6 out of 7 Major Construction Companies Reduce Local Housing Supply

"Local Real Estate Market Slump Combined with Impeachment"

"Polarization Between Local and Capital Region Housing Markets Increasing"

"Local Market Slump and Impeachment Lead to Continued Real Economy Contraction"

Major construction companies are reducing their local housing supply next year. Unlike the heated Seoul housing market this year, the cold wave hitting the local economy shows no signs of easing next year. The unstable political situation, from emergency martial law to impeachment, is also affecting the real economy, causing supply schedules to be postponed.

6 out of 7 Major Construction Companies "Reduced Local Housing Supply Next Year"

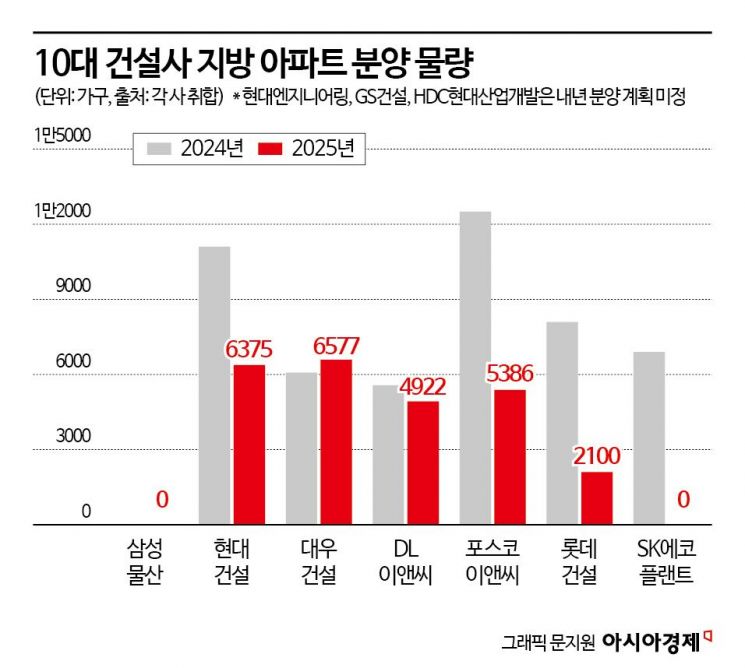

According to the construction industry on the 18th, among the top 10 construction companies that have finalized their supply plans for next year, 6 either have no plans to supply apartments in local areas or have reduced their supply compared to this year. Hyundai Engineering, GS Construction, and HDC Hyundai Development have yet to announce their supply plans for next year.

Samsung C&T and SK Ecoplant have no plans for local housing supply next year. Samsung C&T will not supply apartments in local areas next year, continuing from this year. SK Ecoplant introduced 6,896 units in local areas this year but will only supply in the metropolitan area next year.

Hyundai Construction, DL E&C, Lotte Construction, and POSCO E&C have reduced their local housing supply compared to this year. Hyundai Construction cut its supply from 11,009 units this year to 6,375 units next year. Lotte Construction lowered its target from 8,098 units this year to 2,100 units next year, POSCO E&C from 12,503 units this year to 5,386 units next year, and DL E&C from 5,624 units this year to 4,922 units next year.

An executive from a major construction company explained, "The result of the local housing market slump combined with the chaos following the presidential impeachment." He added, "As material costs rose, housing prices continued to increase, and in local areas, unless the location can become a landmark, there are no buyers. Amid this, the impeachment further destabilized the market."

In contrast, Daewoo Construction plans to supply more local apartments next year than this year. Daewoo Construction's local supply is 6,073 units this year and 6,577 units next year.

Another official from a major construction company said, "Even if local apartment supply increases next year compared to this year, it is difficult to say that supply has increased overall. Given that local supply has significantly decreased compared to previous years, the base effect makes it appear as if some companies have increased local supply." He added, "Some companies that delayed supply can no longer hold out and are starting to supply, and in the case of redevelopment projects, supply depends on the project schedule."

