Report Published on the Impact of Korean Air and Asiana Airlines Integration on the Aviation Industry

With the integration of Korea's two major full-service carriers (FSC), Korean Air and Asiana Airlines, a mega carrier ranked within the global top 10 has emerged, and structural changes are expected in the domestic air transportation industry. In particular, excessive price competition is expected to decrease through route redistribution and the development of new routes, achieving economies of scale and improving operational efficiency.

On the 18th, Samil PwC announced the publication of a report titled “Impact on the Aviation Industry Following the Integration of Korean Air and Asiana Airlines,” which contains these insights.

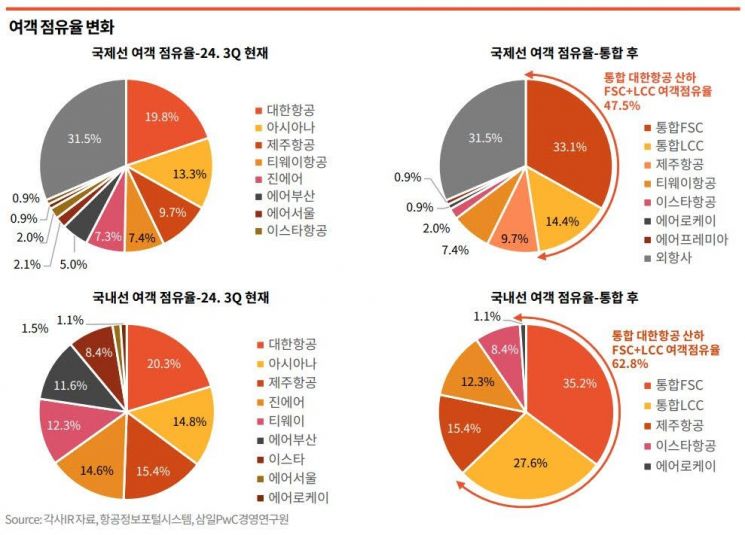

According to the report, as airlines become larger, the passenger sector is expected to see improved supply capacity (expansion of offered routes and services). Additionally, with the integration of low-cost carriers (LCCs) under both companies, including Jin Air, Air Seoul, and Air Busan, the combined entity is expected to become the market leader in the LCC segment with a 41% share, bringing anticipated economies of scale benefits.

The report also analyzed that the enlargement of the aviation industry through the merger is expected to result in ▲reduced unnecessary seat price competition among airlines, ▲improved profitability due to economies of scale, ▲reduced sensitivity to external variables, and ▲improvements in financial structure.

The report emphasized that strategic choices are necessary to achieve economies of scale, ranging from cooperation among airlines to integration and mergers. It stated, “For FSCs, it is necessary to expand global routes or increase route density through their integrated LCC subsidiaries, and in the passenger sector, differentiation and advancement of services such as seat classes are required.” It also suggested, “LCCs can choose strategies to increase passenger capacity (CAPA) through interline agreements and partnerships with major domestic LCCs, following their entry into long-haul routes.”

With the intensification of carbon emission regulations in air transportation centered on the European Union (EU), proactive preparation is also necessary. In Korea, mandatory use regulations for sustainable aviation fuel (SAF) are scheduled to be fully implemented starting in 2027. Digital transformation, operational environment advancement, and related investments are also required to enhance customer convenience and operational process efficiency.

Furthermore, the report pointed out that since the domestic aviation industry is highly susceptible to economic conditions and external variables and is expected to face increased costs due to stricter carbon emission regulations, active government support such as financial and tax assistance and strengthened incentives is necessary.

Won Chi-hyung, leader (partner) of Samil PwC’s Transportation and Logistics Industry, stated, “Although the increasing macroeconomic uncertainties next year are a concern, mergers and acquisitions (M&A) in the aviation industry have generally brought positive effects to the companies and the industry. The integration of the two companies this time will serve as an opportunity for the domestic aviation industry to take a leap forward, and effective government support is required for a smooth integration process and strengthening the competitiveness of the domestic aviation industry.”

Detailed information about the report can be found on the Samil PwC website.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)