Status of Overseas Real Estate Alternative Investments as of Late June

Increase in Loss of Benefit Occurrences Compared to Previous Quarter

Total Overseas Real Estate Alternative Investment Balance Decreases by 700 Billion KRW

FSS "Strengthening Close Monitoring Mainly on Office Market"

Among overseas single business sites (real estate) invested by financial companies, it was found that there were cases of loss of benefit of term (EOD) at business sites worth 2.61 trillion KRW. The increase in assets with loss of benefit of term also rose compared to the previous quarter.

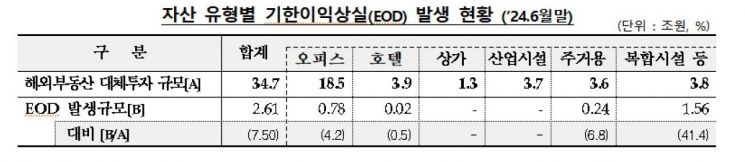

On the 20th, the Financial Supervisory Service (FSS) announced that as of the end of June, among 34.7 trillion KRW worth of real estate invested by financial companies, 2.61 trillion KRW (7.50%) had cases of loss of benefit of term. The increase was 90 billion KRW as of the end of March, but it was recorded as an increase of 110 billion KRW as of the end of June.

By type, the largest amount of defaults occurred in complex facilities and other real estate, totaling 1.56 trillion KRW. This was followed by offices at 780 billion KRW, residential properties at 240 billion KRW, and hotels at 20 billion KRW. The total investment scale was largest in offices at 18.5 trillion KRW, followed by hotels (3.9 trillion KRW), complex facilities, etc. (3.8 trillion KRW), industrial facilities (3.7 trillion KRW), residential (3.6 trillion KRW), and commercial buildings (1.3 trillion KRW).

The total balance of overseas real estate alternative investments in the financial sector, including single business sites, recorded 56.3 trillion KRW as of the end of June, a decrease of 700 billion KRW compared to the previous quarter. This accounts for about 0.8% of the total assets of the financial sector. By financial sector, insurance accounted for 31.2 trillion KRW, or 55% of the total, followed by banks at 11.7 trillion KRW, securities at 7.8 trillion KRW, mutual finance at 3.6 trillion KRW, credit finance at 2.1 trillion KRW, and savings banks at 100 billion KRW.

An FSS official explained, "Despite the pivot in monetary policy, the amount of overseas real estate alternative investments decreased compared to the previous quarter due to delays in the improvement of the overseas real estate market."

By region, North America accounted for 35.2 trillion KRW, or 62.5% of the total. Europe was 10.5 trillion KRW, and Asia was 3.9 trillion KRW. Other and multiple regions were recorded at 6.7 trillion KRW. By maturity, investments worth 4.6 trillion KRW will mature by the end of this year, and investments worth 43.4 trillion KRW will mature by 2030.

The FSS plans to strengthen close monitoring and induce enhancement of loss absorption capacity, especially focusing on the office market where improvement is delayed due to the high investment proportion.

An FSS official stated, "The possibility of investment losses spreading to systemic risk is low," but added, "Since there is a persistent possibility of asset deterioration and loss expansion centered on the office market, we will continue to inspect and improve the overall alternative investment business process."

He continued, "We will closely monitor business sites with unusual trends such as loss of benefit of term, strengthen supervision to induce appropriate loss recognition and sufficient loss absorption capacity of financial companies," and added, "We will also enhance the risk response system through continuous supplementation of the overseas real estate database (DB) and operation of a rapid reporting system."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)