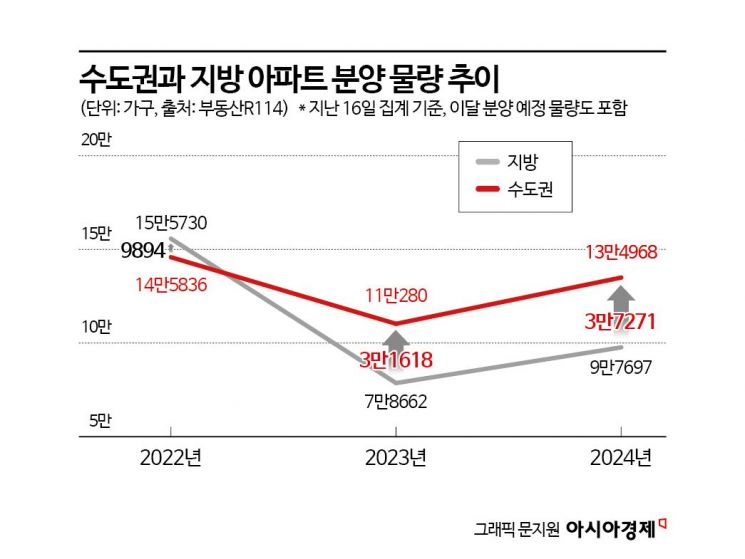

The gap in supply volume between local areas and the metropolitan area is already widening. According to real estate information company Real Estate R114, as of the 16th, the metropolitan area supply this year is 37,271 units more than local areas. The gap has increased compared to last year (31,618 units). In 2022, local areas supplied 9,894 units more than the metropolitan area.

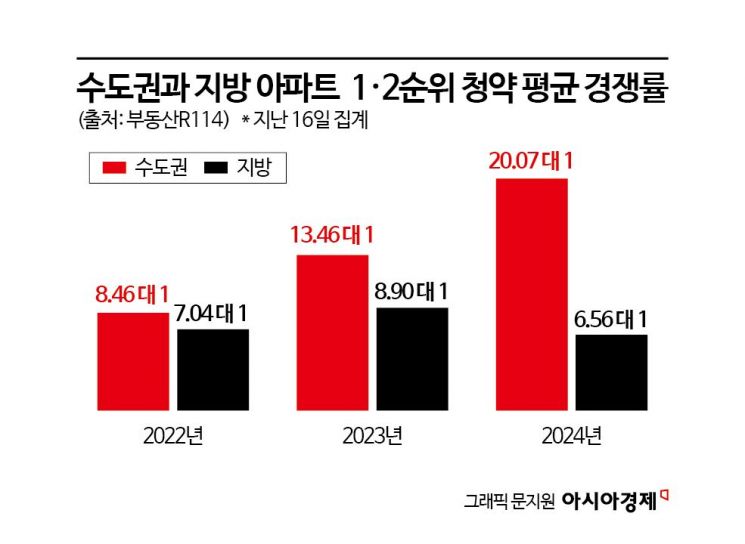

This polarization is also evident in subscription competition rates. This year, the average competition rate for first and second priority applicants is 20.07 to 1 in the metropolitan area and 6.56 to 1 in local areas. Last year, it was 13.46 to 1 in the metropolitan area and 8.90 to 1 in local areas, and in 2022, 8.46 to 1 in the metropolitan area and 7.04 to 1 in local areas.

Experts: "Local Housing Supply Reduction to Continue for the Time Being"

Experts predict that new apartment supply in local areas will decrease for the time being.

Ko Jong-wan, Director of the Korea Asset Management Research Institute, said, "Local buyer sentiment has been weak continuously. However, due to impeachment, financial market instability such as exchange rate increases has caused the real economy to contract." He explained, "These adverse factors have a greater impact on local areas than the metropolitan area, leading to reduced demand and supply."

Hwang Han-sol, Research Team Leader at PRBORN, said, "The impeachment has lowered predictability regarding policy direction, which is also a problem." He added, "With upcoming presidential elections, tax policies and other directions may change, deepening the overall cautious stance in the real estate market." He further noted, "In this situation, local areas with fewer jobs than the metropolitan area may face a bigger wave of stagnation. From the supplier's perspective, reducing apartment supply is the best option."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)