Powell Expresses First Stance on Bitcoin as Strategic Asset: "Cannot Hold"

Expected to Clash with Trump Going Forward

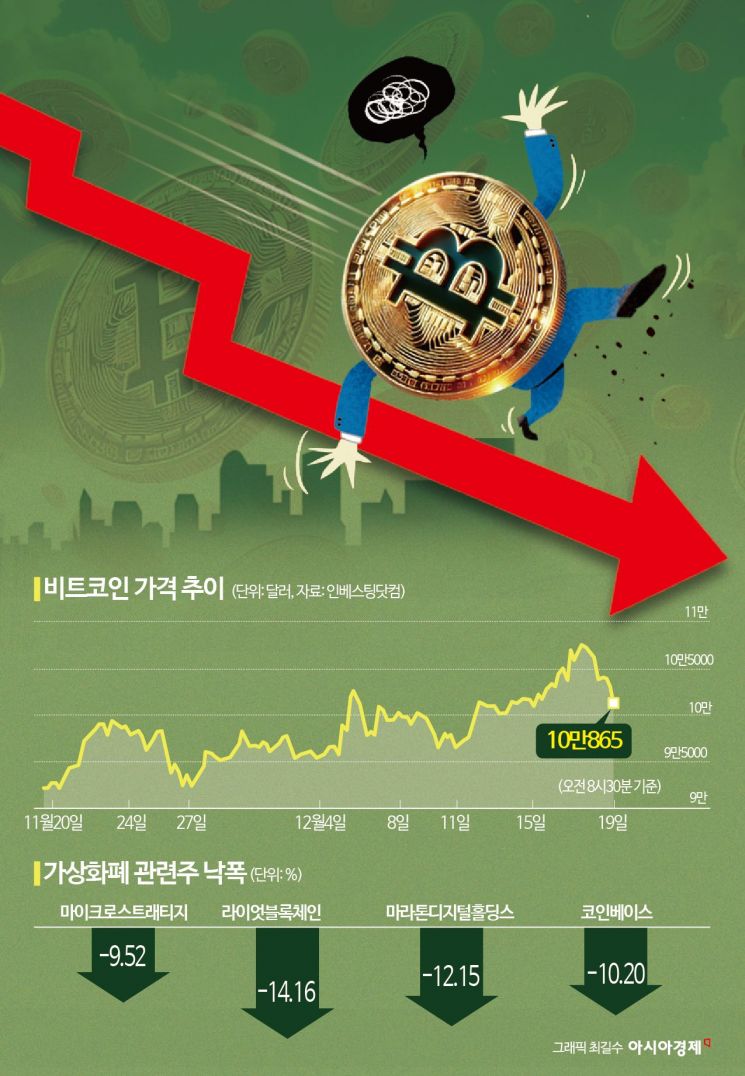

Cryptocurrency-Related Stocks All Down

Bitcoin Falls 7% from Previous Day's High

'Debt Investment' MicroStrategy Plummets 9%

"We cannot hold Bitcoin."

Jerome Powell, Chairman of the U.S. Federal Reserve (Fed), drew a line regarding the expected 'Bitcoin strategic assetization' initiative to be pursued by the second Trump administration launching next year. As the head of the central bank, who should play a key role, publicly expressed no intention to cooperate, cryptocurrencies including Bitcoin plummeted sharply. There is speculation that Chairman Powell and President-elect Trump will continue to clash over the promotion of Bitcoin as a strategic asset.

Powell Draws the Line on 'No Reserves'

Chairman Powell expressed a skeptical stance on the Fed holding Bitcoin during a press conference following the Federal Open Market Committee (FOMC) meeting on the 18th (local time). He stated, "We are not allowed to hold Bitcoin," implying that the Fed would not be involved in the second Trump administration's move to hold large amounts of Bitcoin as a strategic asset. Regarding legal amendments for Bitcoin reserves, he also emphasized, "This is something for Congress to consider," and firmly stated, "The Fed will not pursue legal amendments."

This is the first time Chairman Powell has publicly stated his position on Bitcoin as a strategic asset. President-elect Trump, who has proclaimed himself the 'Cryptocurrency President,' pledged during his election campaign to strategically reserve Bitcoin like gold and crude oil, but Powell poured cold water on this. Although the Treasury Department, which can issue government bonds, can also reserve Bitcoin, central bank involvement is inevitable as it must be coordinated with monetary policy.

However, the dominant view is that Powell's negative stance on Bitcoin reserves was a reasonable and predictable statement from the head of a central bank. Experts have long analyzed that it would be difficult for central banks to hold Bitcoin due to its high price volatility. There are significant risks in selling existing foreign exchange reserves such as foreign currencies and gold to purchase Bitcoin. For example, El Salvador, the first country in the world to hold Bitcoin at the national level, faced a downgrade of its sovereign credit rating to 'Caa1,' indicating 'very high credit risk,' by Moody's following a past Bitcoin crash.

Additionally, concerns have been raised that issuing currency to purchase Bitcoin reserves could trigger inflation. Bill Dudley, former President of the Federal Reserve Bank of New York, recently pointed out these issues in a Bloomberg column, criticizing that "holding Bitcoin would be a bad deal for Americans."

Cryptocurrencies Including Bitcoin Plunge

Cryptocurrency prices fell sharply across the board. The downward pressure increased following the release of the new dot plot signaling a slowdown in the pace of interest rate cuts next year, combined with Powell's 'no reserves' remarks.

According to Investing.com, as of 8:30 a.m. Korean time on the 19th, the price of one Bitcoin traded at $100,865, down 4.85% from 24 hours earlier. Compared to the previous day's all-time high of around $108,300, it dropped about 7%. At the same time, Ethereum, the second-largest by market capitalization, fell 5.77% to $3,658, and Ripple plunged 9.03% to $2.36. 'Meme coins' Dogecoin and Shiba Inu dropped 8.88% and 7.67%, respectively.

Stocks of cryptocurrency-related companies listed on the New York Stock Exchange also saw significant corrections. MicroStrategy, known as a 'Bitcoin leveraged company,' fell 9.52%. Mining companies Riot Blockchain (-14.46%), Marathon Digital Holdings (-12.15%), and exchange Coinbase (-10.20%) also closed sharply lower.

Powell vs. Trump... Will They Clash During the Promotion Process?

Some speculate that President-elect Trump may publicly target Chairman Powell over the promotion of Bitcoin as a strategic asset. During his first term, Trump openly expressed dissatisfaction with Powell. David Lawant, Head of Research at cryptocurrency intermediary FalconX, said, "Generally, macroeconomic factors influence cryptocurrency prices," but added, "With expected policy changes from the new administration, industry-specific factors are likely to drive the market over the coming months."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.