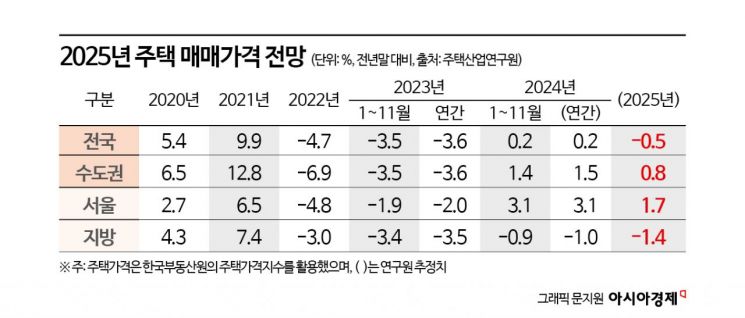

Seoul Up 1.7%, Capital Area Up 0.8%, Nationwide Down 0.5% Expected

Jeonse Prices Nationwide Up 1.2%...Possible Spillover to Sale Price Increase

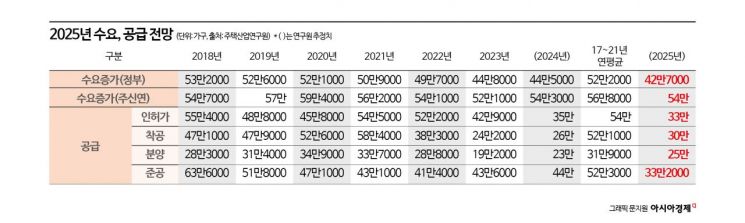

Housing Permits and Construction Starts Down About 30% Compared to Average

Concerns Over Surge After 2026 Due to Accumulated Supply Shortage

Seojongdae, Jusan-yeon CEO, Candid Remarks on Financial Regulations

The Korea Housing Institute forecasted that Seoul housing prices will rise by 1.7% next year. They analyzed that due to housing supply shortages, interest rate cuts, and high monthly rent prices, the market will turn strong from the mid-year onwards. They predicted that this could lead to a housing price surge by 2026.

In particular, Seo Jong-dae, the head of the Korea Housing Institute, emphasized the need to "quickly normalize the abnormal housing finance regulations" to prevent this. He pointed out that treating the Debt Service Ratio (DSR) as a government regulation, remarks by Financial Supervisory Service (FSS) Governor Lee Bok-hyun regarding loan regulations, and measures such as raising the PF (Project Financing) equity ratio have caused supply shortages. He criticized, "The Financial Supervisory Service is not a policy-making institution. Where does the head of a supervisory agency tell others what to do?"

Housing Prices to Rise Next Year

On the 19th, the Korea Housing Institute held a seminar titled ‘2025 Housing Market Outlook and Policy Directions’ at the Korea Chamber of Commerce and Industry. The institute cited impeachment, economic recession, and strong loan regulations as factors for housing price declines. However, due to factors such as interest rate cuts, an increase in the population entering the housing market, and accumulated supply shortages, they expected housing prices in the Seoul metropolitan area and some metropolitan cities to rise.

The Korea Housing Institute forecasted, "The economic recession will continue in the first half of this year, and abnormally high mortgage loan interest rates and loan regulations are likely to persist." However, they analyzed, "Due to the rapid increase in the population in their 30s entering the housing market, the possibility of interest rate cuts, and normalization of mortgage loans and PF, the housing market is likely to return to a thawing mood from the mid-year onwards."

The population reaching age 30 entering the housing market increased to the 750,000 range starting last year. It rose from an average of 670,000 annually between 2017 and 2021 to 740,000 between 2022 and 2024. It is estimated to be 735,000 next year. Due to the increase in the population reaching age 30, demand for monthly rent is expected to increase. The government estimated next year's housing demand (3rd Long-term Comprehensive Housing Plan) at 427,200 households nationwide. Meanwhile, next year's supply (completion volume) is 318,800 households, resulting in a shortage of about 108,400 households compared to demand.

