forecasts a U-shaped market next year, with high-end and low-end wines dominating and mid-priced wines disappearing. Well-known premium wines are expected to strengthen further. Although most countries experienced a decline in price per bottle this year, premium wine regions such as Bordeaux and Burgundy in France ($16.10) and California's Napa Valley in the U.S. ($11.40) saw price increases of 6% and 3%, respectively.

Cost-effective wines priced under 30,000 KRW are also expected to maintain positive momentum. An industry insider said, "We believe that daily wine consumption has somewhat settled internally. Many competitively priced wines that can be enjoyed daily without burden are being launched, so we expect them to receive ample consumer choice." Indeed, Chilean wine 'Diablo,' priced in the 10,000 KRW range and distributed by wine distributor Ayoung FBC, is expected to set a new sales record this year with a 13% growth rate despite the overall market downturn.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)