The Korea Housing Institute also presented housing sale price forecasts considering economic growth rate, housing supply-demand index, and interest rate changes. Compared to the previous year, Seoul is expected to rise by 1.7%, and the metropolitan area by 0.8%. However, non-metropolitan areas are expected to decline by 1.4%, resulting in a nationwide housing price decrease of 0.5%.

The institute stated, "Although many media reports suggested that the impeachment process would act as a downward factor on housing prices in the first half of next year, during President Roh Moo-hyun’s time, there was almost no impact, and during President Park Geun-hye’s time, the rise slowed for 2-3 months but soon recovered."

Next year's housing transaction volume is expected to be similar to this year at around 630,000 cases. The Korea Housing Institute explained, "This volume corresponds to about 3.1% of the total housing stock," adding, "Considering that during normal trading periods when the housing market was neither overheated nor stagnant, the volume was around 900,000 households (4-5%), this year’s and next year’s transaction volumes are about 70% of the normal trading period."

Accumulated Supply Shortage... Possibility of Housing Price Surge After 2026

Due to accumulated supply shortages over the past 2-3 years, there is also a possibility of a real estate market surge after 2026. Seo Jong-dae, head of the Korea Housing Institute, said, "Any government next year will inevitably implement expansionary policies, and there is a shortage of about 120,000 housing starts. The combination of low interest rates, economic expansion, and supply shortages raises concerns about a surge. Even if the 3rd New Towns start sales from 2026, it will be difficult to control housing prices, and they are expected to be controlled only by 2029 when move-ins proceed."

Next year's apartment move-in volume is estimated at 266,022 households nationwide, about 100,000 fewer than this year (363,921 households). Compared to the 10-year average annual move-in volume (2014-2023) of 350,724 households, it is also about 90,000 households short. By region, Seoul has 35,915 households, the metropolitan area (including Seoul) 128,224 households, and provinces 137,798 households.

The Korea Housing Institute analyzed that since the launch of the Yoon Suk-yeol administration until the end of next year, a supply shortage of over 500,000 households will accumulate. In the private market, due to the PF crisis, procurement interest rates have risen, making it difficult to start housing construction projects. Although the public sector such as LH is increasing supply volumes, it is insufficient compared to the demand increase of about 450,000 households annually.

Next year’s jeonse (long-term deposit rent) prices are expected to rise by 1.2% nationwide, 1.9% in the metropolitan area, 1.7% in Seoul, and 0.1% in provinces. The rise in jeonse prices is expected to act as a factor for sales price increases. With a significant decrease in apartment and non-apartment move-in volumes, the upward trend in monthly and jeonse rent prices due to supply shortages is expected to continue. The Korea Housing Institute also predicted that monthly rent prices will maintain an upward trend.

"Housing Finance Regulations Must Be Eased First"

The Korea Housing Institute pointed out that although the government is easing various regulations and expanding public land designation to calm housing supply-demand instability, housing finance-related regulations must be resolved first. While it may seem that housing prices have been controlled through financial regulations, since supply shortages have not been resolved, the shockwave could be greater in the future.

Seo said, "Abnormal housing finance-related regulations must be normalized as a top priority, and issues such as construction costs that greatly shrink private supply, PF tightening, and excessive donation requirements must be swiftly improved. The focus should be on shortening the public land development process so that housing supply in the 3rd New Towns can proceed as soon as possible."

He also viewed that the loan regulation strengthening, which started with the FSS Governor’s remarks, caused confusion because it was not agreed upon with related ministries such as the Ministry of Land, Infrastructure and Transport. Seo said, "The biggest problem is verbal regulations from the FSS. The FSS said until the end of September to raise or lower loans and interest rates, but such policies should be established by the Financial Services Commission. All government regulatory policies are based on laws and regulations. Even now, banks say they cannot do anything. Although loans have been loosened, it varies by bank. I think they should have met and discussed with the Ministry of Land, Infrastructure and Transport, the Financial Services Commission, and the Ministry of Economy and Finance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)